By Richard Sagar, Policy Manager, Charity Finance Group.

1.0.0.20

CFG will produce a full briefing with all the relevant changes for charities released on the same day as the budget, alongside a liveblog announcing anything that might be of interest.

As Physicist Niels Bohr pointed out ‘Prediction is difficult, especially about the future.’ And it becomes even more difficult when it comes to a budget with such economic, political and social uncertainty. With the new government winning seats they have never previously held (the so-called ‘red wall’), the chancellor will face pressure to increase spending on these areas and undo much of the austerity which has affected these communities. But this leads to the question of how he will pay for this additional spending, and seemingly he has one of two options; either increases taxes, something the most Conservative chancellors are loathed to do, or abandon one of the government’s fiscal rules (to have the current budget in balance no later than the third year of the forecast period).

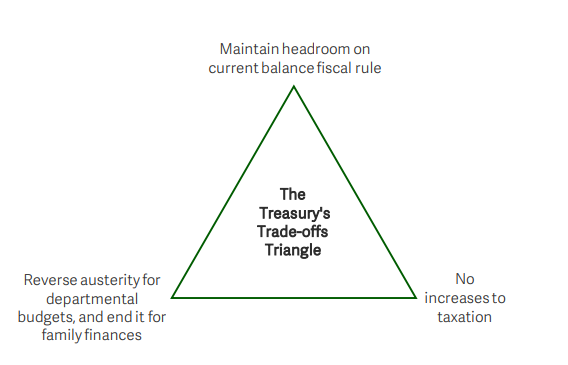

On the face of it Rishi Sunak can only pursue two of these options, which The Resolution Foundation have helpfully identified as ‘the treasury trade-off triangle’ (they should also be commended for the alliteration).

It will be interesting to see which of these will be cast aside.

But with all those caveats in mind, what are some of the key things charities should look out for at the upcoming budget?

Coronavirus- ‘economic security’

Sources from Number 10 have told newspapers that much of the budget has had to be re-written to prioritise ‘economic security’ due to the impact of coronavirus on the economy, rather than the chancellor offering a new economic vision for Britain. The OECD has already downgraded growth for all major economies, including the UK and the FTSE has seen notable declines since mid-February, but there has been a rebound in global stock markets on hopes of a stimulus. There has been reassurance from the Bank of England that they are ready to act to soften the impact of the crisis, but as the Governor of the Bank of England has said "the prospect with this situation is that we will have disruption, not destruction, and that should be and will be the focus of policy."

OBR Forecasts- Doom or just gloom?

Suffice to say I don’t envy the Office for Budgetary Responsibility (The independent body set up to provide an authoritative analysis of the public finances) in the run-up to this budget. Legally obliged by an act of parliament to provide two forecasts in the financial year, and given that they have yet to produce any, they will have been rather busy. On the plus side there has been an agreement made with the chancellor to produce a shorter limited update on the 13 March, alongside the main forecast on the 11 March, to satisfy the two forecasts requirement (see the exchange of letters here).

But with economic uncertainty, even without the impact of the coronavirus (as former Chief Financial Secretary to the Treasury David Gauke has observed, the OBR will likely have to place caveats on any forecast with this in mind), the prospects for the UK economy do not look too positive. The most recent Bank of England economic outlook published in January pointed to a slowing of GDP growth, and this is a trend seen across all major economies.

These things taken together will likely lead to an increase in public sector net-borrowing, and place the government in danger of breaking their fiscal rules, particularly with the additional infrastructure spending already promised. This could mean less money available in the short-term for charities and their beneficiaries.

How big is the envelope?

It is highly likely that the Chancellor will use the budget to announce the total amount of departmental spending that will be available for the upcoming Spending Review scheduled for the Autumn. In public finance speak this is referred to as the ‘spending envelope’. This overall amount will give a strong indication of how departments of most interest to charities will fair. With an increase in the spending envelope meaning less tough decisions being made by the Treasury.

As CFG and other sector bodies have long argued, it is arguably more important what happens to local government funding this year, than any proposed changes to tax or individual pots of money available for the sector.

Tax Changes

A number of proposed changes already briefed including scrapping entrepreneur’s relief, cuts to inheritance tax, a cut to NICs, will have little if any impact on the sector. Others such as the increase to the National Living and National Minimum Wage will add an additional cost burden to charities who can ill afford it. The government has published their review of IR35, confirming that the changes will take place, with there being no financial penalties in the first year, unless there is deliberate non-compliance.

There are always some perennial concerns to keep an eye on; increases to Insurance Premium Tax, reductions to business rates retention for charities etc.… although we have no indication that they will be increased, or in the case of business rates we have positive confirmation that they will be retained.

Will Charity sector bodies be listened to?

CFG, alongside our partners at NCVO, ACEVO, Locality, Lloyds Bank Foundation, Children England, and the Local Trust made four key asks ahead of the budget these were: Additional funding for local government; clarity on the UK Shared Prosperity Fund; establishing a Community Wealth Fund from dormant assets; and for government to work with the sector to implement the recommendations of the charity tax commission.

We may have to wait till later in the year for the Spending Review to see if some of these recommendations have been acted upon, but CFG will be live blogging all the major announcements on the day and producing a comprehensive briefing on the day of the budget with all the latest announcements that will be of interest to the sector.

1.0.0.20