CFG’s Policy Manager Richard Sagar outlines his five key takeaways from the August Inflation Report and explores what they mean for the charity sector.

August has seen the Bank of England release their latest quarterly inflation report, setting out their economic analysis and forecasts that the Bank’s monetary policy committee use to make decisions on interest rates, ultimately leading them to keep interest rates on hold at 0.75%. Alongside this decision, there are a number of other interesting things contained in their analysis. I’ve summarised the five key messages that I think charities should take away from the report below.

- The UK growth forecast has been cut since last quarter, with more pessimism in the near term

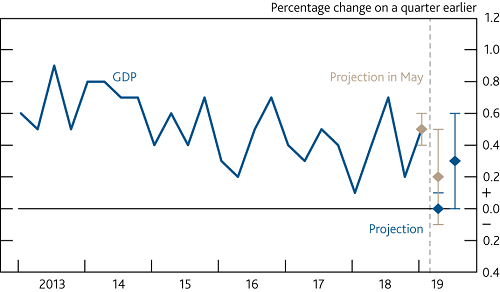

As the chart below indicates, GDP is forecast to be flat in for Q2, and barely increasing for the rest of 2019. The near term growth forecast has been revised down.

The Bank has also stuck its neck out and predicted a slowdown in pay growth , which bucks against the trend of an increase in pay growth across nearly all available metrics in recent months.

- In the event of a smooth Brexit, short-term CPI inflation is expected to fall in the short-term, and go above the 2% target from 2021 onwards

Inflation has fallen since the last inflation report and will stay below the target 2% for some time, but this might not have too big an impact on charity reserves, as it is primarily due to the energy price cap which the government has introduced. The Bank has also predicted that there is a one in three chance of a smooth Brexit leading to a recession.

But as the forecast summary below indicates, this is set to pick up from 2021 onwards. Charities should monitor this closely.

- Sterling has depreciated as the perceived possibility of a no-deal Brexit has increased

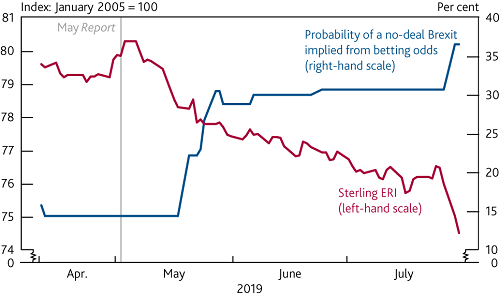

The chart below compares the probability of a no-deal Brexit as implied by betting odds, compared to the value of sterling.

As you can see, there is a negative correlation between probability of a no-deal Brexit and the value of sterling. This should lead us to consider what will happen to sterling if the probability of no-deal becomes a certainty?

- Based on the discussions that BoE agents have had, most businesses have contingency plans in place for Brexit

With 88% of firms the bank spoke to having contingencies in place, this does not compare favourably to the charity sector, who, based on CFG surveys, are lagging behind with fewer than a quarter having a clear plan in place.

When you compare this to charities in the sector, CFG’s soon to be released survey results of our members indicate that the majority of charities are still not prepared for Brexit. This should be a wake-up call that the sector and government need to do more to support charities in preparing for any potential impacts that Brexit may bring.

- A no-deal Brexit would be negative for the economy, and require fundamental economic changes

While offering no new detailed analysis, in keeping with nearly all economic forecasts, no-deal would very likely have a severely deleterious impact on the UK economy – with sterling expect to fall quite sharply, rising inflation and slowing growth.

This has led the Governor of the Bank, Mark Carney to state: "The Bank has been working since the referendum to ensure that the financial system is ready for Brexit whatever form it takes. Similarly preparations by governments and businesses for no deal are vital to reduce the potentially damaging transition costs to a WTO relationship with the EU. But those preparations cannot eliminate the fundamental economic adjustments to a new trading arrangement that a no-deal Brexit would entail."

Anyone expecting no-deal to lead to business-as-usual for the economy is sorely mistaken.

But…

Perhaps one silver lining from the Bank’s forecast of no-deal is that even under the worst-case scenario they produced last year (they will be updating shortly following an intervention from the treasury select committee), they would not expect there to be a credit squeeze like the great recession, in part because banks have greater liquidity. Essentially this means that they envisage that banks would still be able to lend money, even in the event of a particularly bad no-deal Brexit.

Are you prepared for no-deal Brexit? Take part in our survey

Read the Bank of England’s report