Ruth Jenkins from Keep Britain Tidy and Simon Hughes from Crowe UK take a look at the risks of global heating, their interrelated nature and complexities, and pose important questions on managing risk.

As the Earth heats up, climate change is accelerating, and Boards need to make sure the management of the related risks keeps up.

Global heating is bringing with it significant changes to organisation’s risk exposures, with increased impacts and likelihoods for many pre-existing risks on risk registers, together with, as yet, unconsidered new risk items.

The risks are many and varied, affecting non-profits and social purpose organisations in different ways. This can include:

- Business continuity risks

- Increasing need amongst beneficiaries

- Staff health and productivity

- Supply chain risks

- Capital risks

- Lack of available/affordable insurance

- Compliance risks

- Reputational risks

Non-profits are increasingly focused on reducing their environmental impact. However, this is only one part of challenge of global heating. They also need to consider their adaptation to the changes that are happening and the additional risks that will emerge over the coming years.

The context

The 2021 Climate Change Risk Assessment report from Chatham House concluded:

- If policy ambition, low-carbon technology deployment and investment follow current trends, 2.7°C of warming by the end of this century is likely, relative to pre-industrial temperatures. A plausible worst case of 3.5°C is possible (10% chance). These projections assume Paris Agreement signatories meet their Nationally Determined Contributions ('NDCs'). If they fail to do so, the probability of extreme temperature increases is non-negligible.

- If emissions follow the trajectory set by current NDCs, there is a less than 5% chance of keeping temperatures well below 2°C relative to pre-industrial levels, and less than 1% chance of reaching the 1.5°C Paris Agreement target.

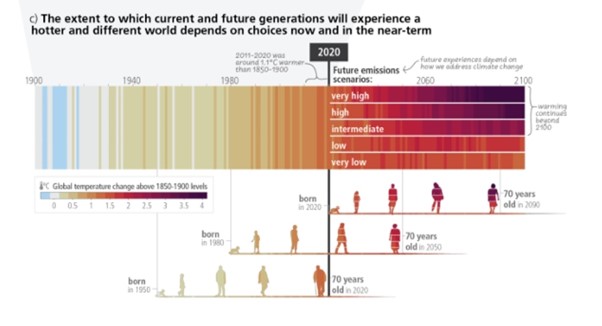

The latest IPCC report (AR6 Synthesis Report 2023) shows these changes visually. The possible scenarios for our futures are laid out on the right hand side.

The best case scenario at the bottom involves cutting global emissions in half by 2030 to have a 50% chance of limiting global heating to 1.5 degrees.

We need to do everything we can to achieve the best possible future. However, at this point it is guaranteed that the climate will continue to change and additional risks will materialise. As such Boards need to plan now to ensure their organisations can weather the literal and metaphorical storms ahead.

Risks to consider

The UK Climate Change Committee ('CCC') considers that flooding and extreme weather events which damage assets and disrupt business operations pose the greatest risk now and in the future.

The nature of climate emergencies is that they can be fast onset and complex, with damage to assets, loss of communications, lack of access, personal impact on staff etc all happening at the same time.

The knock-on impacts of severe weather include disruptions to supply chains and distribution channels, and impacts on staff. Businesses, including charities, need to understand their exposure and not assume authorities will manage risks on their behalf.

In the CCC’s latest report, they recommend adapting for 2 degrees, and assessing the risks for 4 degrees, as well as preparing for extremes.

We consider the following eight risks will need to be considered by the majority of charities in their risk management processes:

1. Business continuity risks

The most obvious risk is that an acute weather event, made more likely by climate change, impacts a physical location where charities deliver their services or have an office. Many organisations already have a business continuity plan in place.

As our understanding of how climate risks are manifesting improves, these may need to be adapted. However, it is not just our own physical locations that could be impacted:

Infrastructure

Charity Boards don’t normally consider national and international infrastructure risks as ‘our’ risks to manage, but we need to understand our dependency on them.

Road, rail and flight options will all suffer significant flood and heat-related disruption. Which parts of our work does that affect? Commuting, distribution, public access?

Digital and telecommunications

We feel more digitally prepared for disaster than ever before after learning how to work at home during the Covid lockdowns, but there are still real risks to resolve.

Are assets at risk of flooding? Data centres are currently developed in areas of high flood risk, and are also underserved in terms of heat protection.

How well are our outsourced providers managing their climate related business continuity risks? What contingency plans do we need for weather related outages? How can we diversify our technologies to build in redundancy?

2. Increasing needs among beneficiaries

What risks affect the health and needs of your beneficiary groups – both human and, for some charities, non-human animals? Issues to consider include:

- weather related mortality, morbidity, disruption and anxiety

- climate-sensitive disease prevalence

- worsening air quality

- overstretched health services & delayed emergency response

- drought risk

How well protected from these changes are our beneficiaries? The less well-resourced individuals are, the more severe their experienced impact from these effects. These least well-resourced individuals are likely to be our beneficiaries.

However, even those best resourced will not be able to insulate themselves fully from the effects of increasingly frequent interruptions and disruptions to global food supplies and associated price effects.

3. Staff health and productivity losses

Post Covid we are used to working from home being the solution to external issues. There may be an assumption that this will be effective mitigation if offices become inaccessible in the short term, however there are some potential flaws to this approach.

Currently there is no legal maximum temperature for safe working but there is a risk that people's homes become an unsafe working location and offices without aircon could also be excessively hot. The duty of care of an employer in this situation is untested but may come into focus as high temperatures become more frequent.

Ultimately, employers may have to accept that there will be circumstances where staff cannot work, and that this impacts those working from home as well as those working from a business location. This will lead to disruption and reduced output.

4. Supply chain risks

The rise of just in time supply chains has felt unstoppable in recent years, with companies like Amazon pushing the boundaries in search of satisfying consumers with near instant gratification. However, we have also seen the risks of disruption to global shipping from conflicts and disputes.

Most charities are to some extent dependent on supply chains to achieve their objectives, and the assumption that these will function may need to be reviewed.

Do you need to hold more of key stocks? How resilient are you to business interruption? Have you conducted any stress testing of critical supply chains?

5. Capital investments

Physical assets

Some charities are fortunate enough to own their own properties, either for their own use or as part of their investments. They provide strength to their balance sheet, and as part of their reserves provide a buffer to support them should they experience a financial downturn.

These properties may be in the UK or overseas, we have focused on the UK as this impacts more organisations. The growth and stability in the UK property market has meant that charities have not needed to worry too much about these assets holding their value. This may change.

In 2021, NASA published a map showing the areas at risk of frequent flooding by 2030. A snapshot of the centre of the country for 2030 indicates clear regional risk (with red showing areas below annual flood level), but local risks will need more careful assessment. The tool itself can be used interactively to visualise risk in any area, over multiple timeframes[1].

In the longer term this will have an impact on property values, and insurance costs (see below). As such, charities need to consider whether they understand the risks to the properties that they hold, and whether holding properties as their reserves of last resort remains the best option in the long term.

Keep Britain Tidy recently chose to move their London office out of Vauxhall, following a review that included assessment of long-term flood risk. Ten years ago, this would not have been the case as Vauxhall would not have been considered a high-risk flood area in the foreseeable future.

Other investments

What proportion of pension scheme assets are at risk, as heavy investment in the energy sector leaves stranded fossil fuel extraction assets unable to deliver a return? What losses might be experienced in investment assets?

6. Insurance

Will you be able to insure your assets e.g. in a flood zone, in an area of coastal erosion, or because of heat/drought related subsidence? In a world of increasing risks, insurance will become more expensive and we could see insurers opting not to ensure or to price prohibitively in high risk areas.

If we draw comparisons with cyber insurance, some organisations are finding that insurance is not available or prohibitively expensive unless they have appropriate risk management in place, and this may become the norm for climate risks as well.

This is likely to impact on decisions about investment in physical locations and operations, as well as the need to hold reserves to self-insure where insurance cannot be obtained.

7. Compliance risks

As the world grapples with climate change, we are seeing and expect to continue to see increasing government action in response. Part of this will include increasing the legal and regulatory responsibilities of companies and non-profits.

Whilst there is clearly a positive aspect to this, increasing compliance requirements will increase costs and stretch limited charitable resources even further. As these compliance requirements progress down to smaller organisations, the risk of not being able to comply becomes greater.

8. Reputational risks

As the negative effects of global heating become more apparent, attention will turn more and more on the drivers and who has been applying the accelerator or the brake. All of us will need to consider the reputational risks arising from our current choices. How will our actions be judged?

For us at Keep Britain Tidy, we have just conducted an Eco-Audit that tells us that over 99% of our operational carbon footprint was coming from our investments: our banking and our pensions. For reference, we are not rich! This heavy weighting will be very common throughout the charity and non-profit sector.

At Keep Britain Tidy we are already shifting our banking and pensions investments to lower carbon options, driven by a desire to avoid the worst scenarios of climate change, but we also need to consider how our investment choices will be judged by supporters and funders alike, and what the effects of that might be.

Relationship between risks

Where this gets even more complicated is the related nature of these risks. Take a care home as an example: The building itself could be at risk of damage from extreme weather, and the individuals living there will almost certainly be more vulnerable than the general population to increasing heat.

However, if a care charity installs air conditioning in all of its locations, it will increase both its operating costs and its carbon footprint, due to increased energy usage and the F-gasses used in the system, which have a significantly greater heating effect on the atmosphere than carbon.

Additionally, it is a system that relies on uninterrupted power supplies, and in extreme weather events around the world we have seen these power supplies fail. These issues are complex due to their interrelated nature.

In an acute event, we must also consider risk contagion. If something goes badly wrong it may be that rather than a single, isolated risk you experience multiple risks materialising at the same time.

You could have your own physical location disrupted, dramatic increases in beneficiary need, staff welfare challenges, travel issues and supply chain disruption at the same time. Do business continuity plans take this into account?

Risk management

We all need to think about how we are managing these risks, and who is becoming the risk owners of these new and emerging risks.

For some organisations, these risks require immediate management and therefore will fit neatly into established processes such of risk registers and active risk management.

For others, the risks are on the horizon and therefore do not fit so well with established risk management processes.

However, the risks above are too big and too probable to ignore. As such, new processes will be needed to periodically assess the size of these risks and the velocity with which they are approaching – both of which will change over the coming years.

The judgement of when to move these risks into active management will be key. Our assessment needs to be integrated thoroughly into our operations, which emphasises the importance of training key risk owners in these new areas.

All too often discussions around risk consider each risk in isolation and do not consider the exposure to a portfolio of risks or risk contagion. The nature of climate risks means that one risk crystallising may cause or correlate with the crystallisation of other risks.

For example, a severe weather event may prevent access to an office but also damage staff’s property leading to health/financial/mental health challenges for those individuals and could also impact suppliers and increase the needs of beneficiaries.

A business continuity plan that focuses solely on coping with lack of access to the building would not be adequate to respond to such a situation.

So what should you do?

It is vital that your risk management process allows you to address immediate risks whilst giving sufficient time to consider high impact risks over the longer term. Covid, cost of living challenges and war in Ukraine have shortened the risk horizon.

Charities need to deal with these short-term challenges (which are likely to continue given global geopolitics etc) whilst making time to assess the short, medium and long-terms risks arising from climate change.

Key questions to consider:

- Do you understand your exposure to the risks described above?

- Do your risk management tools clearly articulate short-term and long-term risks, risk contagion and risk velocity, as well as the traditional impact and likelihood?

- Have your executive team and trustees set aside adequate meeting time to consider both short-term and longer term risks?

Charities have always been established to tackle challenges, many of them to tackle the greatest challenges faced by society. As such charities are often naturally resilient due to the drive and determination of the individuals involved.

Climate change is set to be one of, if not the greatest challenge of the coming decades. To face it effectively, charities will need not only resilient people, but also effective risk management.

Risk contagion

A framework for complex climate change risk assessment - ScienceDirect

Three categories of increasingly complex climate change risk

(A) Category 1: interactions among single drivers (small circles) for each determinant of a risk, namely hazard, vulnerability, exposure, and response to climate change.

(B) Category 2: interactions of multiple drivers (e.g., compounding vulnerabilities of education and income) within each determinant of risk, as well as among the determinants of a risk.

(C) Category 3: interacting risks.

Across categories 2 and 3, compounding and cascading interactions, together with aggregations, generate increasing complexity for risk assessment.

|

|

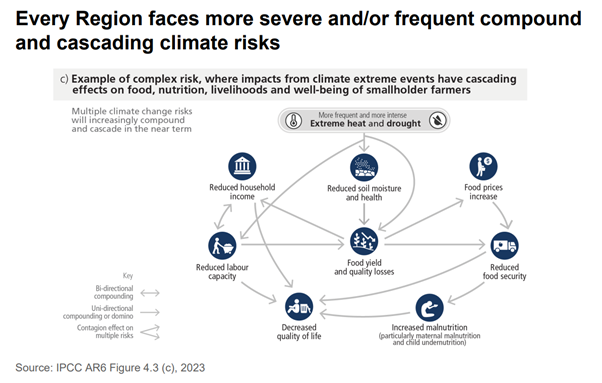

An example of how relationships between risks can be mapped to better understand potential future scenarios from the IPCC:

|

|

Source: PowerPoint Presentation (ipcc.ch) https://apps.ipcc.ch/outreach/documents/707/1687848507.pdf

|

If you have any questions or comments about this article, please email the CFG team.

Connect with the authors

Ruth Jenkins is Director of Finance at Keep Britain Tidy where she has worked since 2020. Ruth is also a Council Member for National Trust.

Simon Hughes is Director of Non-profits at Crowe UK. Prior to joining Crowe in 2018, Simon worked as an International Management Accountant at WaterAid.