Charity Specific Announcements

Charity Commission funding

There will be an increase in funding for the Charity Commission, increasing to £29.8m in 2022-23 and then decreasing slightly to £29m in 2023-24.

Overall, this is a notable increase on the current budget, and should put to rest any calls for charging charities to use the regulator in the short to medium term.

DCMS

Unfortunately, it is not yet clear what has happened to the budget of DCMS (the home department of civil society and the charity sector). On the face of it, the department will see a slight increase in funding from 2021-22 to 2024-25.

But upon further examination, because certain bits of funding have been moved from day-to-day spending to capital budget, and given uncertainty about how much, it is hard to tell if this is a budget cut or increase.

There is a further lack of clarity because the funding to the charities sub-directorate ‘Civil Society and Youth’ is not listed, and we do not know what this means for the funding of civil society and charities.

Sector-specific announcements

Museums and Cultural bodies

- £52m in new funding for museums and cultural and sporting bodies next year to support recovery from Covid-19 and an additional £49 million in 2024-25 to thrive thereafter.

Youth Funding

- £560m for youth services in England, including funding the government’s commitment to a Youth Investment Fund which will deliver up to 300 youth facilities in areas most in need.

The budget document mentions the following as a priority outcome for the department:

- Grow and evolve our sectors domestically and globally, in particular those most affected by Covid-19, including culture, sport, civil society, and the creative industries.

It’s positive that it's recognised that our sector has (and is still) one of the most affected by Covid-19, but there is no corresponding funding announcement to signal government intent to help charities during this difficult time.

Local Government

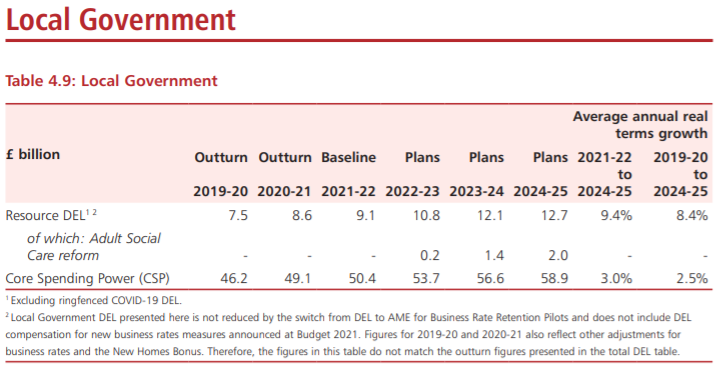

Core spending power for local authorities is estimated to increase by an average of 3% in real-terms each year over the Spending Review period.

With fears that unprotected departments would see sizeable cuts in their budgets, it is good news for the sector that local government will see real-terms increases until 2024-25.

However, the amount falls far short of the asks set out in our joint charity submission of putting local government funding on a sustainable footing - it will still leave Local government spending lower than it was in 2010.

So we can say with confidence that the affects of austerity on this department have not been undone.

International Development

Unfortunately, the Chancellor did not take the decision to reverse the cut to Official Development Assistance (ODA) from 0.7% to 0.5% of GNI.

However, the Chancellor stated that the ODA fiscal tests he previously set out are forecast to be met in 2024-25, earlier than previously anticipated, meaning it will go back to 0.7% of GNI then.

It is still disappointing that the government remains committed to retaining the cut to international development, which will both negatively impact charities that work overseas and the world’s poorest.

UK Shared Prosperity Fund (UKSPF)

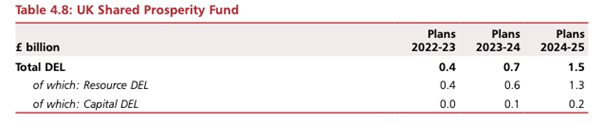

Between 2014-2020 just under £8bn (£7.7bn) was allocated to the UK through EU structural funds.

From the information in the budget there is only £2.6bn of spend for the UKSPF allocated until 2024/25. Unless there is a huge increase in funding in the years following, this is a significant reduction in spend when compared to EU structural funds.

This is hard to square with the 2019 Conservative Party manifesto commitment that they would at 'a minimum match the size of those funds in each nation'.

Additionally, £560m of these funds will go to ‘Multiply’, a new three-year plan to improve the basic numeracy skills of up to 500,000 adults.

Budget

Tax

There were a handful of important announcements on tax for the sector, several of which are positive. These include an extension to the Museums and Galleries Exhibition Tax Relief and a commitment from government to retain Charity Rate Relief.

Museums and Galleries Exhibition Tax Relief (MGETR)

MGETR will be extended for a further two years until 31 March 2024, continuing the government’s support for charitable companies to put on high-quality museum and gallery exhibitions.

Theatre Tax Relief (TTR), Orchestra Tax Relief (OTR) and MGETR

The government will increase the headline rates of relief for TTR, OTR and MGETR: from 27 October 2021, the headline rates of relief for the TTR and the MGETR will temporarily increase from 20% (for non-touring productions) and 25% (for touring productions) to 45% and 50%, from 1 April 2023, the rates will be reduced to 30% and 35% and will return to 20% and 25% on 1 April 2024.

For MGETR, the relief will expire on 1 April 2024 and no expenditure from this date will be eligible for relief, from 27 October 2021, OTR rates will temporarily increase from 25% to 50%, reducing to 35% from 1 April 2023 and returning to 25% on 1 April 2024. From 1 April 2022, changes will be made to better target MGETR, TTR and OTR and ensure that they continue to be safeguarded from abuse.

Business Rates

The final report of the ‘Fundamental Review of Business Rates’ has been released, and there was positive news for charities, with the government committing to retain charitable rate relief (amongst others) for the foreseeable future.

This is a crucial relief for the sector, worth more than Gift Aid, and follows a joint submission from CFG and others which called for the relief to be retained.

'This system of reliefs plays a vital role in ensuring the overall sustainability and fairness of the tax, and the government continues to keep the full set of reliefs under review to ensure that these remain fit for purpose. The government does not intend to remove any of the existing reliefs at this time.'

Other relevant announcements

- Introduce a new temporary business rates relief for eligible retail, hospitality and leisure properties for 2022-23. Eligible properties will receive 50% relief, up to a £110,000 per business cap 144 Autumn Budget and Spending Review 2021.

- Introduce a 100% improvement relief for business rates. This will provide 12 months relief from higher bills for occupiers where eligible improvements to an existing property increase the rateable value. The government will consult on how best to implement this relief, which will take effect in 2023 and be reviewed in 2028.

- Increase the frequency of business rates revaluations so that they take place every three years instead of every five years, starting in 2023.

Investment

Unlike previous budgets there were few, if any, announcements that provided additional funds directly to charities.

There was a commitment to provide additional funds to support veterans, promising £5m in 2022-23 to 'research into surgery techniques for amputees with blast injuries; new treatments for mental health issues, including post-traumatic stress disorder; new technology to enable wounded, injured and sick veterans to rebuild their lives; data and digital projects to explore better use of technology for heath; and research and treatment for mild traumatic brain injury.'

While the new fund will be administrated by the Office for Veterans’ Affairs and DHSC and the MoD, there is a commitment to work 'in collaboration with the charitable sector where appropriate'.

Further details will be announced in due course.

National Minimum Wage & National Living Wage

As leaked in advance on the budget, the National Living Wage will increase to £9.50 per hour, the government's highest rate will also include those aged 23 and over.

The new rates will come into force on 1 April 2022. The government has also accepted other recommendations for the NMW:

- increasing the rate for 21 to 22 year olds by 9.8% from £8.36 to £9.18 per hour

- increasing the rate for 18 to 20 year olds by 4.1% from £6.56 to £6.83 per hour

- increasing the rate for 16 to 17 year olds by 4.1% from £4.62 to £4.81 per hour

- increasing the rate for apprentices by 11.9% from £4.30 to £4.81 per hour

- increasing the accommodation offset rate by 4.1% from £8.36 to £8.70 per hour

While this is good news for those who are low paid, charities will be concerned that without corresponding increases to grant funding or contracts, it will only increase operating costs, particularly for those who operate in social care.

Universal Credit taper rate

The government did not commit to reverse the cut to Universal Credit as we called for in our budget submission, but there was a more generous than expected cut to the Universal Credit taper.

- Reduce the taper rate that applies in Universal Credit from 63% to 55% by 1 December 2021 so working households will keep more of every pound they earn.

- Increase the amount that households with children or a household member with limited capability for work can earn before their Universal Credit award begins to be reduced – the Work Allowances – by £500 a year by 1 December 2021.

The reduction of UC taper rate is certainly a positive for those on low incomes, but it is important to note that it won’t benefit all working families on UC, and even for most of the families who do benefit, it will not go far enough to making up for the recent cut. Here, the government falls short in its support of families seeking work, those unable to work, those on Working Tax Credit and legacy benefits, despite rising costs of living.

Levelling Up Fund

The government committed to investing £1.7 billion via the first round of the Levelling Up Fund in 105 projects to improve everyday life, from regeneration to sustainable transport projects and cultural assets. This includes more than £342m for Scotland, Wales and Northern Ireland, which will fund more than 100 projects to improve local infrastructure. With the overall fund set for £4.8bn.

The budget documents contained a disparate list of areas and organisations that will receive funding, (including the redevelopment of the Theatr Bryndcheiniog Arts Centre in Brecon).

In addition, the government published a complete list of successful first round bids. Our initial analysis suggests very little of this will go towards social infrastructure, with the majority instead dedicated to physical regeneration, improving town centres and transport infrastructure.

We would hope to see further details on how the government plans to invest in Social Infrastructure in the forthcoming white paper on levelling up.

There was an additional announcement of the £9m Levelling Up Parks Fund, funding over 100 new parks in 2022-23 to ensure equal access to parks in urban areas that are deprived of green space.

Comments from CFG's corporate partners

Tax reliefs for the arts sector

From today Theatre, Orchestra and Museums, Galleries and Exhibitions Tax Reliefs are to be given at higher rates.

TTR and MGETR will increase temporarily from 20% (for non-touring productions) and 25% (for touring productions) to 45% and 50%.

From 1 April 2023, the rates will be reduced to 30% and 35% and will return to 20% and 25% on 1 April 2024. For MGETR, the relief will expire on 1 April 2024 and no expenditure from this date will be eligible for relief.

OTR rates will increase from 25% to 50%, reducing to 35% from 1 April 2023 and returning to 25% on 1 April 2024.

“This is a great boost for the arts sector which has had a tough time with enforced closures over the last 18 months. Arts charities and their trading subsidiaries need to ensure they review the small print to ensure they take advantage of these wherever possible.” - Ross Palmer, Sayer Vincent

Business rates

The government has said in its business rates consultation response: 'This system of reliefs plays a vital role in ensuring the overall sustainability and fairness of the tax, and the government continues to keep the full set of reliefs under review to ensure that these remain fit for purpose. The government does not intend to remove any of the existing reliefs at this time.'

"It is certainly good news for charities that no changes to their mandatory relief is planned but the potentially sinister “at this time” qualification means the sector, together with CFG and CTG, need to keep up the pressure on government to maintain this relief.” - Helen Elliott of Sayer Vincent

A Charitable Budget?

As with a number of recent budgets, Rishi Sunak’s focus has been on the Conservative Government’s desire to create a high-skill, high-wage economy. With this focus, observers with an interest in charities and not-for-profit organisations might be forgiven for thinking the Third Sector is an afterthought.

Prioritisation has clearly been given to those tech and knowledge sectors on which the government is relying to drive the economic growth needed to increase the Treasury’s coffers sufficiently to fund promised public sector spending initiatives, and indeed to pay for the unprecedented pandemic spending levels.

Many charities have benefited from specific additional funding during the pandemic, but many still face an uncertain financial future with increasing costs of fuel, and inflationary pressures on wages affecting charities as much as any other business. Those charities reliant on the general public attending their venues or undertaking fundraising at large scale events still have challenges from the continuing pandemic.

Amongst all the “levelling up” talk, there was some very good news for cultural charities including theatres, orchestras and museums. These charities have their own tax credit schemes which generate tax refunds as a way of subsidising their activities. These are hugely important revenue streams to those entities. Many of these charities have been closed or had to postpone events, and as an additional incentive the rates of tax refund available under their tax relief schemes have been increased.

The Theatre Tax Relief and Museums and Galleries Exhibition Tax Relief schemes both have an increase to 45% (non-touring productions) and 50% (touring productions) from their current levels of 20% and 25% respectively. This increase is temporary, so will be phased out, dropping back to 30% and 35% after 1 April 2023 and then back to current levels from 1 April 2024.

As the rates suggest, this will potentially double the tax benefit to the company making the claim – a highly valuable incentive to support culturally significant charities get back to running shows or exhibitions. The Exchequer expects this to provide an approximately £250m stimulus to the sector over five years.

Indeed, the Museums and Galleries relief was due to expire on 31 March 2022 but has been extended until 31 March 2024. It remains to be seen whether this will be extended further in future Budgets. A review of the relief was launched in 2020 with the results now due for publication in 2022, the outcome of which will drive whether the relief remains in its existing format, is revamped or indeed scrapped.

There was further positive news for cultural charities with £850m of spending committed to protecting museums, galleries, libraries and local culture.

Some minor tightening to the rules surrounding the qualifying expenditure has also been announced, although the detail of that will need to await the issue of the Finance Bill on 4 November 2021.

Charities will also have had a keen eye on the business rate reforms, with the sector having lobbied hard to ensure that the valuable charitable reliefs were retained. There was no mention of those reliefs in the speech, but the additional 50% discount for retail & hospitality and the freezing of the multiplier are likely to mean good news for charities who may have fundraising or other non-charitable trading subsidiaries in these sectors.

Charities with an involvement in the housing sector will have been relieved to note that following the consultation on the new residential property development tax, a specific exemption applying to charitable registered social housing providers and their trading subsidiaries will apply.

So, there is some good news for the sector.

However, a number of long running areas of concern for the sector, such as the efficiency of the Gift Aid system and the complexity of the VAT system for many charities, have not been addressed. - Jon Sparkes, Tax Director at Bishop Fleming

Unique opportunity missed

“The government has missed a unique opportunity with this budget, the first since before the pandemic, to put an end to charities having to pay IPT.

“Our charity insight barometer found that financial pressure was the biggest risk facing charities. By granting charities exemption from this tax the government will free up vital funding, enabling them to continue to carry out their vital work and to plan for the future.

“Charities have constantly stepped up to support those most in need and the last 18 months has tested them to their limits. The loss of funding through fundraising activities and an increase in demand for their services has left many charities at crisis point, using vital reserves to stay afloat." - Faith Kitchen, Customer Segment Director at Ecclesiastical Insurance

A shift in narrative

"With the pandemic seemingly in the rearview mirror, at least as far as this budget was concerned, the narrative shifted from job retention and government loan support in the last budget, to investment in growth and levelling up.

"There is very little said directly about the country’s hugely important charity and not-for-profit sector and the key role it plays, albeit there were some welcome programme announcements. There were some longstanding issues such as charity VAT and Gift Aid reform being overlooked.

"An increase in the National Living Wage to £9.50 was pre-briefed to the press well ahead of today and, Labour argue, falls short of what is needed. Whilst it is welcome news for many of the country’s lowest paid and a positive step, charities and NPOs will again need to fund increased wages, without certainty that grant or government contract funding will increase to match.

"The adjustments to creative tax reliefs for theatres, museums, orchestras and galleries, doubling until 2023, will be a welcome boost for a sector still reeling from the impact of the pandemic. It is claimed to be worth around £250m, as part of a tax relief for culture, but we know the £700m arts, culture and sport package announced at the last budget did not fill the revenue gap left by empty audience seats.

"Also welcome, were the announcements around education funding and a £560m UK wide numeracy programme. Although there was little detail on what this would look like at this stage, or how it would be rolled out.

"The ‘big reveal’ for this budget was the anticipated change to Universal Credit, with the taper adjusted more generously than expected. Reducing the taper by 8% from 63% to 55% at a time when the cost of living is increasing and the Treasury expect inflation to sit around 4% next year, could prove to be a critical change for many families at risk of living in poverty." - Leo Jones, Head of Charities and Not for Profit Organisations, HSBC UK

Frustrating, lukewarm focus

"Whilst this autumn budget included some welcome funding and investments in the cultural sector, it was once again frustrating to see a rather lukewarm focus on the charity sector. Yes, tax measures have been introduced to support businesses, including the long-awaited outcomes from the business rates review.

"However, the Chancellor was light on the specifics of support for all charities at a time when they continue to suffer with the fallout from Covid-19. Of course, the extension to tax relief for museums and galleries for another two years is welcomed. This will be invaluable for those involved in that arena. But is it not time for more imaginative thinking to help all charities continue with their invaluable work in supporting wider society? We reckon so." - Nick Simkins, Partner & Head of Not for Profit at Cooper Parry

Further investment needed

“Whilst the increase in the national living wage to £9.50 is welcome for those on the lowest incomes, it will be wiped out in many cases by the 1.25% NI. Also, for charities in the social care sector, it is yet another cost increase whilst they will see none of the Health and Social Care levy until 2025. In the meantime, whilst the sector that worked tirelessly to care for the most vulnerable during the pandemic struggles with staffing shortages and increased costs, sadly there appears to be no alternative funding boost in this budget.

“Charities in the entertainment and leisure sector – our theatres, those providing leisure facilities – have suffered considerably during the pandemic. What a shame then that the 1 year 50% business rates cut in their sector is unlikely to help them, given that most will already be benefiting from charitable rate relief of up to 80% with their properties being used for charitable purposes. A missed opportunity.

“For charities working internationally there is no comfort that accounting sleights of hand which recategorise debts, IMF handouts and the costs of Covid vaccines as official oversees aid, will significantly reduce the UK’s aid budget. This continued drop in funding is likely to cause serious suffering to those living in poverty internationally, damage the UK’s reputation in the aid sector and stifle funding opportunities for charities looking to tackle inequality internationally. This budget has done nothing to help the most vulnerable in the world.

“Children’s charities will welcome the budget’s £500m support package aimed at young families. £200m will go towards the Supporting Families Programme, over £80m will be directed towards Family Hubs, £100m will fund mental health support for new and expectant parents and there will be a further £120m investment towards other family support programmed. However, the serious impact of the pandemic on children and the pressures it has placed on families are significant. This support package is a start to supporting families out of the crises many have found themselves in since the beginning of the pandemic, but further investment will be needed.” - Edwina Turner, Legal Director, Charities Team, Anthony Collins Solicitors LLP

Welcome boost

"The Chancellor announced a very welcome boost to the cultural sector with a substantial temporary increase in the rate (to 45% or 50%) for Theatre Tax Relief and similar creative industry tax credits for museums, galleries and orchestras in helping to put on new productions and exhibitions. Museum and Galleries Exhibition Tax Relief which was due to expire in March 2022 has also been extended by another two years. Together with other reliefs for the wider hospitality sector, this is all welcome news, and I hope it will encourage more visitors back to these essential venues for days and evenings out." - Luke Savvas, Tax Partner, Buzzacott

Good news for arts and culture

"There was a sunset clause included in the Museum and Galleries Tax Relief legislation that meant that the relief was due to come to an end on 31 March 2022. Thankfully, the relief has been extended for two years until 31 March 2024. This gives the sector more time to demonstrate how valuable the relief is. Importantly the tax relief available for expenditure incurred between 27 October 2021 and 31 March 2023 has been doubled. This will help Museums and Galleries to fund the development of new exhibitions to attract visitors following the Covid lockdowns.

"The doubling of tax relief was also extended to Theatres and Orchestras and this will increase the relief that production companies can claim to encourage the production of more high-quality productions." - Rachelle Rowbottom, Tax Partner, BHP: Creative industry tax reliefs

Some good news for the sector

"The Chancellor announced that business rates will be reformed but crucially for the sector confirmed that existing reliefs, including the mandatory and discretionary charity reliefs will remain in place. Good news given that these are estimated to be worth over £2bn a year to the sector." - Simon Buchan, Head of VAT Services, BHP

A Final Word

Caron Bradshaw OBE, CEO of Charity Finance Group, shares her initial thoughts on the Chancellor's Autumn budget statement:

"Today’s budget could be described as the good, the bad and the ugly. There's no doubt that it includes some welcome announcements. We’re delighted that the Chancellor has acted upon many of the sector’s recommendations.

"It’s great news for charities that business rates relief will be retained. And our joint call with Charity Tax Group and others to extend the Museum and Galleries Exhibition Tax Relief until March 2024 is good news too.

"We also welcome the promised investment in skills, education, youth services, community football and local outdoor spaces. The focus on towns outside of the south-east of England is welcome news also.

"But, it's what’s missing from the budget that spells bad news for millions. With no reversal of the cuts to Universal Credit and a delayed reversal of the foreign aid budget cuts, the Chancellor’s announcements will do little to quell the fears of the most vulnerable, and those who face the rising costs of living with trepidation.

"The increase of 3% to local government has failed to address our calls to put it on a sustainable footing. Money to the UK Shared Prosperity Fund falls well short also. All this will have a negative impact on the government’s ambition to level up.

"It’s critical that government supports civil society and engages with us. Only then can we boost those levelling up ambitions, and help put this ugly crisis behind us – all while we continue to serve those who desperately need us."

Useful Links

HM Treasury Budget 2021

Office for Budget Responsibilty’s Economic and Fiscal Outlook, October 2021

Institute for Fiscal Studies Initial Response

CFG Press Release

« Back to all news