What is social investment and what are the key considerations when thinking about repayable finance? Read this handy guide from the team at Good Finance.

What is Social Investment?

Starting from the top, it’s always helpful to provide a very basic definition of what can be quite a complex topic. At Good Finance, we define social investment as the use of repayable finance to help an organisation to achieve a social purpose.

Perhaps as importantly, what is it not? It’s not a grant or donation. A charity might generate a surplus through trading activity (like a shop or a café) delivering public services (like training programmes or rehabilitation programmes), grants and donations or a combination of some or all of these. That surplus is then used to repay investors.

This quick one-minute explainer covers the basics quite well.

Your financial toolkit…

Most small charities have different sources of capital, including (but not limited to) grants, donations, fundraising, banks, trading income, contracts and more. It’s important to think about social investment as yet another tool to help you to achieve impact.

Crucially, taking on repayable finance is not a magical solution to all your financial woes and should never be considered as a ‘be all or end all’ for a charity.

Key considerations

Purpose – what do you need the money before?

Ahead of exploring social investment, it’s a good idea for any charity to have a clear idea on what it is they need this money for. Typically, we’ll see charities using this finance to buy an asset, maintain cashflow, kickstart a new service or programme or to grow and innovate their existing services.

Repayment – do you have a profitable income stream?

Perhaps unsurprisingly, an important question to ask at this stage is whether your organisation can afford to take on repayable finance. Do you have the means to generate a profit and are you confident in your ability to repay investors?

Profit can some times be considered almost negatively within the third sector – but it’s essential to building resilience and enabling your charity to continue to deliver impact to those that need it most.

Impact – what difference will this money make?

What are the additional activities and outcomes you hope to achieve through access to this finance? This is what really sets social investors aside from more mainstream investors; they really care about what difference you’re making on the ground and how the money can support you in doing so.

Types of social investment (and where it comes from)

Broadly speaking, there’s two main types of social investment.

Debt: when an organisation borrows money and pays it back to the investor over an agreed time period (usually with interest).

Equity: when an organisation sells shares to an investor, who then owns a percentage of their organisation.

Similarly, there’s two main types of providers of social investment. An organisation – like a specialist social investment firm, a social bank or trust or foundation – and an individual – like crowd funding, community shares or angel investment.

Where an organisation's money comes from will determine how patient or ‘risky’ they can be with the money they are lending out to charities.

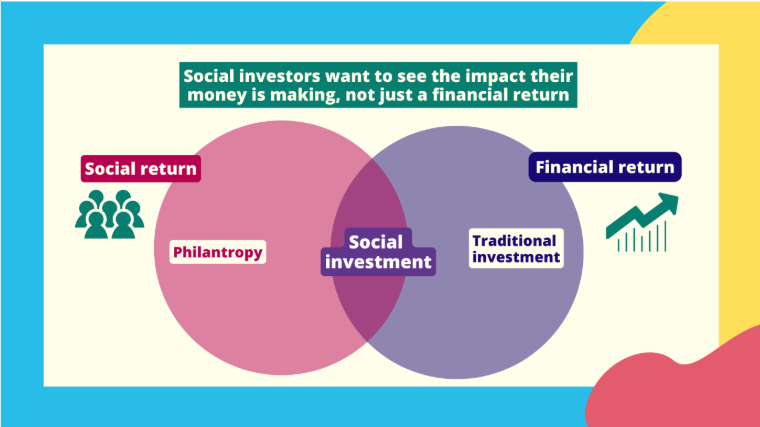

The diagram below shows the full capital spectrum from traditional investment focusing purely on financial return to philanthropy, with looks solely at social return.

Social investment tends to sit somewhere in the middle, but how far left or right on that scale an organisation sits will be determined by where their money comes from.

Three tools and resources for charities interested in learning more…

- Wondering if social investment could be right for your charity? Take the two-minute ‘Is It Right For Us’ tool to get quick answers over whether repayable finance is a viable option for your ogranisation – now or in the future.

- Looking for inspiration? See examples of charities like yours that have harnessed the power of social investment through the extensive case study collection on Good Finance – with each real story including key details like cost of capital, duration and turnover to better understand what it looks like in action.

- Whether social investment is something for your charity to consider now or in the future, sign-up to the Good Finance newsletter to receive monthly updates from the world of social investment – including all the latest events, opportunities, announcements and more.

If you have any questions about social investment or would like to understand more about how it might work for a charity like yours, please visit goodfinance.org.uk.

Good Finance is a collaborative project designed to help charities and social enterprises to navigate the world of social investment. In this blog, Senior Digital Content Manager, Annie Constable explore the basics of what social investment is, how it works and why it could be helpful for small charities to consider when looking to diversify their financial toolkit.