In the world of charity finance, the path to improved financial health often focuses on increasing income, but Peter Roberts of ProVantage Procurement highlights the importance of costs savings which can strengthen your organisation's financial position.

The simplest ways to improve your charity’s bottom line are through income and savings. In all industries and all sectors, the cost areas prioritised when looking for potential savings very often mean that relatively easy wins are overlooked or seen as not particularly ‘business-critical’, leading to missed opportunities.

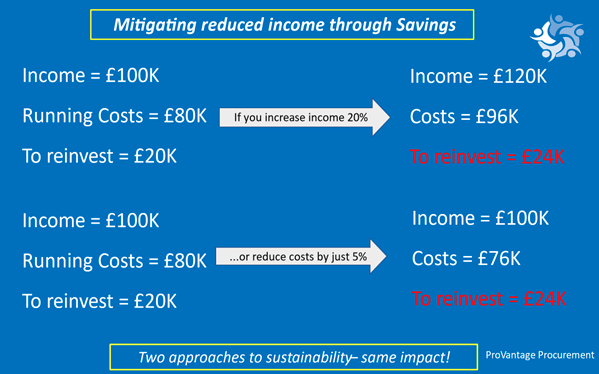

The impact that savings can have on your bottom line though shouldn’t be underestimated though and a simple way of approaching it is for your budget holders to appreciate that reducing your overheads by 5% can have the same effect as increasing your income by whatever means by 20%. And it is very likely to be a lot easier to do!

If, for example, your income is £100,000 and the costs of creating this to your charity are £80,000, then simplistically your profit or excess is £20,000.

To increase profit via income; if you increased sales by 20% your income is now £120,000, the associated costs to get that go up proportionally so they rise from £80,000 to £96,000 – and your profit is now £24,000 – or up 20%.

To increase profit by reducing costs; if you reduce your spend by just 5% from £80,000 to £76,000, even with zero increase to sales your profit margin is still £24,000 – or up the same 20%.

Key to addressing and capturing this potential can be in in staff understanding the impact and benefits of the savings to the charity as a whole, particularly so where the responsibility for the purchase of goods or services lies outside of a dedicated procurement department, or where purchasing is devolved through the charity.

The result here is that the process is very often not given the focus that it could have, with time and resources being seen to be limiting factors. With most indirect spending budgets then being tacked on to the remits of individual departmental Heads or budget holders on top of their day-to-day responsibilities, those costs invariably end up higher than they may otherwise need to be.

Most commonly these opportunities tend to fall under the cost centres of what are known as ‘indirect spend’.

For most organisations much greater emphasis is usually (and naturally) placed on the ‘direct’ or core costs – those that apply to the delivery of whatever it is that the organisation produces and this can be even more prevalent in the charities sector.

For example, a food production company’s direct spend is the fruit, wheat, nuts etc., a hospice would be the end of live care provision, a cancer research charity would be on fundraising and so on – but all will have the same areas of indirect spend necessary just to keep the wheels of the organisation turning.

Or to look at it another way, there are invariably excellent opportunities to find savings and make quality improvements in the ‘indirect spend’ areas if the resources to focus on them can be found.

The areas of indirect cost tend to be the same for most – insurance, vehicles, buildings and buildings maintenance, utilities, IT, telephony, travel and so on - and often add up to 40% or more of an organisation’s outgoings. Strategically they frequently get seen as less important than the key services charities deliver but the financial impact is just the same.

If you would be interested to see areas to reduce your charity’s direct and indirect costs, please contact Peter Roberts.