CFG's policy team - Richard Sagar and Ida Karlsson - take a look at today's Spring Statement to dissect what the announcements and OBR forecasts mean for the charity sector.

The Chancellor, Rachel Reeves, was keen to emphasise in the run-up to today’s Spring Statement that this was not a major fiscal event. Nevertheless, there were many significant announcements for society as a whole.

It is no surprise that the public finances are not in a good position, and the OBR forecast demonstrated as much. Higher debt interest costs and other forecasting changes left the current budget in deficit by £4bn in 2029-30. Growth is also forecast to decline this year from 2% to 1%, but with the forecast thereafter seeing modest increases in growth from 2026 onwards.

In an attempt to shore up the public finances and close the fiscal hole the Chancellor finds herself in, she has announced further cuts to spending on top of those to the welfare budget that were made in the previous weeks.

A further c.£500m of cuts to the health element of Universal Credit is expected to lead to a c.£10bn surplus in the budget. These changes to spending ensure the Chancellor sticks to her self-imposed ‘fiscal rules’, which she described as ‘non-negotiable’.

The government’s own impact assessment shows that the announced cuts to health-related benefits (freezing the UC health element until 2029-2030 and reducing it to £50 a week for new claims in 2026-27) risk pushing a further 250,000 people into poverty.

Aside from the obvious impact on those directly affected, this will likely place further strain on the charitable organisations that support these people - at a time when they themselves are operating under increasing pressure.

Overall, the announcement and the corresponding forecast from the OBR point to a very challenging set of circumstances. There are no glimmers of hope for those charitable organisations already struggling.

We will need to wait until mid-June for the Spending Review and the forthcoming Autumn Budget to see how changes to government departmental spending might impact on the sector.

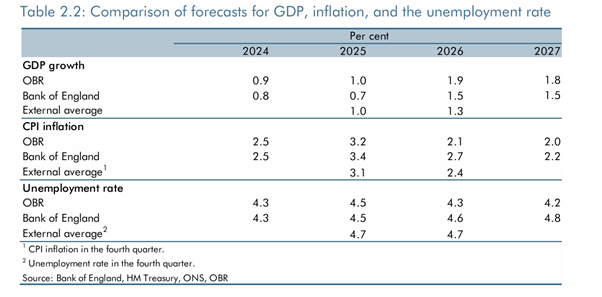

OBR forecast

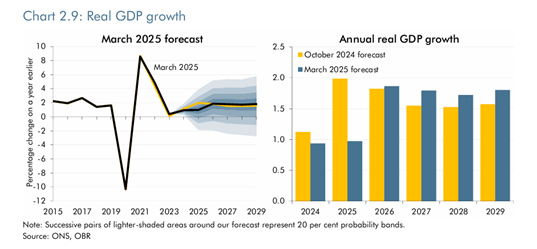

Growth

- GDP is projected to grow by 1 per cent in 2025, half of the 2 per cent forecasted in October 2024 mainly due to low productivity.

- GDP growth is expected to accelerate to 1.9 per cent in 2026 as monetary policy eases, gas prices fall back and slack in the economy is taken up.

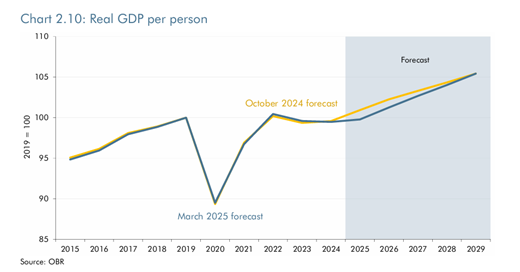

- After falling 0.2 per cent in 2024, real GDP per person is expected to grow by 0.3 per cent in 2025

- GDP per person then continues to rise to 1.4 per cent a year, driven by the recovery in productivity growth.

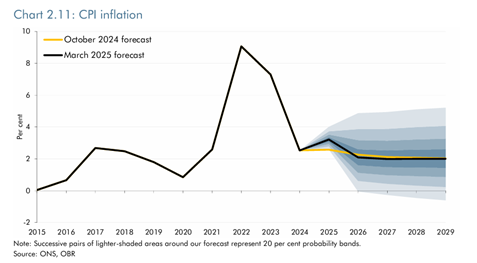

Inflation

- CPI inflation is forecast to rise form 2.5 per cent in 2024 to 3.2 per cent in 2025.

- The rise and peak in inflation is driven by increases in the Ofgem price cap due to higher energy and water bills and food costs.

- It is them expected to fall rapidly to the 2 per cent target from mid-2026 onwards.

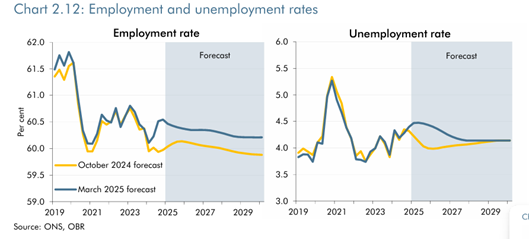

Employment

- The employment rate is forecast to decline 0.3 percentage points from 2024 to 2029 as the population ages.

- Population growth means that cumulative employment growth over the forecast is around 1.2 million, broadly the same as in October.

- Unemployment is expected to peak at 4.5 per cent in 2025 before falling to its estimated structural rate of 4.1 per cent in 2028.

- The unemployment rate has been trending up since the post-pandemic low of 3.8 per cent in line with wider indicators of a cooling labour market as labour demand weakens.

Comparison- GDP, inflation and unemployment rate:

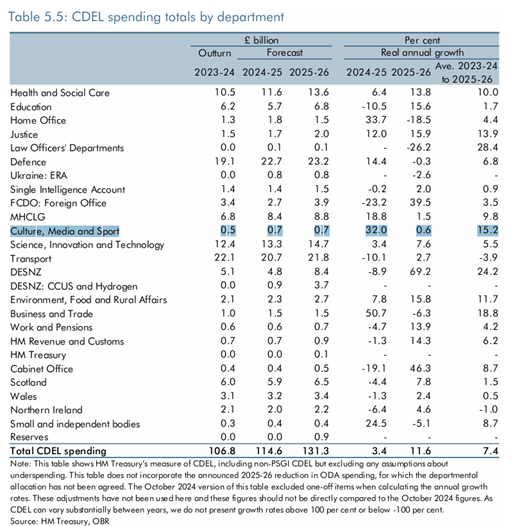

Capital spending by Department:

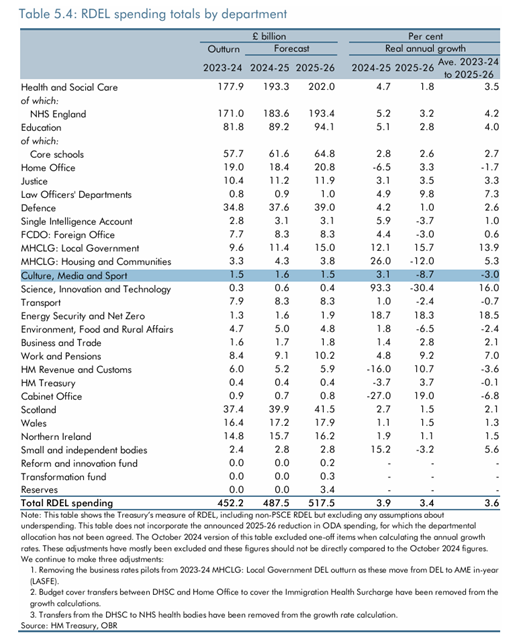

Resource (day to day) spending by Department:

Please see below for all the relevant policy announcements that accompanied the Spring Statement:

Welfare

The following policy measures on welfare were announced:

Universal Credit Health Element – The government is rebalancing the payment levels in Universal Credit, to address perverse incentives in the system. The Universal Credit health element will be frozen for existing claimants until 2029-30. For new claims, the Universal Credit health element will be reduced to £50 a week in 2026-27 and then frozen until 2029-30.

Universal Credit Standard Allowance – The government will increase the Universal Credit standard allowance for new and existing claims above inflation from April 2026, reaching CPI + 5% from April 2029. This means the standard allowance weekly rate for a single person aged 25 and over will increase from £92 in 2025-26 to £106 in 2029-30.

Welfare Fraud and Error: increasing preventative checks in Universal Credit – The government will increase checks on potential Universal Credit claimants by introducing more ways to verify the amount of savings they hold, as well as their earnings and expenses. This is expected to save £200 million in 2029-30.

Welfare Fraud and Error: Recruit over 500 new fraud and error staff – The government will invest to recruit over 500 additional DWP fraud and error staff who will make better use of government data to correct errors in benefit claims. This is expected to save £40 million in 2029-30.

Trussell have been damning of these changes announcing “Social security for disabled people has been slashed in the Spring Statement. This is cruel, irresponsible and shameful. People at food banks are already telling us that they’re terrified about how they will survive.” We will monitor the situation to see what this means for those affected by these changes.

'Closing the tax gap'

The accompanying documents to today’s statement includes a raft of measures to ‘close the tax gap’ by investing in HMRC and introducing the following measures:

Investing in HMRC’s debt management capacity – The government will invest £87 million over the next five years in HMRC’s existing partnerships with private sector debt collection agencies to collect more unpaid tax debts.

Investing in additional HMRC debt management staff – The government will invest £114 million over the next five years to recruit an additional 600 HMRC debt management staff.

Investing in additional HMRC compliance staff – The government will invest £100 million over the next five years to recruit an additional 500 HMRC compliance staff.

Making Tax Digital (MTD) – The government will expand the rollout of MTD for income tax Self Assessment to sole traders and landlords with incomes over £20,000 from April 2028. The government will also make further detailed changes to MTD as set out in the technical note “Modernising the tax system through Making Tax Digital”.

Increasing late payment penalties – The government will increase late payment penalties for VAT taxpayers and income tax Self Assessment taxpayers as they join MTD, from April 2025 onwards. The new rates will be 3% of the tax outstanding where tax is overdue by 15 days, plus 3% where tax is overdue by 30 days, plus 10% per annum where tax is overdue by 31 days or more.

Direct recovery of tax debts by HMRC – HMRC will re-start “direct recovery” of tax debts owed by individuals and companies who have the ability to pay but choose not to do so. The government will also explore options to automate the process for collecting lower value tax debts.

Making better use of third-party data – As announced at the Budget last autumn, the government is publishing a consultation on modernising how HMRC acquires and uses third-party data to make it easier for taxpayers to get tax right first time.

Behavioural penalty reform – As announced at the Budget last autumn, the government is publishing a consultation on options to simplify and strengthen HMRC’s inaccuracy and failure to notify penalties.

Enhancing HMRC’s ability to tackle tax advisers facilitating noncompliance – As announced at the Budget last autumn, the government is publishing a consultation on options to enhance HMRC’s powers and sanctions to take swifter and stronger action against tax advisers who facilitate non-compliance.

Closing in on promoters of marketed tax avoidance – As announced at the Budget last autumn, the government is publishing a consultation on a package of measures to close in on promoters of marketed tax avoidance.

Overseas Aid - To help fund increases in defence spending the government has confirmed the previously announced reduction in spending on Official Development Assistance to 0.3% of GNI:

Official Development Assistance (ODA) profile – As announced on 25 February 2025, the government is confirming the profile of ODA spending across the scorecard period, delivering on the Prime Minster’s announcement that ODA will be reduced to 0.3% of GNI by 2027 to fund the increase in defence spending.

Comments from CFG's corporate partners:

Quantum Advisory:

Following the Autumn Budget, the government’s main fiscal event of the year, Reeves today set out the government’s ‘Spring Statement’, providing an update on the latest economic forecasts and reiterating many of the sentiments previously made.

Despite Reeves remaining silent on pensions within the Spring Statement, the country will see many of the changes made in the Autumn Budget coming into effect from April 2025.

The Triple Lock

The Triple Lock, introduced in 2011, promises that the State Pension will rise each year by the highest of either price inflation (measured by CPI), average earnings growth or 2.5% and guarantees that the annual State Pension increase will never lag any of these measures.

Reeves announced in the Autumn Budget that the Triple Lock would be maintained for April 2025. This didn’t come as a big surprise considering the government had previously promised to maintain the Triple Lock for the duration of this parliament, i.e. until August 2029. However, over recent months, due to the current economic backdrop and the ‘need to raise some much-needed cash’, there has been much speculation around whether the government will continue to ‘maintain’ the Triple Lock, whilst amending the formula used to calculate it, making it less generous for pensioners.

Sarah Garnish, Pensions Consultant, Quantum Advisory added:

“It seems quite clear that there are decisions that need to be made by the government around both the Triple Lock and tax-thresholds. Time will only tell as to who/what takes priority when making that decision.”

Employer National Insurance thresholds and contributions

As announced in the Autumn Budget, from April 2025 employers will pay National Insurance Contributions at the increased rate of 15% on earnings above the newly lowered threshold of £96.15 per week.

Understandably employers will have spent the past six months quantifying the impact this change will have, deducing ways of recuperating the additional costs and incorporating that into their future business strategies.

Sarah Garnish said:

“One form of recuperation employers may not have considered however is the additional saving they will make if their employees pay their pension contributions via salary sacrifice.

“Salary sacrifice is a tax efficient way for both employers and employees to pay into a workplace pension. Salary sacrifice is where an employee accepts a lower salary, but in return the employer pays all pension contributions resulting in a National Insurance saving, for both the employer and the employee.

“The increase in the employer National Insurance contribution rate will mean a bigger saving for employers. This could be a good time for employers to implement the use of salary sacrifice for employee pension contributions, not only will the employer see a saving, but it will encourage employees to think about saving for retirement and also provide them with an increase in their current take home pay, a win-win for everyone.

“For employers who don’t currently offer this to their employees, now may be the perfect time to start.”