VAT is one of the most complex tax issues affecting the charity and not-for-profit sector and navigating its rules can be challenging. In this article, UHY’s Sean Glancy addresses some of the most frequently asked VAT questions they receive.

We are only a small local charity, can’t we buy things we need VAT-free?

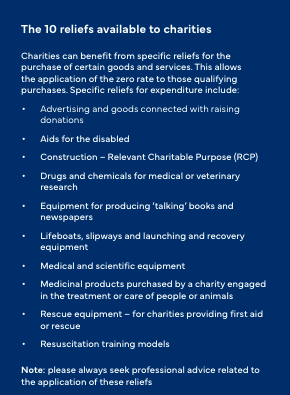

Although the government has introduced several specific reliefs to help the charity sector, the truth is that many of your costs will include VAT. Unfortunately, you will probably be unable to reclaim much of this. The focus should be to ensure your various suppliers apply the reduced or zero-rate of VAT where they can, to reduce your VAT costs overall.

The reliefs are defined but include charity advertising, property development, some fundraising activities, supplies of staff between charities and some other specified activities. It is critical to check the requirements as all have closely defined conditions.

We’re not running a business. Does VAT really apply to us?

Unfortunately, yes it does. VAT is a tax on individual sales of goods or services. Whenever you sell something in return for payment, even though you might not make any profits, you are probably within the VAT system and must deal with all its obligations.

HMRC issued a clarification of their view of business activities following a court decision in its favour. This simplified the interpretation but will mean that more transactions are within the scope of VAT.

I’ve never dealt with VAT before. Is it something we can do ourselves or do we need help?

It is a sad fact, but the charity sector is forced to grapple with some of the most complicated areas of VAT. That is not to say that you are unable to deal with it yourself, but we would recommend that first a specialist adviser helps you understand the VAT issues that affect your organisation and set up your accounting systems in the right way to produce the information you need. This should allow you to be compliant and also reduce VAT cost.

Going forward, you will probably be able to deal with the routine VAT returns by yourself. However, to ensure you are protected from a later VAT cost, we would always recommend seeking advice when anything unusual arises or you are considering a new project.

HMRC has written to us saying that we are in business and owe VAT. Have we done something wrong?

This is one of the most common problems for the charity sector, where a source of income is believed to be free of VAT but HMRC takes a different view. Often you have not done anything wrong, it may simply be that the contract or funding agreement was not drafted with VAT in mind and is therefore not as clear as it could be, giving HMRC the opportunity to challenge the VAT treatment.

The issues often revolve around grant funded activities, where there can be a fine line between a grant and a payment for services provided under a contract. A grant is generally free of VAT, whereas services provided under a contract could be subject to VAT at 20%.

Obviously, this is a big difference, particularly if the funder providing the grant is unable to reclaim the VAT. Conversely, charging VAT will enable you to reclaim the VAT you pay on associated expenditure, so being in the VAT system might be positive.

If the funder providing the grant, such as a Local Authority, can reclaim any VAT you might charge, working under a service contract rather than a grant funded arrangement could be in your charity’s best interest. The key issue is to establish if there is a benefit and who receives the supply made by the charity.

One of our trustees thinks we may have non-business issues and partial exemption. Are they different things or can we deal with them together?

The first question for you to consider is whether your activities are carried on in the course or furtherance of business for VAT purposes. Non-business activities will generally not allow you to reclaim any VAT paid on purchases relating to the non-business activity.

Any business activities could be subject to VAT at 20%, 5%, 0% or even exempt from VAT. Exemption from VAT prevents VAT paid on associated expenditure from being reclaimed. If taxable and exempt supplies are made, this will result in partial exemption applying and mandatory recovery calculations.

Determining whether your activities are business or non-business, taxable or exempt, is crucial before you can even start to work out how much VAT you can reclaim.

How do I work out my recovery method?

Once you have determined the VAT treatment of your activities, you must then carry out business vs non-business calculations to work out how much VAT is considered input tax (VAT incurred that relates to business activities) and undertake a partial exemption calculation to determine how much input tax you can recover.

There is no specified VAT recovery method for business and non-business VAT recovery apportionments. However, there is a statutory method for partial exemption. Both methods must result in a fair and reasonable result.

You can agree something different with HMRC and a combination method (business/non-business and partial exemption) if appropriate. These calculations can be subjective and are, unfortunately, the cause of many disputes between not-for-profit organisations and HMRC.

We let out some rooms, for example to local mother and toddler groups, and just recoup our costs. HMRC say it’s a business activity and want VAT from the building works we had completed some years ago. Can that be right?

We talked about non-business activities, above, preventing you from reclaiming VAT on associated expenditure. Non-business activities have types of goods and services free of VAT, including specified building works free of VAT.

HMRC is likely to take the position you have supplied services in return for payment which is a business activity for VAT purposes. The fact that the income was exempt from VAT as a welfare service does not matter, because it could mean that either your builder should have charged you VAT at the time or you have changed your activities and HMRC can charge you VAT on a proportion of the original building costs. Where a builder relied upon the non-business certificate provided at the time of the build, HMRC will demand the VAT from the charity involved, as they are doing here.

There is normally a ten-year adjustment period for capital expenditure, so change of use and particularly increased business use will cause issues and needs to be monitored.

We want to rent office space for our team giving out grants, but the landlord wants to charge VAT which will make it very expensive.

Provided you will use the office for non-business purposes, you can give the landlord a certificate to that effect which will prevent them charging VAT on the rent. However, this might result in a VAT cost for the landlord.

We suggest you agree the treatment before issuing a certificate. In some situations, landlords might be more willing to reduce the rent but keep it subject to VAT, rather than remove the actual VAT charge itself.

We own our building and need to undertake building works, but adding 20% VAT to the costs will mean we need more funding. A local charity says they got all their building works VAT-free. Can we do that?

If you want to simply renovate your building, there may be little that can be done about the VAT. If you want to construct an extension or annexe, however, provided it can be structured as a self-contained annexe and subject to certain conditions, you may be able to arrange its build free of VAT. You will need to be careful, as HMRC are strict on the type of annexes they will allow to be built free of VAT and you will need to consider the VAT implications from the very first stage of seeking planning permission to ensure that everything meets HMRC’s requirements to allow zero rating.

We have always treated our trading as business activities, but HMRC says it is non-business and wants us to repay all of our input VAT.

This situation often arises when a charity provides goods or services that are free of VAT, leading to a regular or even permanent refund situation as regards its VAT returns. HMRC may argue that the activities are actually non-business to try and block input VAT refund claims. The key takeaway is to plan your contracts in advance; make them as robust as possible and clearly drafted as sales contracts with goods or services provided in return for payment. The crucial point is to ensure a ‘direct and immediate link’ between the goods or services provided and the payment received, even if the payment comes from a third-party.

Some of our corporate sponsors are quite generous and we want to give them rewards for their donations, such as tickets to an event or an award named after them. The money they give us is still okay, isn’t it?

This is an area of real difficulty and one that has resulted in many charities owing significant sums of VAT. The simple rule is that if the donor is given no more than a simple acknowledgement of their support, the donation is not seen as payment for anything and is free of VAT. As soon as you display their brand or logo, or name an award after them, they are seen as receiving advertising services from you and the whole sum could be subject to 20% VAT.

This also applies to free tickets to an event, which are seen as a supply of services in return for the money. In some situations, where you can identify the price of the goods or services and the amount of the donation on top, HMRC may allow VAT to be applied just to the actual payment, leaving the additional donation free of VAT. However, this would need to be examined carefully to avoid an additional VAT bill and penalties.

Does VAT apply to online training and sales overseas?

Online training can have special VAT rules. If the supply is passive (ie. pre-recorded with no human intervention), it may trigger a VAT registration obligation in the customer’s country if they are outside the UK – and there is no registration threshold.

For charities selling goods online, the normal VAT rules apply. If the goods are exported to another country, this can cause VAT obligations, including potential registration requirements. Although the EU offers some simplifications, these cannot be applied retrospectively.

What are the penalties for errors?

VAT errors are likely to result in penalties. For errors in accounting, these are typically 30% of the error, plus interest. The penalty regime was extended to nil returns and repayment returns in 2023, even if there was no revenue risk or loss.

What is it like dealing with HMRC?

HMRC is a revenue raising department with additional revenue targets and ongoing resource issues. While we frequently challenge HMRC decisions, we always maintain a professional working relationship, advocating for the right answer for our clients.

Where there is a risk of challenge, we will look to gain certainty for clients. However, the courts have noted that HMRC generally decline to give rulings that might be relied upon, which mirrors our experience. As a result, we work within HMRC’s practices to provide assurance for clients, frequently seeking to establish ‘legitimate expectation’ which is the only defence for the tax payer if HMRC fail to properly advise (previously referred to as misdirection) to the charity’s detriment.

We are here to help

VAT is a constantly evolving challenge for charities, and misunderstandings can lead to significant financial consequences. Whether you’re unsure about VAT reliefs, need guidance on structuring grants and contracts or want to ensure your organisation is reclaiming VAT correctly, it’s crucial to stay informed and proactive.

UHY specialise in helping charities and notfor-profits navigate VAT complexities. If you have any VAT-related concerns, no matter how small, please get in touch and read UHY's full Charity Outlook 2025 for more information