CFG's policy experts, Richard Sagar and Ida Karlsson, dig into all the relevant announcements and changes so you don't have to.

Chancellor of the Exchequer Rachel Reeves

This budget was always going to be big, not only in terms of the measures introduced, but also politically, as the decisions made on taxes and departmental expenditure will set the political landscape for years to come.

There were no surprises that this budget delivered significant tax increases, due to the £22bn ‘fiscal blackhole’ that the Chancellor alleges the previous government left them. This was, in addition to a speech by the Prime Minister on Monday, promising £35bn in tax increases, to avoid austerity.

Many commentators pointed out that this would be challenging, as the government had made a commitment in its manifesto not to increase Income Tax, VAT, or NIC, the three largest taxes by revenue.

However, an even higher increase in tax was delivered, with just over £40bn raised in total, over half (£25bn) as a result of an increase in Employer NICs by 1.2 percentage points to 15% and a cut to the Secondary Threshold from £9,100 to £5,000 until April 2028.

The big headline changes announced were also trailed in advance, most notably the aforementioned increase in Employer NICs from 13.8% to 15%, removing Inheritance Tax exemptions and increasing Capital Gains Tax.

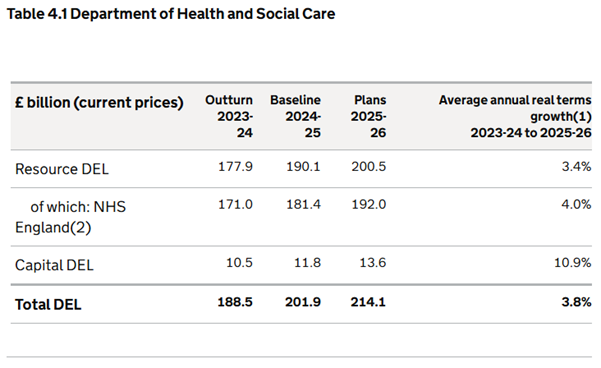

There were sizeable increases in public spending with over £22bn for the NHS and Social Care, alongside an increase to Local Government funding.

As predicted, the Chancellor changed the fiscal rules to allow for more borrowing for investment and also adjusted the headline target for government debt (more information on that from the Office for National Statistics (ONS) here).

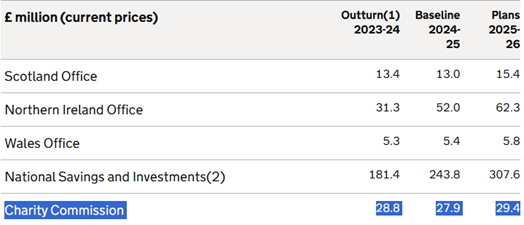

Some of the changes directly relevant to the charity sector, which did not make headlines, included a small short term cut to funding for the Charity Commission for England and Wales, although this is followed by a small increase the year after. There is also a proposal to introduce charity compliance measures by legislating to prevent abuse of the charity tax rules.

Both of these changes are minor and are overshadowed for most by the sizeable increases in the cost of operating by increases to Employer NICs and the National Living Wage/National Minimum Wage.

While the budget did not provide many of the changes proposed by the sector, which would have delivered low-cost and impactful improvements to the operating environment for charities, there were one or two wins. This includes clarification on the removal of charitable business rate relief from private schools, and introducing a protected minimum floor for reductions to Universal Credit Standard Allowance.

There was also an interesting announcement on the creation of a Social Impact Investment Vehicle, which could be an positive way to leverage investment and promote philanthropic giving. We look forward to receiving further information and the opportunity to consult in its design.

It is fair to say that this fiscal event did not deliver what the sector had hoped for in terms of providing funding to put the sector on a sustainable footing, or proposing meaningful changes to incentivise philanthropy and giving.

Further details on the Office for Budget Responsibility Economic and Fiscal outlook, and all measures relevant to the charity sector from the Spending Review and Budget are detailed below:

OBR forecast and economic data

Inflation

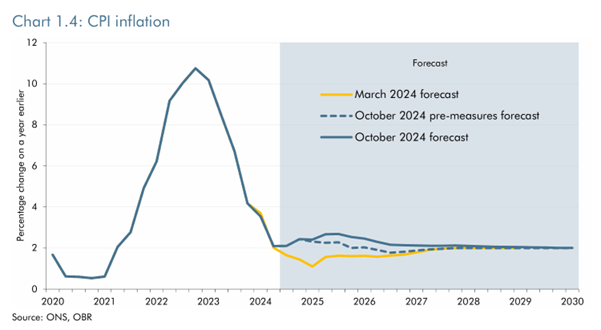

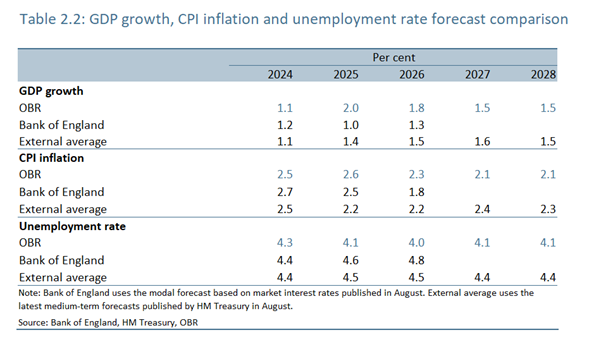

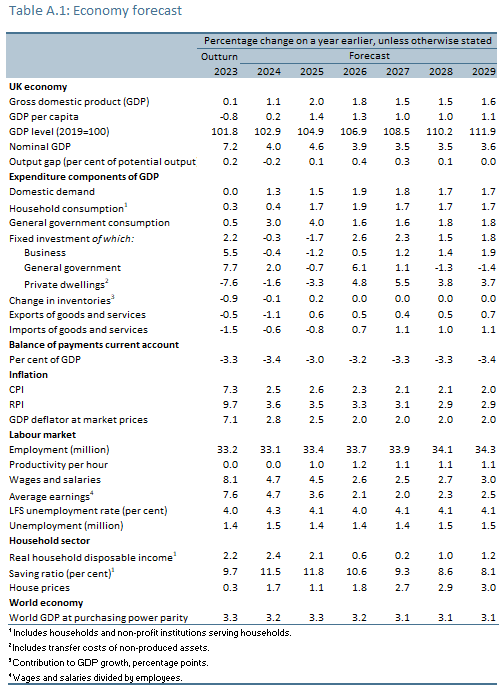

The OBR is forecasting consumer price index (CPI) to pick up to 2.6 per cent in 2025 after having returned back to around the 2 per cent target in mid-2024. The increase to 2.6 per cent is driven by higher gas and electricity prices and the direct effect of policies announced in the budget, as well as the effect of a small positive output gap on domestically generated inflation. CPI inflation is then expected to slowly return to and remain at the 2 per cent target throughout the forecast period as the positive output gap closes and energy price growth normalises

Public Finances

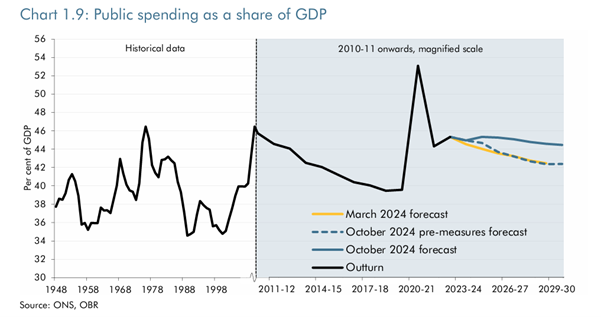

Capital departmental expenditure limits (CDEL) are planned to increase by £20 billion (0.6 per cent of GDP) per year on average over the next five years. This will lead to an increase in departments’ day-to-day spending of 1.5% on average a year over the next 6 years.

The OBR report also highlights the fall in public sector net debt (PSND) from a peak of 98.4 per cent of GDP this year to 97.1 per cent of GDP in 2029-30.

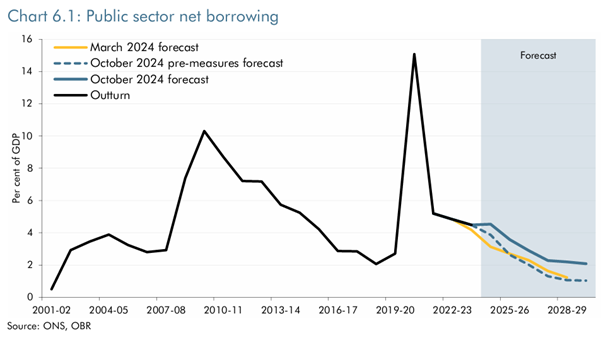

Public sector net borrowing (PSNB) fell to £121.9 billion (4.5 per cent of GDP) in 2023-24. The OBR forecasts that it will continue to fall each year to reach £70.6 billion (2.1 per cent of GDP) in 2029-30.

Employment and Earnings

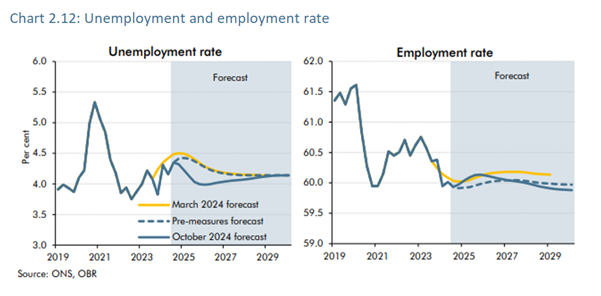

The OBR expects unemployment rate to peak at 4.3 per cent at the end of 2024 before falling to 4 per cent in mid-2025. The unemployment rate has risen since the pandemic and this broad trend is consistent with wider evidence of a cooling labour market. The temporary output boost from the budget reduces the unemployment rate by 0.3 percentage points, equivalent to around 90,000 people, on average in 2025 and 2026.

The employment rate rises a little in the near term and then declines through the rest of the forecast period to just under 60 per cent. This is more than 1.5 percentage points below its pre-pandemic peak and is driven mainly by higher inactivity.

The OBR expects real earnings to grow 2.4 per cent this year and 1.2 per cent in 2025. Real earnings are then expected to stall as firms pass on the cost of higher Employer NICs. In effect, this means that real wages are not expected to resume growing in line with productivity (around 1 per cent a year) until beyond the forecast horizon.

Growth

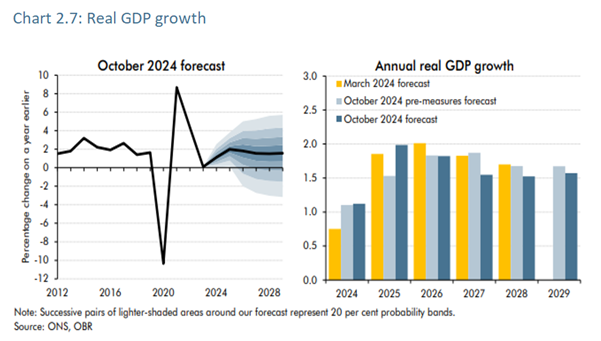

The OBR is forecasting real GDP growth to accelerate from 1.1 per cent in 2024 to 2 per cent in 2025 and then drop back slightly to 1.8 per cent in 2026. This is mainly driven by falling interest rates, the household saving rate passing its peak and budget measures temporarily boosting demand. GDP growth is then expected to slow down to around 1.5 per cent from 2027 onwards.

Sector 'asks' ahead of the Budget

Ahead of the budget, CFG led on a submission from the Civil Society Group to the Chancellor, proposing several quick wins – measures that could be implemented in the near-term that are low-cost and impactful. These included:

- Encourage philanthropy, improve the provision of wealth advice

- Reinstate mandatory reporting of charitable giving by companies

- Increase charity tax limits in line with inflation

- Consult on the introduction of VAT relief on charitable donations and donated goods

- Extend charitable rate relief to wholly-owned charity trading subsidiaries

- Confirm that funding will be provided to continue HMRC’s review of Gift Aid

- Provide greater clarity on removing charitable business rates relief for private schools in England.

Alongside these asks, we set out a longer-term vision for putting the sector on a more sustainable footing while ‘contributing to the delivery of the government’s missions’. These included:

- Introduce a protected minimum floor for reductions to Universal Credit Standard Allowance, to give those in the most precarious financial situations more certainty about their income.

- Require and enable public bodies at every level to ensure that grants and contracts meet the true costs of delivering public services, as civil society organisations are critical partners in delivering public services

- Ensure the Charity Commission for England and Wales has sufficient funding to improve its effectiveness and efficiency, and is able to take advantage of the latest technology and data techniques to support charity transparency. Urge the devolved administrations in Scotland and Northern Ireland to extend similar support to their regulators, OSCR and CCNI.

- Appointment of a philanthropy champion to drive up charitable giving by individuals and businesses

Several of the proposals we put forward were included in the budget, further clarity was provided on removing charitable business rates relief for private schools, and government did introduce a protected minimum floor for reductions to Universal Credit Standard Allowance. However it is disappointing that other measures, particularly those requiring no additional cost were not introduced or consulted on.

Spending review

Charity Commission funding

The Charity Commission for England and Wales will see a slight increase in funding from £27.9m in 2024/25to £29.4m in 2025/26.

In advance of the budget we asked that the Charity Commission for England and Wales should have sufficient funding to improve its effectiveness and efficiency and is able to take advantage of the latest technology and data techniques to support charity transparency. It is positive that Commission has received more funding, but it remains to be seen if this modest increase will allow them to achieve this end. We await further information form the Commission on the impact that this might have.

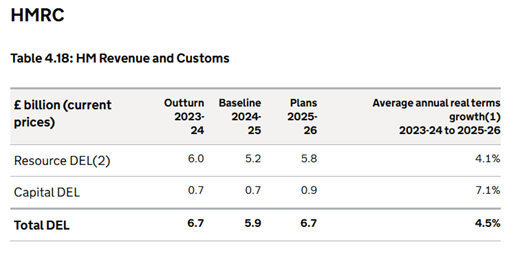

The increase in funding for HMRC is positive, as the settlement prioritises funding to help close the tax gap, modernise and reform HMRC and improve customer service. By recruiting 5000 more compliance staff and providing resources to “answer 85% of phone calls where customers want to speak to an advisor.” We hope that this translates to better customer service for charities needing to speak to HMRC.

Local government

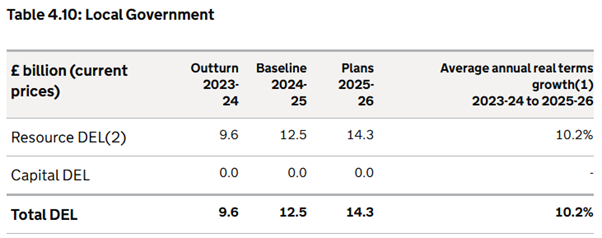

It is positive news that local government has seen a sizeable increase to its funding with an increase of over 10% in real terms.

However, Cllr Tim Oliver, Chairman of the County Councils Network has commented that “this funding does not eradicate councils’ funding gap, and local authorities will incur significant additional expense due to the increase in the National Living Wage. Therefore, councils will have little choice but to raise council tax and still will need to take difficult decisions over services to balance their budgets.”

We hope that the increase in funding would translate to further funds becoming available for charities which receive public sector contracts, particularly to take account of the other costs of operating that are increasing as a result of this budget (Employer NICS and NLW/NMW). However, this will be just one of many competing demands councils have to face, given the other sizeable constraints on local government budgets, particularly adult and children’s social care which will take £600m of the new funding.

NHS and Social Care

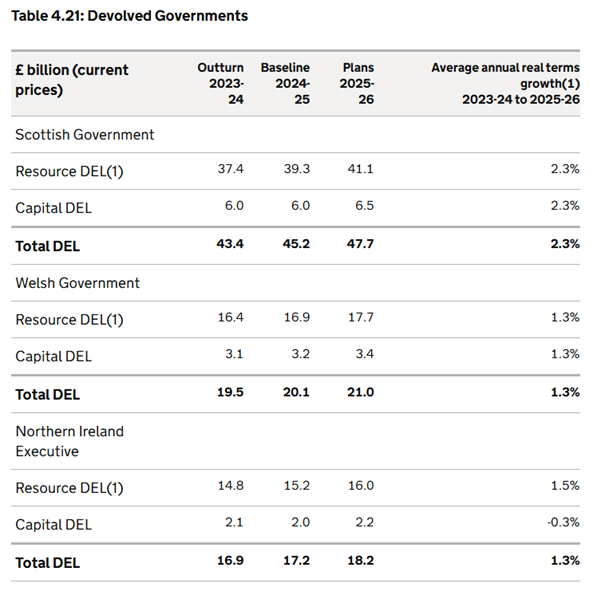

Devolved Nations

Benefits and unemployment support

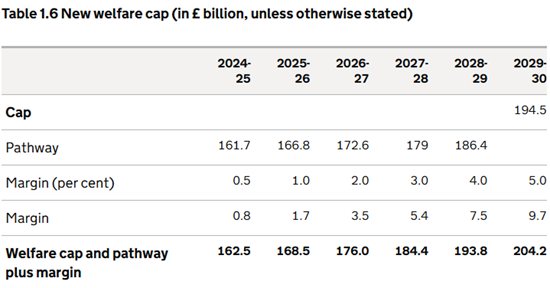

The government committed to setting a new welfare cap for 2029/30 “to support spending control and ensure that welfare spending is sustainable in the medium term.”

The government has set out the following measures on welfare and pensions:

Welfare cap reform

The government is setting a new welfare cap in its fiscal framework and has reset the cap for 2029-30. The margin has been revised and, to support ongoing spending control and to strengthen accountability, the Department for Work and Pensions will publish an annual report on welfare spending.

Universal Credit: Moving Employment and Support Allowance claimants onto Universal Credit sooner

The government will migrate Employment and Support Allowance claimants to Universal Credit from September 2024 instead of 2028. This move will bring more people into a modern benefit regime, continuing to ensure they are supported to look for and move into work.

DWP Fraud and Error: 3,000 new fraud and error staff

The government is expanding DWP’s fraud and error staff by 3,000, as part of its £110 million investment in 2025-26 to tackle fraud and error. This is expected to deliver gross savings of £705 million in 2029-30.

DWP Fraud and Error: new powers to recover debt

The government will increase DWP’s powers to recover debt as part of the forthcoming Fraud, Error and Debt Bill. This is expected to save £260 million in 2029-30.

DWP Fraud and Error: new investment to prevent fraud and error

The government will invest in DWP to carry out additional checks on Universal Credit claimants who have changes in their circumstances, as part of a £110 million investment in 2025-26 to tackle fraud and error. This is expected to save £250 million in 2029-30.

DWP Fraud and Error: Extending Targeted Case Review

The government will extend DWP’s Targeted Case Review which helps spot incorrect Universal Credit claims, saving £2.5 billion in 2029-30.

HMRC Fraud and Error: investment to tackle fraud and error in Child Benefit and Tax-Free Childcare

The government will invest in 180 new counter-fraud staff to increase HMRC’s capabilities to better tackle fraud and error in Child Benefit and Tax-Free Childcare. This is expected to deliver a gross saving of £95 million in 2029-30.

Universal Credit: Fair Repayment Rate

The government is creating a new Fair Repayment Rate which caps debt repayments made through Universal Credit at 15% of the standard allowance. This will mean 1.2 million households will be better off by £420 per year on average as a result of this change. This measure increases the public sector net cash requirement by £385 million in 2029-30.

Universal Credit: surplus earnings

The government will maintain the Universal Credit surplus earnings threshold at £2,500 in Great Britain until March 2026.

Universal Credit: amend Severe Disability Premium transitional protection regulations

The government will amend the Severe Disability Premium to better support claimants who move from supported or temporary accommodation into rented housing.

Households Support Fund and Discretionary Housing Payments

The government will provide £1 billion in 2025-26, including Barnett impact, to extend both the Household Support Fund (HSF) in England, and Discretionary Housing Payments (DHPs) in England and Wales. The HSF will help households facing the greatest hardship and financial crisis, including supporting them with the cost of essentials such as food, energy and water. This builds on the previous investment of £500 million, including Barnett impact, to extend the HSF in England to 31 March 2025. DHPs are administered by Local Authorities and will continue to support vulnerable and low-income claimants to meet additional housing costs or temporarily cover rent.

Targeting Winter Fuel Payments

As announced in July 2024, the Winter Fuel Payment will be targeted to those in receipt of Pension Credit or certain other income-related benefits from winter 2024-25, saving an average £1.5 billion of taxpayers’ money each year. The Winter Fuel Payment continues to be worth £200 for eligible households, or £300 for eligible households with someone aged over 80.

Enhancing Pension Credit take-up for new claims to Housing Benefit

The government has been working to maximise Pension Credit take up and ensure those eligible for this benefit are receiving it. There has been a significant increase in Pension Credit claims following the announcement to target Winter Fuel Payments. The government is optimising the use of Housing Benefit data and individuals applying for Housing Benefit from Spring 2025 will be proactively encouraged to apply for Pension Credit. The government is contacting 120,000 pensioners currently in receipt of Housing Benefit inviting them to claim Pension Credit too.

Bringing together the administration of Housing Benefit and Pension Credit

The administration of Pension Credit and Housing Benefit will be brought together for new claimants from 2026. This is two years earlier than previously announced, and will support more people to receive the benefits that they are entitled to.

State Pension and Pension Credit uprating for 2025-26

The government will maintain the State Pension Triple Lock for the duration of this parliament. The basic and new State Pension will increase by 4.1% from April 2025, in line with earnings growth. The Pension Credit Standard Minimum Guarantee will also increase by 4.1% from April 2025.

DWP and HMRC working age benefits uprating for 2025-26

The government will uprate working age benefits by September 2024 CPI of 1.7% from April 2025. This will see around 5.7 million families on Universal Credit gain £150 on average in 2025-26.

High Income Child Benefit Charge reform, simplification and targeting of economic support to households

The government will not proceed with the reform to base the HICBC on household incomes. This is because it would have come at a significant fiscal cost of £1.4 billion by 2029-30 if setting the threshold to £120,000-£160,000, where no families would lose out. To make it easier for all taxpayers to get their HICBC right, the government will allow employed individuals pay their HICBC through their tax code from 2025, and pre-prepopulate Self Assessment tax returns with Child Benefit data for those not using this service. The government will also explore how better data use and sharing across government departments can improve the targeting of economic support to households, especially in times of crisis.

Official Development Assistance (ODA)

The Chancellor has not heeded the demands of International Development charities to increase the aid budget, instead continuing with the previous spending commitments of 0.5% of GNI on Official Development Assistance (ODA), equalling £13.3 billion of ODA in 2024-25 and £13.7 billion in 2025-26.

The government states that “over the last spending review period the government spent an increasing proportion of the ODA budget on the costs of refugees and asylum seekers here in the UK.” They add that “The government is committed to ensuring that asylum costs fall, has taken measures to reduce the asylum backlog and is ending the use of expensive hotel accommodation. These plans should create more space in the ODA budget to spend on our international development priorities overseas.” We will have to wait and see if these this materialises.

They have committed to return to the previous commitment of 0.7% GDP in ODA “as soon as the fiscal circumstances allow” but a date of when this will be achieved has not been provided, and the OBR’s forecast indicates that this will not happen within the parliament.

Budget

National Wage and National Minimum Wage

From April 2025 the National Living Wage will increase to £12.21 per hour for all eligible employees, and the National Minimum Wage for 18-20 year olds will increase to £10.00 per hour for all eligible workers. The government is also increasing the minimum wages for Under 18s and Apprentices to £7.55 per hour, and the Accommodation Offset rate will increase to £10.66 a day.

The government announced a sizeable increase in the National Living Wage by 6.7% from April 2025. While it is positive that wages will increase for lower paid workers, it is less clear how charities will be able to afford these increases with their own budgets already so tight. Additional financial support for the sector is needed for many organisations to remain viable without making cutbacks in staff and/or reducing services. Unlike businesses, charities rarely have the option of passing on increased costs to customers through higher prices.

Tax

Many predicted that the thresholds for paying Income Tax and National Insurance Contributions would be frozen until 2029/30, in essence increasing Income Tax and National Insurance for many as more and more people would be captured by thresholds due to inflation – ‘fiscal drag’. However, the government decided not to extend the freeze to Income Tax and National Insurance contributions thresholds. So from April 2028, these personal tax thresholds will be uprated in line with inflation.

Charity compliance measures

The government will support charitable giving by legislating to prevent abuse of the charity tax rules, ensuring that only the intended tax relief is given to charities. These changes will take effect from April 2026 to give charities time to adjust to the new rules.

The only specific mention of charities in relation to tax was the government promising to legislate to prevent abuse of charity tax rules. This followed a consultation over 18 months ago, to which CFG and sector partners responded.

A full list of the measures they plan to introduce is included here - Charities tax compliance - summary of responses - gov.uk For the most part we do not envisage these changes providing too much additional administrative burden to the sector.

We will provide more detail on these measures in due course, once the draft legislation is published and accompanying guidance is published next year.

Employer National Insurance Contributions

Secondary Class 1 NICs (Employer NICs)

The government will increase the rate of Employer NICs from 13.8% to 15% from 6 April 2025.

The Secondary Threshold is the point at which employers become liable to pay NICs on employees’ earnings, and is currently set at £9,100 a year. The government will reduce the Secondary Threshold to £5,000 a year from 6 April 2025 until 6 April 2028, and then increase it by Consumer Price Index (CPI) thereafter.

The Employment Allowance currently allows businesses with Employer NICs bills of £100,000 or less in the previous tax year to deduct £5,000 from their Employer NICs bill. The government will increase the Employment Allowance from £5,000 to £10,500, and remove the £100,000 threshold for eligibility, expanding this to all eligible employers with Employer NICs bills from 6 April 2025.

This is perhaps the most concerning announcement for the sector in the budget, as alongside the increase in the NLW/NMW it will substantially increase the cost of operating for charitable organisations who have many employees. CFG, alongside sector partners, is working to determine the impact that this will have on charities, and more importantly the beneficiaries they serve.

Inheritance Tax

Inheritance tax: unused pension funds and death benefits

The government will bring unused pension funds and death benefits payable from a pension into a person’s estate for inheritance tax purposes from 6 April 2027. This will restore the principle that pensions should not be a vehicle for the accumulation of capital sums for the purposes of inheritance, as was the case prior to the 2015 pensions reforms.

Inheritance tax: extension of agricultural property relief to environmental land management

The government confirms it will extend the existing scope of agricultural property relief from 6 April 2025 to land managed under an environmental agreement with, or on behalf of, the UK government, devolved governments, public bodies, local authorities, or approved responsible bodies.

Inheritance tax: agricultural property relief and business property relief

The government will reform these inheritance tax reliefs from 6 April 2026. In addition to existing nil-rate bands and exemptions, the current 100% rates of relief will continue for the first £1 million of combined agricultural and business property to help protect family businesses and farms. The rate of relief will be 50% thereafter, and in all circumstances for quoted shares designated as “not listed” on the markets of recognised stock exchanges, such as AIM.

Inheritance tax: nil-rate band and residence nil-rate band

The inheritance tax nil-rate bands are already set at current levels until 5 April 2028 and will stay fixed at these levels for a further two years until 5 April 2030. The nil-rate band will continue at £325,000, the residence nil-rate band will continue at £175,000, and the residence nil-rate band taper will continue to start at £2 million. Qualifying estates can continue to pass on up to £500,000 and the qualifying estate of a surviving spouse or civil partner can continue to pass on up to £1 million without an inheritance tax liability.

It is unclear if the changes to IHT will have much impact on giving and legacies, although they may provide a slight incentive for more individuals to donate to charity. If someone bequeaths 10% (or more) of their net estate to charity, the IHT liability on what is left is reduced from 40% to 36%. But it is likely that the impact for charities of this change will be marginal at best.

Capital Gains

Capital Gains Tax Rates

The lower and higher main rates of Capital Gains Tax will increase to 18% and 24% respectively for disposals made on or after 30 October 2024. The rate for Business Asset Disposal Relief and Investors’ Relief will increase to 14% from 6 April 2025, and will increase again to match the lower main rate at 18% from 6 April 2026. The new rates will be legislated in Finance Bill 2024-25.

Capital Gains Tax: Investors’ Relief lifetime limit

The lifetime limit for Investors’ Relief will be reduced to £1 million for all qualifying disposals made on or after 30 October 2024, matching the lifetime limit for Business Asset Disposal Relief. This will be legislated in Finance Bill 2024-25.

VAT on Private Schools and removing Business Rates Relief

VAT on private school fees

From 1 January 2025, to secure additional funding to help deliver the government’s commitments relating to education and young people, all education services and vocational training provided by a private school in the UK for a charge will be subject to VAT at the standard rate of 20%. This will also apply to boarding services provided by private schools. The government has published a response to its technical consultation on this policy.

To protect pupils with special educational needs that can only be met in a private school, local authorities and devolved governments that fund these places will be compensated for the VAT they are charged on those pupils’ fees.

The government says it greatly values the contribution of our diplomatic staff and serving military personnel. The Continuity of Education Allowance (CEA) provides clearly defined financial support to ensure that the need for frequent mobility of staff and personnel, which often involves an overseas posting, does not interfere with the education of their children. Ahead of the VAT changes on 1 January, the MOD and the FCDO will increase the funding allocated to the CEA to account for the impact of any private school fee increases on the proportion of fees covered by the CEA in line with how the allowance normally operates. The MOD and FCDO will set out further details shortly.

Business rates: removing charitable rate relief from private schools

As announced on 29 July 2024, private schools in England will no longer be eligible for charitable rate relief. The Ministry of Housing, Communities and Local Government (MHCLG) will bring forward primary legislation to amend the Local Government Finance Act 1988 to end relief eligibility for private schools. This change is intended to take effect from April 2025, subject to Parliamentary process.

It is helpful that the government has provided further details on the proposed changes to private schools. Private schools which are ‘wholly or mainly’ concerned with providing full time education to pupils with an Education, Health and Care Plan will continue to receive the relief, which will be reassuring to those schools and the parents and carers of those children with additional needs.

Other changes to Business Rates

Business rates: retail, hospitality and leisure relief

For 2025-26, eligible retail, hospitality and leisure (RHL) properties in England will receive 40% relief on their business rates liability. RHL properties will be eligible to receive support up to a cash cap of £110,000 per business.

Business rates: multipliers

For 2025-26, the small business multiplier in England will be frozen at 49.9p. The government will lay secondary legislation to freeze the small business multiplier. The standard multiplier will be uprated by the September 2024 CPI rate to 55.5p.

Business rates: sectoral multipliers

The government intends to introduce permanently lower multipliers for Retail, Hospitality and Leisure (RHL) properties from 2026-27, paid for by a higher multiplier for properties with Rateable Values above £500,000.

Business rates reform

A discussion paper has been published setting the direction of travel for transforming the business rates system and inviting industry to a dialogue about future reforms.

Other relevant tax changes

Stamp Duty Land Tax: Increase to the Higher Rates on Additional Dwellings

From 31 October 2024 the Higher Rates for Additional Dwellings (HRAD) surcharge on Stamp Duty Land Tax (SDLT) will be increased by 2 percentage points from 3% to 5%. Increasing HRAD ensures that those looking to move home, or purchase their first property, have a comparative advantage over second home buyers, landlords, and businesses purchasing residential property. This is expected to result in 130,000 additional transactions over the next 5 years by first-time buyers and other people buying a primary residence. This surcharge is also paid by non-UK residents purchasing additional property.

The single rate of SDLT that is charged on the purchase of dwellings costing more than £500,000 by corporate bodies will also be increased by 2 percentage points from 15% to 17%.

Fuel duty rates 2025-26

The government will freeze fuel duty rates for 2025-26, a tax cut worth £3 billion over 2025-26 which represents a £59 saving for the average car driver. The temporary 5p cut in fuel duty rates will be extended by 12 months and will expire on 22 March 2026. The planned inflation increase for 2025-26 will also not take place.

Company Car Tax rates 2028-29 and 2029-30

The government is setting rates for Company Car Tax (CCT) for 2028-2029 and 2029-30 to provide long term certainty for taxpayers and industry. CCT rates will continue to strongly incentivise the take-up of electric vehicles, while rates for hybrid vehicles will be increased to align more closely with rates for internal combustion engine (ICE) vehicles, to focus support on electric vehicles.

- Appropriate Percentages (APs) for zero emission and electric vehicles will increase by 2 percentage points per year in 2028-29 and 2029-30, rising to an AP of 9% in 2029-30.

- APs for cars with emissions of 1 – 50 g of CO2 per kilometre, including hybrid vehicles, will rise to 18% in 2028-29 and 19% in 2029-30.

- APs for all other vehicle bands will increase by 1 percentage point per year in 2028-29 and 2029-30. The maximum AP will also increase by 1 percentage point per year to 38% for 2028-2029 and 39% for 2029-2030. This means for vehicle bands with emissions of 51 g of CO2 per kilometre and over, APs will increase to 19% – 38% in 2028-29 and 20% – 39% in 2029-30.

Theatre Tax Relief, Orchestra Tax Relief and Museums and Galleries Exhibitions Tax Relief: 45%/40% rates from 1 April 2025

From 1 April 2025, the rates of Theatre Tax Relief, Orchestra Tax Relief and Museums and Galleries Exhibitions Tax Relief will be set at 40% for non-touring productions and 45% for touring productions and all orchestra productions. These rates apply UK-wide. This measure was announced at Spring Budget 2024 and has been legislated.

Government funding/support for charities

The only specific mention of charities in the budget came in relation to the important work of the Holocaust Educational Trust, with government committing to 'ensure that the Holocaust is never forgotten and that its lessons are learnt by current and future generations, an additional £2 million will be spent next year on Holocaust remembrance and education.' It is unclear if the money will be received by the Holocaust Educational Trust directly.

Social impact investment vehicle

The government is announcing that work will begin to develop a social impact investment vehicle, led by the Chief Secretary to the Treasury, working with DCMS, to support the government to deliver its missions. This will bring together socially motivated investors, the voluntary sector and government to tackle complex social problems. This will be designed and developed through engagement with the sector, with further details to be announced at Phase 2 of the Spending Review.

This is an interesting proposal which could provide much need investment to the sector to help government deliver on its missions, we look forward to consultation prior to the Spring when there will be further details.

UK Shared Prosperity Fund

The UK Shared Prosperity Fund will continue at a reduced level for a further year with £900 million of funding; this transitional arrangement will provide as much stability as possible in advance of wider local growth funding reforms. The Long Term Plan for Towns will be retained and reformed into a new regeneration programme.

Uplift to the Carers Allowance

Carers, who are predominantly women, will have greater flexibility to manage both employment and caregiving responsibilities through reforming Carer’s Allowance to increase the weekly earnings limit to the equivalent of 16 hours at the National Living Wage.

CFG’s view

Caron Bradshaw OBE, CEO, CFG:

“Before her first budget and spending review, Chancellor Rachel Reeves strongly emphasised that tough choices would be made. Those difficult choices have been set out in the budget, and many within the charity sector will now be facing similarly difficult decisions. While the increase in National Living and National Minimum Wages will be welcomed by most, when coupled with an increase in Employer NICs, these rises will put significant financial pressure on many charities. Charity leaders will be looking at this budget and asking themselves what they can do to keep the doors open to the people and communities they serve.

“The financial pressures and demands on the sector have long been documented. However, there was nothing in the budget that will directly support its financial sustainability. It is positive that the Chancellor has recognised that longer-term thinking and planning is needed but, in the immediate and short term, the sustainability of many charitable organisations remains a very real concern.

“With operating costs – especially around staff – rising sharply, and no evidence that the government’s investments will reduce the demand and pressure on charities any time soon, many charity leaders will be left wondering how to balance their own budgets whilst continuing to support those who rely on them.

“If there’s a bright spot to be found, it’s that we sense the new government and the charity sector are now starting to speak the same language. Despite the £22bn ‘blackhole’ legacy the Chancellor said was left by the previous government, this budget goes some way towards plugging the enormous gaps in public services and local government funding.

“We welcome, for example, the £11.2bn increased investment in education, including £1bn for special educational needs, and £22.6bn for the NHS. We also welcome the £26m investment in new mental health crisis centres, £233m to prevent homelessness and support for the retail, hospitality and leisure organisations. We also appreciate the government’s support for veterans and Holocaust remembrance and education. We are keen for more details on the Social Impact Investment Vehicle.

“We believe more could be done, as we set out in our recent letter to the Chancellor, alongside our sector partners. We will continue to work with government officials and departments, to press for the sector’s ‘invest to save’ asks, to work effectively to improve the operational and regulatory environment, and to ensure that the relationship between government and the sector is reset, as set out in the recent launch of the Civil Society Covenant consultation.

“There are reasons to be hopeful, but for now many in the sector will be re-focusing on what they need to do to keep their organisations in operation, so they can continue to deliver public benefit and remain financially sustainable.”

Dr Clare Mills, Deputy CEO, CFG:

“We’re looking forward to finding out more about the government’s plan to develop a Social Impact Investment Vehicle. This could have enormous potential to promote philanthropy and connect purposeful giving to the expertise of the charitable and voluntary sector.

“We've seen positive moves from the government that indicate they understand the huge insight, experience and innovation that the voluntary sector can bring to tackling some of the most complex societal problems, for example with the appointment of James Timpson taking on the role of Prisons Minister.

“CFG is ready to work closely with HM Treasury and DCMS – and every other government department – to foster connections. Voluntary organisations and their people think about the impact they are having every single day, and we welcome any opportunity to co-design impactful programmes that will work for everyone.”

Richard Sagar, Head of Policy, CFG:

“Public trust in charities is crucial, so we welcome any measures that support and build confidence and help to prevent the abuse of tax rules. CFG responded to the previous government’s consultation on charities tax compliance in 2023. We welcome the government’s approach of making small and incremental changes and will continue to work with HMRC on the accompanying guidance, to ensure it is clear and useful to the relatively small number of charities that will be impacted.”

Reactions from CFG's corporate partners

Megan Utley, Senior Tax Manager at BHP LLP:

“Whilst there were no direct changes to charity taxes announced today, the third sector will feel an indirect impact from some of the measures announced. The increase to Employer NIC and the National Minimum Wage will increase the cost base for employing charities, while the announcement of reforms to restrict Inheritance tax reliefs may encourage an increase in charitable donations.

"Disappointingly there was no specific funding announced for charities working to support those who are impacted most by the cost of living crisis, however there may be funding opportunities for charities operating within the education and healthcare sectors, as well as those who receive funding from local councils as government spending is targeted to increase in these areas to support our schools, innovation and the NHS. Overall, today's Budget has not made operating in the charitable sector any easier and trustees will need to continue to find ways to operate efficiently in a difficult economic climate.”

Ross Palmer, Senior Tax Manager at Sayer Vincent:

“This was a budget that promised a change in approach, and it certainly delivered with a number of changes to both spending and tax. For many charities, employee costs are one of the biggest areas that will need review beyond April 2025, with changes to both the National Living Wage and Employer NICs potentially resulting in increased costs for services already under funding pressure. However, for some charities, the increase in the headline rate of NI may be mitigated by the increase in the employment allowance from £5,000 to £10,500, with more organisations eligible following the removal of the restriction for employers with NIC greater than £100,000.

"It will be interesting to see what arises from the promised increases in departmental budgets, including for local government. With many charities helping to deliver vital services from government funding, they will hope that this increase feeds through to allow these services to continue to be delivered. I would argue that there was a missed opportunity to recognise the role of charities and the benefit that additional funding could bring to improving these services.

"In fact, the only real specific mention of charities was a response to last year’s charity tax compliance consultation, which has stated an intent to introduce new requirements for introduction in late 2025, early 2026. It will be important to ensure that the proposed legislation is reviewed carefully to ensure these rules do not impose any further significant administrative burden on charities, at a time when the sector has been highlighting the benefits a simplification of approach in areas such as Gift Aid could bring.”

James Bird, Consultant at Quantum Advisory:

“Discussions in the media around potential employer pension contribution taxation and a decrease in the maximum tax-free cash lump sum available ultimately proved more to be a lesson in how uncertainty in the pensions industry can drive consumer behaviour. For example, there is evidence that some individuals accelerated their tax-free cash lump sum plans and will now need to consider how to invest these tax-free cash lump sums to not make a loss.

"Overall, the pensions industry is in a finely balanced position as it is widely accepted that the majority of current pension systems will not provide a sufficient level of income for members in retirement. This has led to the government initiating a review into pensions adequacy, balancing this with their desire to use pensions investment to boost growth in the UK economy.

“It was well reported before the budget that the Chancellor is an adept chess player and has learnt how to think several steps ahead through the game. At this stage I expect that the Chancellor has elected to make simpler changes elsewhere to recoup the current reported deficit in the nation’s finances at this stage. The wider stage to consider then how the pensions landscape will need to adapt will play out on the chessboard over the next years.

"With that said, the battle may have got significantly harder now that employer costs have increased further as part of this budget.”

Sarah Garnish, Consultant at Quantum Advisory:

“Whilst pay packets for ‘working people’ will not be directly affected, this increase in Employer NIC could indirectly affect employees. For instance:

- Employers reducing future salary increases in order to recuperate the additional costs.

- A decrease in recruitment drives from companies leading to an increase in unemployment.

- A potential decrease in business confidence leading to stifled growth.

- A rework of existing pension contribution structures to recuperate the additional costs. This could either be a reduction in DC pension contributions or more of the NI saving from salary sacrifice schemes going to employers rather than employees.

"However, looking at the change specifically from a salary sacrifice pensions point of view, the increase in the Employer National Insurance rate makes providing a pension provision for employees more attractive for employers where pension contributions are paid via salary sacrifice.”

Andrie Kazamias, tax director at RSM UK:

“On the face of it, this was not a great budget for charities. The government’s response to the consultation on tax compliance by charities, which closed in July 2023, has at last been published. Changes will be introduced from April 2026 in relation to donor-benefits, charitable investments, non-charitable expenditure and the Fit and Proper Persons test. Although badged as measures to “support charitable giving”, these changes will inevitably introduce additional complexity and uncertainty, at least in the short to medium term.

“Many charities will be impacted by the increase in Employer NIC and in the National Living Wage, which could also have an inflationary impact on the cost of goods and services purchased by charities. Unfortunately, unlike many businesses, charities that rely on voluntary income can’t simply pass these increased costs on to their customers, and so will likely see a further squeeze on their financial resources.

“So not a particularly sunny outlook, and positively stormy for private schools.”

Coming soon: look out for CFG's budget and spending review highlights video with CFG's Policy Team.