CFG's policy team takes a look at the government's latest Spending Review as announced by Chancellor Rishi Sunak on 25 November 2020.

This briefing provides a summary of the key points of the 2020 Spending Review, including those of particular interest to the charity sector, alongside the latest key pieces of information from the Office for Budgetary Responsibilities economic and fiscal outlook.

Useful links:

If you would like to discuss any of the issues arising from the 2020 Spending Review, please email the policy team.

Latest data on the UK economy

To accompany the Spending Review, the Office for Budget Responsibility (OBR) also publishes forecasts for the economy and public finances. Below is a snapshot of some of the key updates taken from the central forecast:

-

Unemployment

Unemployment is expected to rise to 7.5% in the second quarter of 2021 but will then decrease to 6.5% in 2022. As the CJRS comes to an end it is not surprising that we will see an increase in unemployment, but the OBR has stated that the CJRS will lower the level of unemployment by 300,000 compared to what would have happened in its absence.

-

Inflation (CPI)

Inflation is predicted to fall to 0.8% in 2020, 1.2% in 2021, not returning to the Bank of England’s 2% target until 2024.

-

Earnings

Average earnings are expected to grow by 1.2% in 2020, 2.1% in 2021 levelling off to 2% by 2022. The increase in earnings (although relatively modest) in spite of the pandemic, is also largely due to the CJRS helping to subsidise employees who are producing little or no output.

-

Inheritance tax

The OBR has reported that annual inheritance tax receipts will remain largely unchanged from £5.1bn in 2019/20 to £5.2bn by 2020-21.

It is hardly surprising that the central economic forecast for GDP is as bad as it is (in fact it is the worst in 300 years), and it is only right for the government to increase borrowing to tackle Covid-19 and stimulate economic growth when the cost of servicing debt has fallen to historic lows, so one needn’t be too concerned about such a significant increase in borrowing for the moment. At some point in the future, this will need to come down, but to paraphrase St Augustine “Lord make me chaste, but not yet”.

The OBR states clearly that "Our central forecast shows £20-30 billion in spending cuts or tax rises would be required to balance revenues, in addition to day-to-day spending and to stop debt from rising by the end of this Parliament."

This will mean there are some very tough choices ahead for the Chancellor, and one would expect to see tax rises at the upcoming Spring budget in March 2021.

Charity announcements

There were very few announcements on funding to charities directly at this year’s Spending Review. However, there were some to note:

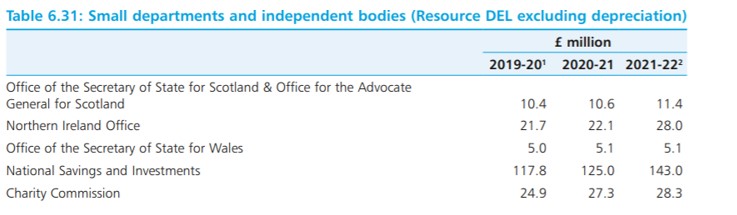

The Charity Commission will see an increase in funding from £24.9m in 2019/20 to £28.3m in 2021/22.

This follows an increase in funding for the regulator in previous years and means it is approaching the size it was prior to the financial crisis. It should also end any calls for charities to be charged to fund the regulator for some time. There are further issues of governance and remit (which are outside the purview of the spending review) which still need to be resolved.

The government has announced that it will “achieve efficiencies in the Office for Civil Society (OCS) by rationalising work to better deliver the government’s priorities for the sector.”

It is unclear what exactly this means for the department, but undoubtedly cuts will be on the way. OCS has seen its budget cut for the last few years, but this could mean significant changes in how charities engage with government, we will seek to find out more and update our members.

International Development

As has been widely reported, the UK’s overseas aid budget has been cut from 0.7% of GNI to 0.5% for 2021. With this equating to an almost £4bn cut overall. The government has made the commitment to return to 0.7% “when the fiscal situation allows”. CFG, alongside our sector partners, are strongly opposed to this announcement, having signed an open letter advocating against this cut.

Former minister Baroness Sugg resigned as Minister for Sustainable Development as a result of the announcement. Suffice to say that all charities stand in solidarity with those organisations and beneficiaries affected by this cut, which affect not only beneficiaries overseas, but organisations and individuals involved in delivering public benefit in the UK.

Local Government

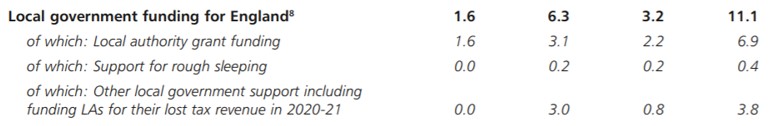

As the table above from the Covid-19 spend summary by department table shows, local government is receiving additional funding to help respond to Covid-19, and to help fund them for their lost tax revenue in 2021, equating to £6.3bn more in 2020-21, £3.2bn in 2021-22, and £11.1bn in total.

The Spending Review also announced additional funding for rough sleepers and those at risk of homelessness during Covid-19 through an ‘additional’ £254m of resource funding, which, however, includes £103m already announced earlier this year for accommodation and substance misuse. This takes total resource funding for rough sleeping and homelessness in 2021-22 to £676m, which is a 60% cash increase compared to last year’s Spending Review.

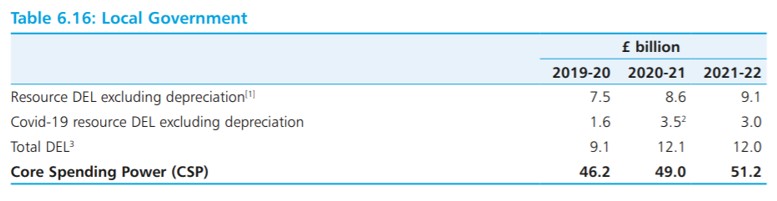

Government will slightly increase local government spending, with local government core spending power (CSP) increasing from £46.2bn in 2019/20 to £49bn in 2020/21, and £51.2bn in 2021/22. But if one excludes the c.£3bn focused on Covid-19, and Covid-19 recovery, this is not an increase, and while providing some certainty for the next year or so, the Local Government Association have righty commented that “Overall, the Spending Review provides more certainty for councils next year but the long-term outlook remains unclear.”

The increase in CSP also depends on increases to council tax and the adult social care precept which allows local authorities to levy a 3% precept to raise revenue. Social care organisations have lamented the approach, which does not address the gaping need. In the long term, there will need to be a more sustainable approach to adult social care, with the government bringing forward proposals on this next year. So overall this equates to a £2.5bn cash injection from central government for next year.

The settlement above is intended to follow the priority outcome of “a sustainable and resilient local government sector that delivers priority services and empowers communities.” Given the financial challenges local authorities face due to many years of funding cuts since 2010, it is far from clear if the settlement from the 2020 Spending Review will deliver this outcome. It is fair to say that there is a still a long way to go before charities and the wider third sector can feel satisfied that the fifth point of our Five-Point Plan is satisfied, so that local authorities can once more feel that they are on a sustainable footing.

UK Shared Prosperity Fund (UKSPF)

There has been a long delay in government providing further details about the UKSPF, and we were hoping to find out more from the Spending Review. While it is mentioned, there are still many outstanding details. It is also one of the points in our Five-Point Plan for the sector.

The initial text looks promising and aligned with our Five-Point Plan in some respects. UK-wide funding will at least match current EU receipts, on average reaching around £1.5 billion a year. Although important to note that it is based on EU receipts and not allocation.

It will be delivered in two tranches. The first portion will target areas most in need with investment focusing on; investment in people, communities and place, and local business, with the projects being asked to agree specific outcomes to target within a newly announced UK-wide framework.

These proposals will then be approved by the government "among a representative stakeholder group". It goes without saying that it will be crucial that charities and other social change organisations are part of that stakeholder group. The second portion will target people most in need through bespoke employment and skills programmes that are tailored to local need.

There is also further funding announced to support communities through pilot programmes and new approaches, with the additional funding delivered UK-wide, using new powers in the UK Internal Market Bill to be announced in the New Year.

Much more detail is needed, but it looks like Local Enterprise Partnerships (LEPs) won't be key to the process, but it's unclear if the UK-wide investment framework will include the promised consultation. It is also not clear if equality and non-discrimination objectives will remain as key criteria. We will continue to engage with this, every step of the way, working with wider sector partners to continue our joint ask that the UKSPF works for civil society.

Levelling Up Fund

Perhaps the biggest surprise from the Chancellor was the £4bn Levelling Up Fund for England, with £0.8bn for Scotland, Wales and Northern Ireland.

The fund will invest in local infrastructure that has a visible impact on people and their communities and will support economic recovery. The fund will be cross-departmental, and see investment in local projects worth up to £20m including “local road schemes, bus lanes, railway station upgrades, regenerating eyesores, upgrading town centres and community infrastructure, and local arts and culture”, with £600m available in 2021-22. Projects must complete in this parliament. A full prospectus will be published in the new year, alongside the launch of the first round of competitions.

Although initially announced by the Chancellor that projects must be supported by the local MP to go ahead, Treasury has since made clear that the local MP supporting will not be a requirement for funding, but what will be required is the buy-in of local stakeholders.

While it’s positive that there is at least a nod to the notion of levelling up, the element of competition for funds troubles those of us who believe that a bidding war isn’t the best way to achieve outcomes for communities in need of investment and ‘levelling up’. There is a danger that it could exacerbate inequality rather than level up.

The apparent focus on physical infrastructure over social infrastructure is also a concern, as is the need for local MP support which may indicate a level of political involvement that would not be transparent. However, that element seems to have been downplayed subsequently by the Treasury.

There are many details that have not been announced about the fund, but we look forward to hearing more and working to ensure that civil society organisations are able to play their full role.

National Living Wage and National Minimum Wage

In line with recommendations from the Low Pay Commission, the government has made the following increases to the National Living Wage, National Minimum wage, with them all being effective from April 2021:

-

Increasing the National Living Wage (NLW) for individuals aged 23 and over by 2.2 per cent from £8.72 to £8.91

-

increasing the rate for 21 to 22-year-olds by 2.0 per cent from £8.20 to £8.36 per hour

-

Increasing the rate for 18 to 20-year-olds by 1.7 per cent from £6.45 to £6.56 per hour

-

Increasing the rate for 16 to 17-year-olds by 1.5 per cent from £4.55 to £4.62 per hour

-

Increasing the rate for apprentices by 3.6 per cent from £4.15 to £4.30 per hour

Universal Credit

One of the biggest concerns from today’s announcement is that the £20 uplift to Universal Credit will not be made permanent, so will be cut in April 2021. Given the OBR forecast that unemployment will peak in Q2 of 2021, it is a baffling decision and one which will hurt some of the most disadvantaged in society. Might this be another government u-turn to come? CFG will seek to join campaigns which challenge this decision.

Employment Support

The Chancellor announced £3.6bn of funding in 2021-22 to deliver labour market support, including:

-

£2.9bn funding for the Restart programme that will provide intensive and tailored support to over one million unemployed people and help them find work. With £0.4m funding in 2020-21.

-

£1.4bn to build on the Plan for Jobs commitment to increase capacity in JobCentre Plus and double the number of work coaches.

-

£1.6bn in 2021-22 for the previously announced Kickstart scheme which targets young people at risk of long term unemployment.

CFG's view

"COVID 19 has shone a light on how important our sector is within the fabric of society, both during times of crisis and strategically in addressing long term social issues. Until Government recognises our role in achieving its ambitions it will continue to miss opportunities to deliver real change.

The ‘Levelling up’ £4bn investment is welcome and we are keen to see how it will be distributed, how quickly and to whom but there is an important context this is set against which includes the depth and breadth of local authority cuts over the past decade, and the immediate rising demand in unmet needs caused by both the pandemic and the potential future consequences of a WTO Brexit. We would hope and expect to see a quick injection of resources into those communities that have been hit hardest, rather than a bidding war.

While the UK Shared Prosperity Fund made an appearance, full details will only emerge in the spring, a good few months after our departure from the EU which is unfortunate.

Although the cut to international aid was expected, it will hit on-the-ground humanitarian efforts overseas hard. Being frank – this it is a short-sighted move at a time when health has become a global emergency.

I am no longer surprised at the absence of reference to charities and social enterprise from successive Chancellors in anything other than in pet projects and giveaways. However, we will continue to press Government to acknowledge the public good charities deliver and the central importance of funding social infrastructure, not just physical infrastructure. Including by reference to the Charity Five-Point Plan which is a roadmap for real action.

The government needs to shift its thinking away from the short term gimmicks to strategic investment if it is ever to succeed at ‘levelling up’ and see Britain ‘build back better’. It can no longer afford to ignore vital non-profit organisations who work on the ground, here in the UK and overseas."

— Caron Bradshaw, CEO at Charity Finance Group