CFG takes a look at the Chancellor's spring budget announcements and analyses what they mean for the charity sector.

Read the PDF version

On the whole, there were a few positives in the 2024 spring budget. But a lot of crucial issues remain unaddressed and the announcements made by Chancellor Jeremy Hunt on 6 March will do little to increase confidence and certainty across the sector.

CFG welcomes the news on funding for creative industries, but in the context of local government funding collapse, it’s hard to see how this will help the arts sector at the grassroots level and in the longer term.

We also welcome the government’s firm commitment to ensure charities can continue to claim Gift Aid on membership subscriptions.

CFG is working with the relevant government departments, charity members and infrastructure partners (such as CIoF and NCVO), to ensure that the solution proposed is practical and does not provide additional work for charities.

Concerns remain about the DMCC Bill, but we will engage with government to address the concerns about a ‘cooling off period’ and work to encourage the government to create guidance and provide support for affected charities.

Changes to the VAT threshold and the Chancellor’s new announcements on pensions will be of interest to the sector and we will work with partners to determine exactly what they mean.

Today’s tax cut announcements will be welcomed by average earners who will save around £450 per year, but the cuts will make little difference to those on low incomes. And although there are some positive short-term measures, such as extending the Household Support Fund, there was no pledge to help the most vulnerable with an ‘Essentials Guarantee’ (see opposite).

Once again, we’re disappointed that there is a lack of clarity on how the government will put local authorities on a sustainable financial footing. The voluntary sector is a critical partner in delivering public services and the most recent VCSE Sector Barometer report shows how tied the fortunes of local authorities and charities are.

The third sector has been sounding the alarm for a long time, and this year it went unheard by the government.

What did the sector ask for?

1. The introduction of an ‘Essentials Guarantee’: CFG and the Civil Society Group joined Joseph Rowntree Foundation, Trussell Trust and other sector partners to call for the Essentials Guarantee which would embed the widely supported principle that, at a minimum, Universal Credit should protect people from going without essentials.

2. Enable public bodies to ensure that grants and contracts meet the true costs of delivering public services: We called on government to sufficiently fund public bodies so that they can work in effective partnership with the voluntary sector to provide critical services to their communities.

3. Extend funding for Levelling Up funds, including the UK Shared Prosperity Fund (UKSPF) to 2030 to match the Levelling Up missions’ timetable: We’ve asked for long-term funding that provides financial certainty for commissioners and providers, and enables continuity of support for individuals. It wuld also enable preventative or early action initiatives.

4. Streamlining and reviewing the charity tax system: This covers transitional relief for Gift Aid; protecting fiscal incentives for charitable bequests; a reform of irrecoverable VAT for charities; and extending charitable rate relief to wholly-owned charity trading subsidiaries.

Read the full letter

Budget overview

Elements of the spring budget had been trailed before the big day and it was widely reported that the Chancellor would seek to cut taxes ahead of a general election.

There was some speculation on whether it would take the form of cuts to the basic rate of income tax or a cut to NICs. In the end, the Chancellor announced a cut in the main rate of National Insurance from 10% to 8% with, Class 4 self-employed NICs being cut from 8% to 6%, mirroring the 2% cut that occurred in last year’s autumn statement.

This announcement followed on from a suite of measures. The proverbial ‘rabbit out of the hat’ was a reform to the high income Child Benefit Charge, increasing the threshold to £60,000 and tapering to £60,000 to £80,000 from 6 April 2024. The ultimate aim was to administer it on a household, rather than an individual, basis by April 2026 (following consultation).

These measures to “reward working people” were in part paid for by scaling back the non-dom tax regime, extending windfall tax on the profits of oil and gas companies, removing tax breaks on holiday lets, and raising passenger air duty for business travellers.

But as with the fiscal events in spring and autumn 2023, there were noticeable holes in the package of announcements.

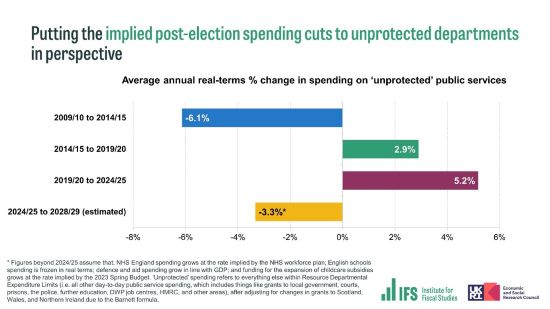

There was no further clarity on which government departments will bear the brunt of cuts in the years to come, with overall spending only increasing by 1% in real terms year-on-year. The Institute for Fiscal Studies has forecast that this implies a c.3.3% per year cut to unprotected departments.

These unprotected departments will likely experience very difficult times ahead. Some departments, such as justice and local government, rely heavily on the third sector to deliver public services, and cuts in these budgets will have a significant impact on our sector.

In response to the lack of clarity on funding, the Local Government Association (LGA) commented that ‘it is disappointing that the Govt [sic] has not today announced measures to adequately fund the local services people rely on every day… it is unsustainable to expect them to keep doing more for less in the face of unprecedented cost and demand pressures’.

While many expected a spending review before the next election, the budget’s accompanying documents confirmed that it will not take place until after the general election.

However, the government promised to reimagine how it delivers public services through the Public Sector Productivity Programme, ‘ensuring the public sector achieves the outcomes that matter most to the public while keeping costs under control.’

Funding of £4.2bn has been pledged to improve the productivity of the public sector. This includes an additional £3.4bn over three years as part of the NHS’s productivity plan in England and £0.8bn to wider public services over the same period.

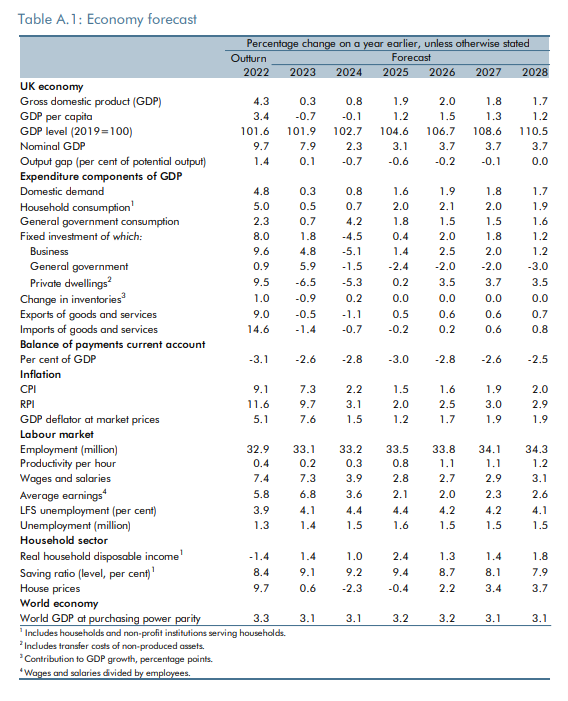

The news on inflation was much more positive than previous forecasts, with the OBR expecting it to fall to the Bank of England’s 2% target in a few months’ time, with CPI staying below or at 2% until 2028.

This will be welcome news for charities. Persistently high inflation has had a significant impact on organisations’ spending power and has eroded the value of donations, grant income and reserves.

Read on for more... Or download our briefing document to read as a PDF

Latest data on the UK economy

The OBR report states:

Inflation

The OBR is forecasting easing inflationary pressures with the inflation rate falling from 4.2% in the last quarter of 2023 to an average of 2.2% this year and 1.5% in 2025, before gradually returning to target at the end of the forecast period in 2028. As a result of this fall in inflation market participants expect to see a sharper fall in interest rates (currently at 5.25%) than in the autumn, with an expected fall to 4.2% in the final quarter of 2024.

Public finances

£0.9bn more departmental capital spending per year on average between 2025-26 and 2027-28 on a public sector productivity programme focused on the NHS, and £0.8bn per year less departmental resource spending from 2025-26 onwards.

Employment

Weak near-term GDP growth drives a modest rise in the unemployment rate in 2024, which then falls back as the recovery gathers pace. The latest ONS data suggest that unemployment fell to 3.8 per cent in the fourth quarter of 2023. In contrast, claimant count data measuring the number of people on unemployment benefits has remained flat in recent months, while the redundancy rate has been on a slow upwards trend since the middle of 2022. We therefore judge that this and wider evidence is consistent with a moderate rise in the unemployment rate, peaking at 4.5 per cent in the last quarter of 2024, in line with our forecast for subdued economic growth and increasing spare capacity in the economy. The peak in unemployment of around 1.6 million people is marginally lower (by about 40,000 people) than in our November forecast, though it comes half a year sooner. The unemployment rate is then forecast to decline to its estimated structural level of 4.1 per cent by 2028.

Read the OBR's economic and fiscal outlook for March 2024

Benefit/unemployment support

The measures announced fall far short of the ‘Essentials Guarantee’ being embedded in our social security system, which was called for by CFG and the Civil Society Group.

There were some positive announcements on the Household Support Fund and extending budgeting advance repayment periods for Universal Credit.

But the Trussell Trust have described these as ‘a short-term sticking plaster’ and that they are ‘already seeing unprecedented numbers of people unable to afford the essentials. Today’s budget will do little to change this in years to come.’

The government has set out the following:

• Universal Credit: extending Budgeting Advance repayment periods – The government will increase the maximum repayment period on new budgeting advance loans from 12 months to 24 months. This will apply to Budgeting Advances taken from December 2024 onwards.

• Household Support Fund Extension – To help the most vulnerable households with the cost of essentials such as food and utilities, the government is also providing an additional £500 million (including Barnett impact) to enable the extension of the Household Support Fund in England from April to September 2024.

• Extending Additional Jobcentre Support (AJS) pilots and introduction of new claimant commitments – The government is extending the duration of the current AJS pilot, currently live in 90 Jobcentres in England and Scotland, for a further 12 months. As part of the pilot extension, claimants will also be required to accept a new claimant commitment at 6, 13 and 26 weeks, agreeing to more work requirements or have their claim closed.

• Additional funding to support the processing of increased volumes of disability benefit claims – The government is providing additional funding that will increase system capacity to meet increased demand, and therefore enable people to get the right support in a timely manner.

Tax

Aside from the aforementioned cut to NICs, there was a positive announcement from government to ensure charities can continue to claim Gift Aid on membership subscriptions.

CFG is working with the relevant departments, our members and infrastructure partners (including CIOF and NCVO) to ensure that the proposed solution is practical and does not provide additional work for charities.

Concerns remain about the DMCC Bill, but CFG will engage with government to address concerns about a ‘cooling off period’, and work to ensure that the government also creates guidance and provides support for affected charities.

Another positive for the sector was the rate of Theatre Tax Relief, Orchestra Tax Relief (OTR) and Museums and Galleries Exhibitions Tax Relief (MGETR) being made permanent at 40% (for non-touring productions) and 45% for touring productions and all orchestra productions, and the removal of the sunset clause on the relief.

Those sectors have welcomed the relief, with the chair of CFG’s partner the Association of Independent Museums (AIM) saying: “The certainty a permanent relief provides makes it more accessible to independent museums, guaranteeing a long-term return on the resource investment required to claim it.

“Our visitors and communities will ultimately benefit from this astute investment in a sector which makes significant contributions to the UK’s economy and its sense of self.”

The increase of the VAT threshold to £90,000 is to be welcomed, especially for charities close to the threshold. However, CFG’s corporate partners, BHP, commented: “The reality is that the cliff edge of VAT registration and all that goes with it is probably still too close for comfort.”

The government has set out the following:

• Amending Gift Aid legislation due to implications of the Digital Markets, Competition and Consumers Bill – The Digital Markets, Competition, and Consumers Bill is introducing new protections for consumers who take out subscription contracts. The government will amend existing Gift Aid legislation by Statutory Instrument so that charities can continue to claim Gift Aid while complying with these new protections. The government’s intention is that these amendments to the Gift Aid regime will be in place by the time the relevant provisions of the Bill come into force.

• National Insurance contributions (NICs) rates – The government will cut the main rate of Class 1 employee NICs from 10% to 8%. This will take effect from 6 April 2024. The government will also make a further 2p cut to the main rate of self-employed National Insurance on top of the 1p cut announced at Autumn Statement. This means that from 6 April 2024 the main rate of Class 4 self-employed NICs will now be reduced from 9% to 6%.

• Theatre Tax Relief (TTR), Orchestra Tax Relief (OTR) and Museums and Galleries Exhibitions Tax Relief (MGETR) – From 1 April 2025, the rates of TTR, OTR and MGETR will be permanently set at 40% (for non-touring productions) and 45% for touring productions and all orchestra productions. The sunset clause for MGETR will be removed.

• VAT registration threshold: increase to £90,000 – The government will increase the VAT registration threshold from £85,000 to £90,000, and the deregistration threshold from £83,000 to £88,000, freezing them at these levels. These changes will apply from 1 April 2024.

• Fuel duty main rates – The government is freezing fuel duty rates for 2024-25, a tax cut worth £3.1 billion over 2024-25. The temporary 5p cut in fuel duty rates will be extended until March 2025 and the planned inflation increase for 2024-25 will not take place.

• High Income Child Benefit Charge (HICBC) reform – The government will increase the HICBC threshold to £60,000 from April 2024. The rate at which HICBC is charged will also be halved so that Child Benefit is not fully withdrawn until individuals earn £80,000 or higher. The government plans to administer the HICBC on a household rather than an individual basis by April 2026, and will consult in due course.

• Exploring options to better target support to households – The government will consult shortly on options to enable better targeting of economic support to households. This will improve the fairness of policies such as HICBC, by allowing it to move to a system based on household income, and the targeting of future economic support including in times of crisis.

• Capital Gains Tax: Higher rate cut for residential property – From 6 April 2024, the higher rate of Capital Gains Tax for residential property disposals will be cut from 28% to 24%. The lower rate will remain at 18% for any gains that fall within an individual’s basic rate band. Private Residence Relief will continue to apply, meaning the vast majority of residential property disposals will pay no Capital Gains Tax.

• Stamp Duty Land Tax: Acquisitions by Registered Social Landlords and public bodies – Legislation will be updated to ensure that from 6 March 2024, registered providers of social housing in England and Northern Ireland are not liable for Stamp Duty Land Tax (SDLT) when purchasing property with a public subsidy and public bodies will be exempted from the 15% anti-avoidance rate of SDLT.

Pensions

The government has set out the following on pensions:

• Local Government Pension Scheme new reporting requirements – Revised annual reporting guidance will require LGPS funds to provide a summary of asset allocation, including UK equity investment, as well as provide greater clarity on progress of pooling, through a standardised data return, taking effect from April 2024.

• Financial Conduct Authority (FCA) Value for Money (VFM) proposals – The FCA’s spring VFM consultation will include proposals to require the publication of contract-based Defined Contribution (DC) default funds’ historic net investment returns and a breakdown of their UK investments. Proposals will require schemes to compare their performance, costs and other metrics against those of at least two schemes managing over £10 billion in assets. This is an initial level expected to increase significantly over time. In coordination with the FCA the government will legislate at the earliest opportunity to apply the VFM framework across the market and provide the Pensions Regulator with new powers, using secondary legislation if necessary to ensure key disclosures are in place by 2027.

• Pensions Lifetime Provider – The government has confirmed that it remains committed to exploring a lifetime provider model for Defined Contribution (DC) pension schemes in the long-term. The government will undertake continued analysis and engagement to ensure that this would improve outcomes for pension savers, and build on the foundations of reforms already underway, including the Value for Money Framework.

Government funding and levelling up

The government has set out the following on funding and levelling up:

• Levelling up culture projects – The government is confirming the allocation of £100 million of funding for culture projects (subject to business case), recognising the important role that culture and pride in place have to play in levelling up. This will support a combination of nationally-significant cultural investments such as the British Library North in Leeds, National Railway Museum in York, and National Museums Liverpool, as well as the development of cultural projects in places previously prioritised for levelling up investment but which have not to date received levelling up funding, including in High Peak, Redditch and Erewash. DLUHC will publish a full list and explanation on gov.uk.

• Scottish cultural regeneration – To ensure every city in Scotland benefits from levelling up, the government will work with the cities yet to receive an allocation – Perth and Dunfermline – to invest a shared £10 million for cultural investment.

• Village halls – The government is providing an additional £5 million for the Platinum Jubilee Village Halls Fund, to support local village halls across England to remain at the heart of their communities.

• Capital regeneration projects – The government is investing £23.7 million across two shovel-ready capital projects in Bradford and Ashfield, to support regeneration in places across England.

• Community regeneration projects – The government is providing £6 million of funding for work with the King’s Foundation to pilot how community led regeneration projects anchored around heritage assets and sustainability considerations can complement government’s wider place-based initiatives for levelling up, subject to business case approval.

• Support for culture and investment in the West Midlands – The government has announced £15 million of funding for the West Midlands Combined Authority to support culture, heritage and investment projects in the region, subject to a business case. This will provide £10 million of funding to support culture and heritage projects, and £5 million to drive inward investment in the region.

• Theatr Clwyd funding – The government will provide £1.6 million for Theatr Clwyd in Wales, subject to business case approval. This is the largest producing theatre in Wales and the funding will help support a major refurbishment.

Further commentary

CFG’s corporate partners were invited to share their analysis and reactions to the spring budget 2024. Read on for their analysis...

Andrew Robinson, tax partner, RSM UK, comments:

There was little in today’s Budget that impacted charities directly. Indeed, the word 'charity' does not appear anywhere in the 98-page Spring Budget ‘Red Book’. It’s worth noting that the much-heralded reduction in National Insurance relates to employee contributions only. Employer’s National Insurance, which is paid by charities on their employees’ salaries, has remained unchanged at 13.8%.

Museums and performing arts charities might be comforted by the announcement that the rates of orchestra, theatre and museums and galleries tax credits, which were to reduce by 15% in April 2025, are to reduce by only 5% instead. The revised rates have been made 'permanent' from 1 April 2025– at least until the next budget.

The ‘glass half full’ view is that the Budget is unlikely to result in additional tax costs for charities, and that there is still plenty of opportunity for the sector to lobby the next government for the much needed reforms to the tax system as it affects charities. Until then, it’s a case of ‘as you were’.

Ross Palmer, Senior Tax Manager, Sayer Vincent, says:

With the government’s focus clearly on an impending election, the Chancellor chose to focus on the electorate as individuals with the cut to National Insurance being the clear headline grabbing announcement.

There was some relief for those concerned about potential threats to Gift Aid, with no cut to Income Tax, and the government have also confirmed that they intend to ensure that proposals to implement statutory cooling off periods will not impact on charities ability to claim Gift Aid.

However, this means that, yet again, the Chancellor has missed an opportunity to support charities at a time when many are under increased pressure to provide crucial services under underfunded agreements.

Katherine Robinson, Tax Manager, BHP, says:

This was an interesting budget. There was no mention of ‘charities’ at all by the Chancellor with a focus on pleasing taxpayers before the next general election. This was clear from the noted absence of any comment in relation to the recent charity tax compliance consultation that ended in the summer.

The Chancellor did however mention funding for certain causes as well as some very welcome changes to cultural tax reliefs which recognises the sector’s invaluable contributions to public education and tourism.

He specifically mentioned the permanent status of Museum, Galleries and Exhibitions Tax Relief (‘MGETR’), that was due to expire in 2026, as well as making the tax credit rates previously announced permanent for MGETR, Theatre Tax Relief and Orchestra Tax Relief to 45% for touring and all orchestra productions, and 40% for non-touring productions.

Other changes included a further decrease in Class 1 Employee National Insurance contributions from 10% to 8% from 6 April 2024. It was a nice announcement from the Chancellor, however it might cause a headache for payroll software providers given that it only gives them one month to input the changes through their systems. This is something the payroll teams in charities and their trading subsidiaries will need to keep an eye on.

Simon Buchan, Head of VAT, BHP, comments:

In yet another budget where the charity sector was largely ignored the announcement to permanently set Theatre, Orchestra and Museums and Galleries Tax relief at 40% or 45% will be welcomed by the cultural sector.

Village halls play a vital role in local communities. The provision of £5m to the Platinum Jubilee Halls Fund, although probably nowhere near what is needed, will make a welcome difference in some communities.

Whilst the increase in the VAT registration threshold to £90,000 may be welcome news for charities close to the current threshold, the reality is that the cliff edge of VAT registration and all that goes with it is probably still too close for comfort.

Simon Hubbard, Principal Consultant at Quantum Advisory, comments:

Further reductions in National Insurance contribution rates will be welcomed by many. The change, at face value, indirectly makes saving into a pension less attractive for employees where contributions are paid before the deduction of tax and National Insurance through an arrangement known as salary sacrifice. This change reduces the National Insurance that employees save by using such an approach.

These tax cuts must be viewed alongside the freeze on income tax thresholds until 2027. Given this, we expect that salary sacrifice arrangements will remain the most efficient way for employees to pay their pension contributions and there is no impact on the National Insurance savings made by the employer.

Cuts in National Insurance will only benefit income earned through work, so pensioners will not benefit in the same way that employees do.

Disclosure and value for money for DC Schemes and LGPS arrangements

The announcement from the government will help concentrate DC pension funds on delivering the best returns for members whilst encouraging further investment in the UK economy. We welcome the aim to target good investment returns for every member.

Careful consideration will need to be given in the coming months on how to encourage this for DC Schemes whilst allowing funds to invest in long-term growth assets that may be volatile in the short-term.

The abolition of the LTA will as a whole simplify the pensions industry and encourage more to save for retirement and work for longer. It remains to be seen whether this policy will change if there was a new government following the imminent general election, given the Labour party’s opposition to the abolition of the LTA.

The triple lock guarantee for 2024/25 (which the Labour Party has also committed to retaining) will ease pensioner fears, particularly given the recent years of high inflation.

Whilst this news will be welcomed, wider issues remain with the functionality of the State Pension, which is becoming increasingly more expensive in real terms due to current birth/death rates.

We expect there will be further discussions around the State Pension following the election.

This briefing was produced by Charity Finance Group for its charity members. We would like to thank our corporate and infrastructure partners for contributing.

If you have any questions or queries, please contact CFG's policy team by email.

Download the PDF version of this briefing