More than 100 members and partners attended a special CFG event on inflation in May. CFG's expert speaker panel presented the latest inflation figures and forecasts, and highlighted the many different areas where higher prices will impact charities – and what charities can do to mitigate the effects.

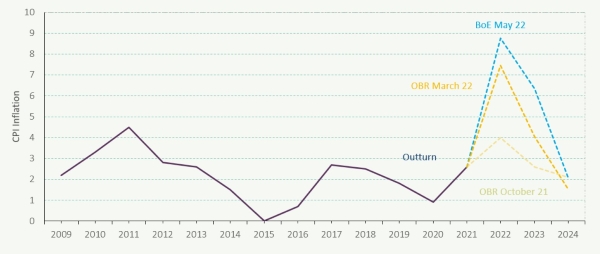

Opening the event, Jamie O’Halloran, Economist with Pro Bono Economics, looked ahead to provide an overview of what the Office for Budget Responsibility and Bank of England have forecast inflation to be for the year ahead. The Bank of England predicts that inflation will remain at 9% for the year and peak at 10%, in part due to supply side issues with Brexit and the aftermath of the pandemic, but also because of significant energy and food price increases.

These price rises have already affected many of the charities we’ve spoken to. And it’s not set to improve. With the energy price cap expected to increase by almost 50% in October, more people on low incomes will rely on charity services as time goes on, leading to an increase in demand amongst many charities.

Jamie O’Halloran emphasised the three areas where this will impact charity finances: high inflation will reduce the value of donations; £20 in 2021 will be worth around £17 in 2024. The value of reserves will decline by a similar proportion. And to keep pace with current levels of pay, staff costs would need to increase by £94,000 in 2024.

Governance and audit

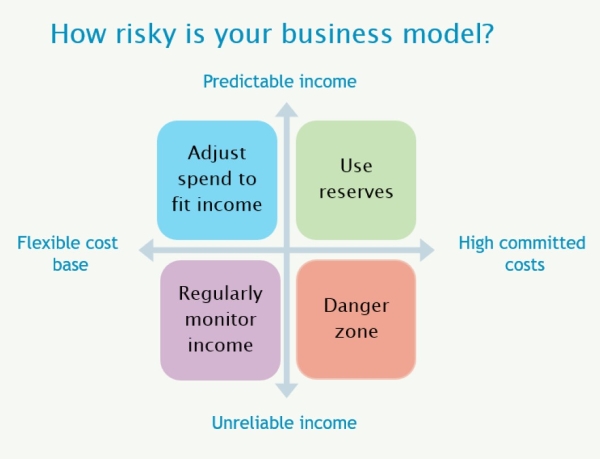

Up next was Judith Miller, Partner at Sayer Vincent, who spoke about how to approach these issues from a governance perspective. Judith shared tips on financial planning and what to consider from an audit perspective.

Judith explained the importance of considering your organisation’s business model and explained how the finance team can be a strategic leader for its organisation. The differences between the private and charity sectors were set out, acknowledging that there is not a simple income-cost relationship with a profit margin and there are potentially many different income streams and costs. Emphasis was placed on the three key parts of financial management: results, the impact on reserves, and working capital.

Judith also explained the many lessons learned from the pandemic on how to deal with cashflow management and working capital. With frequent communication with trustee boards and management teams likely for the foreseeable future, there might also be a need for rolling forecasts.

One tip to potentially reduce spend was on procurement. Double check with your suppliers that you are getting the best prices on the goods and services you buy. There was a further emphasis on trying to find productivity gains where possible. And linked to this, if there are ways to deliver your charitable objectives via collaboration, where appropriate.

From an audit perspective, it was emphasised to include a comment on impact in your financial review, and factor into your considerations for the going concern assumptions.

High inflation and investment

Patrick Truman from James Hambro and partners, spoke about the impact that inflation is having, and will likely have, on charity investments and the wider market.

After a long absence, inflation has appeared, and the market’s faith in the ability of central banks to bring inflation back to their target level has been challenged.

Longer-term inflation is expected to increase sightly and remain above the Bank of England’s 2% target. It was pointed out that after a strong year in 2021 for equities, 2022 will be much more difficult across all investment classes.

So, what to own given the economic climate and levels of inflation? The helpful chart below outlines the potential options: Three potential outcomes were raised, each depending on how successful central banks are in attempting to bring inflation under control without crashing the economy:

- Inflation rises too high, demand declines and unemployment increases, leading to

dreaded stagflation.

- Central banks tighten too much which reduces demand leading to a recession.

- There is a soft landing where markets adjust to an increase in interest rates, inflation reduces and markets adjust without too much volatility.

It was noted that the UK and Europe look to be in a more challenging situation that the USA.

Recruitment and retention

The final speaker was David McDowell, co-CEO, Altum Consulting, who spoke on how rising inflation and the wider cost of living crisis will impact the jobs market. David revealed that more than one-third of employers are concerned about staff retention, and that a similar proportion of employees are considering changing jobs.

According to David, the average pay increase for a candidate moving roles was 8.4%. Vacancies are outstripping the number of available candidates, with nearly 90% of all candidates being in multiple recruitment processes at once.

David shared different ways to attract and retain employees aside from salary increase, including promoting flexible or remote working, promoting employee wellbeing, additional holidays and days off, investing in employees’ careers, and secondments to help with career development and to gain a breadth of experience. Key takeaways included: focus on internal talent first; understand what talent management plans you have in place; ensure you have flexible and creative benefit packages, and act quickly when recruiting.

No silver bullet

All of the event's speakers emphasised that there are no silver bullets when addressing high levels of inflation. However, with the right processes in place and good financial management, charities can help to mitigate some of the worst effects.