On Wednesday 11 June 2025, Chancellor Rachel Reeves delivered her first Spending Review, and the first multi-year review since 2021. It's fair to say that the context remains politically and economically difficult.

As the Institute for Fiscal Studies pointed out, “sharp trade-offs are unavoidable”. The Chancellor's announcement set out day-to-day expenditure for the next three years and investment spending for the next four years. The government had already announced that total departmental spend will grow by 2.3% in real terms per year.

Unlike the Spring Budget, an accompanying Economic and Fiscal Outlook from the OBR was not included, so we will have to wait until the autumn to see their projections for how this might affect public finances and economic growth.

Winners and losers

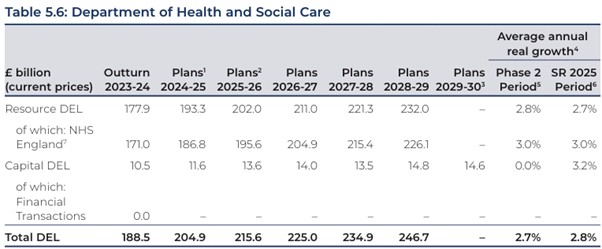

The big announcements that were trailed in advance of the statement made clear who the winners were going to be. There will be an additional £39bn to help build social and ‘affordable’ housing over the next ten years; an increase of 3% per year for the NHS for each year of the Spending Review, and a rise in defence spending from 2.3% of GDP to 2.6% of GDP by April 2027.

The fortunes of unprotected departments did not fare so well, and unsurprisingly were not mentioned in the Chancellor’s speech.

The Home Office will see 1.4% cuts to departmental spending over the three years period; the FCDO sees a cut of 6.9% of total departmental spending a year over the same period, and DEFRA will see a reduction of departmental spend of 2.7%.

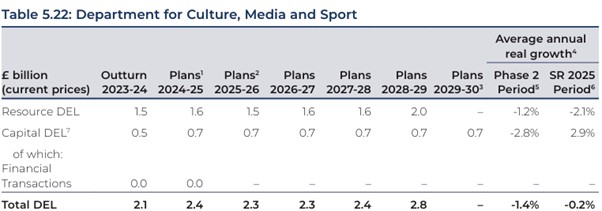

The announcement of most direct relevance to the charity sector is a 1.4% cut to the Department for Culture, Media and Sport (which includes Civil Society and Youth) over the three year period.

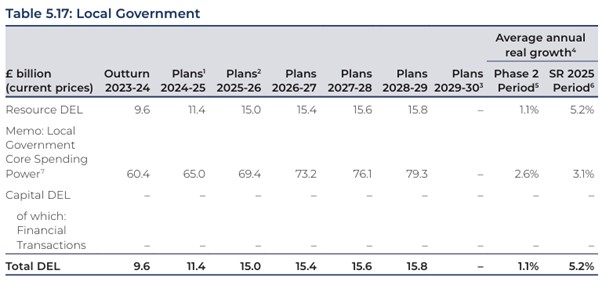

Local government will see a very modest increase of 1.1%, but with Local Government Core Spending Power increasing by 2.6%. This means an increase in Council Tax is on the cards.

As was previously announced, the Overseas Aid Budget (ODA) will be cut to just 0.3% of Gross National Income (GNI). The cross-party political consensus that the aid budget should remain at 0.7% of GNI seems a long time ago now. The consequences this will have for INGOs and, more importantly the people, they serve is hard to overstate.

What did we ask for?

In response to a consultation feeding into to today’s Spending Review, CFG alongside other civil society organisations, wrote to the Chancellor outlining our joint asks.

These included adequately funding the Charity Commission for England and Wales; moving to a more sustainable funding model for Local Authorities to bring greater stability to local councils; and investing in HMRC to simplify and streamline Gift Aid processes.

The very modest increases to local council budgets are not what we would describe as ‘sustainable funding’, especially with ongoing social care remains such a concern for local authorities. However, it is still positive that their budgets are increasing.

It is at best unclear what HMRC’s funding settlement means for the charity sector and the digitisation of Gift Aid processes. Nonetheless, we will continue to push for our asks.

What lies ahead?

The upcoming Autumn Budget will be a pivotal moment. Many organisations (including the Institute for Fiscal Studies) are predicting tax increases, though this will not be as a direct result of the funding commitments made at the Spending Review.

Instead, they believe the funding increases laid out are insufficient to meet demand, and political pressure may lead to the government spending more than predicted (the U-turn on Winter Fuel Allowance is one such example). However, we will have to wait until the next fiscal event for further clarity.

See below for a top-level breakdown of spending commitments for each department relevant to the charity sector:

Departmental budgets

Department for Culture, Media and Sport

-

It is hard to determine precisely how this will impact Civil Society and Youth, but we will endeavour to find out more over the coming weeks and months. However, as the creative industries saw a significant funding increase this could mean that Civil Society will be negatively impacted.

-

As part of the Dormant Assets Strategy announced earlier this month, £132.5m of dormant assets funding has been allocated to support disadvantaged young people to access new opportunities in their communities, schools or libraries, and increase access to welcoming safe spaces.

-

As stated in the Autumn Budget 2024, the government reiterated that they were developing a social impact investment vehicle to support mission delivery and tackle complex social problems. HM Treasury, DCMS and the Office for Investment have been working closely with the sector, including through the Social Impact Investment Advisory Group, bringing together socially motivated investors, philanthropy, civil society and other impact investment experts. They have confirmed that an announcement on the vehicle will be made over the summer. We look forward to finding out more details once announced.

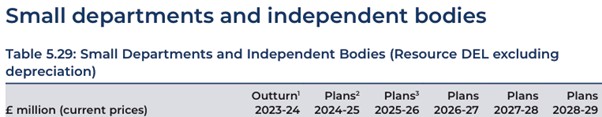

Charity Commission

There was some good news that the Charity Commission budget will see a notable increase in funding from planned spending of £29.8m in 2025-26 to an increase of £37.9m in 2026-27, falling to £34.4m in 2028-29.

It's unclear precisely what impact this will have on charity regulation and on their day-to-day operations, but we hope more funding will ensure the Charity Commission is able to fulfil its key priorities as set out in its strategy last year.

International Development

As set out at the Spring Statement, the government decided to reduce Official Development Assistance (ODA) spending to the equivalent of 0.3% of Gross National Income (GNI) by 2027 to help fund increases in spending on defence.

The government have, though, reaffirmed that they remain “committed to returning spending on ODA to 0.7% of GNI when the fiscal circumstances allow” and that they will “continue to monitor future forecasts closely, and each year will review and confirm, in accordance with the International Development (Official Development Assistance Target) Act 2015, whether a return to spending 0.7% of GNI on ODA is possible against the latest fiscal forecast.”

Local Government

It is fairly positive that some additional funding has been found for Local Government. It will see a 1.1% increase in funding over the three-year period to 2028-29.

However, the increase to Local Government Core Spending Power of 2.6% depends on the addition of a 3% core council tax referendum principle and a 2% adult social care precept. This means there is an expectation of Council Tax increases to help cover these increases in spending.

Health and Social Care

CFG comments:

Richard Sagar, Head of Policy, CFG, says:

“The government’s Spending Review is a real mixed bag for charities. While the Chancellor’s announcement will not be cause for celebration, the targeted increases for the NHS, local government and housing will provide vital support for charities operating across these sectors.

“However, these modest funding boosts fall short of placing local government on the sustainable financial footing that remains urgently needed. The sector continues to face structural challenges that require more comprehensive long-term investment.

“The small budget increase for the Charity Commission is to be welcomed, yet cuts to DCMS and ongoing uncertainty as to the department’s future raise some concerns about the sector’s ability to engage effectively with government.

“There are certainly questions that remain unanswered, and we will have to wait for the Autumn Budget to see what the future will hold for tax increases, and the broader economic impact for the sector.”

Comments from the sector

Cllr Louise Gittins, Chair, Local Government Association:

“It is positive that the Spending Review delivers on some key LGA asks. Funding announced for children’s services and SEND support will help more children get the right support and avoid reaching crisis point. We are also pleased at increased investment in the Affordable Homes Programme and the commitment to a 10-year rent settlement, which will support councils to invest in maintaining existing homes and ramping up vital new build programmes. Extra investment in places to support regeneration, transport and infrastructure is good news for residents and communities in these places.

“We will analyse the detail to assess the full impact on councils and communities. A recommitment to multi-year local government funding settlements is essential for financial planning while efficiency and innovation continues across local government. However, all councils will remain under severe financial pressure. Many will continue to have to increase council tax bills to try and protect services but still need to make further cutbacks. While government faced tough choices, future funding for adult social care is good news but a lack of significant extra government money needed to meet immediate pressures is worrying."

Mairi MacRae, Director of Campaigns & Policy, Shelter:

“This increased investment is a watershed moment in tackling the housing emergency. It’s a huge opportunity to reverse decades of neglect and start a bold new chapter for housing in this country. To truly tackle rising homelessness, it must come alongside a clear target for delivering social rent homes.

“For too long, past governments allowed thousands of social homes to be lost each year, while funnelling public money into so called ‘affordable homes’ which are priced far out of reach for many. The result has been record homelessness, and families, young people, and key workers priced out of their communities.

“Social homes are the only genuinely affordable homes by design with rents tied to local incomes and around two thirds lower than private rents. They keep communities together, save public money and provide the stability people need to thrive. To ensure this funding tackles homelessness at its root, the government must now set a target for how many social rent homes it will deliver through this programme.”

Dr Lindsey MacDonald, Chief Executive, The Magic Breakfast:

“Magic Breakfast welcomes the Government’s continued commitment to their flagship policy to introduce free breakfasts for all primary-aged children in England. The Chancellor set out that this policy aims to ensure that “no child goes hungry, and every child can have the best chance to thrive and succeed”. Today’s spending review announcement, however, does not clarify when the Government’s free school breakfast policy will roll out, and how much money they will commit to this nationally.

“The commitment to provide breakfast for every primary-aged pupil is vital but leaves gaps that mean many older pupils will remain hungry each school morning. It is disappointing to see that the Government has not provided detail of how they will address some significant gaps in their proposed breakfast policy. We ask that the Government looks again at including secondary-aged pupils in special schools and how they prevent a cliff edge for the 700 secondary schools who will lose National School Breakfast Programme funding from April 2026."