A survey of 45 charity leaders reveals significant concerns remain over the impact of the rise in employer national insurance contributions, with many charities already cutting services and staff.

Following the announcement that the rates of Employer National Insurance Contributions would rise by 1.5% in April 2025, CFG launched a survey which revealed deep concerns over the impact that this increase in costs would have on charities. Five months on from that announcement, we followed up with those who responded to the original survey to ask how they feel now about the changes.

With many charities finalising budgets for the new financial year, CEOs, trustees and finance directors have told us that many of the concerns they had in November last year remain.

Despite ongoing advocacy work, the amendment to exempt small charities from the National Insurance Contributions bill which passed through the House of Lords was not passed in the House of Commons. This exemption would have given a lifeline to those facing difficult decisions around cuts to staff and services.

The CFG team would like to thank everyone who took part in our 2024 and 2025 surveys. The information you provided is helping us to share the impact of the government's decisions with parliamentarians and the general public.

Results summary

Some of the key statistics from our follow-up survey are as follows:

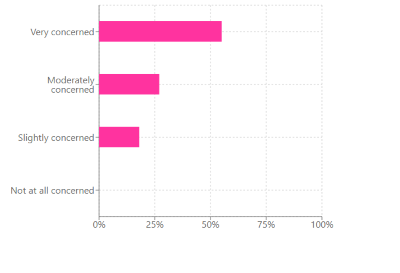

- 82% of respondents are either very or moderately concerned about the affordability of the rise in ERNICs, with 0% saying they are ‘not at all concerned’.

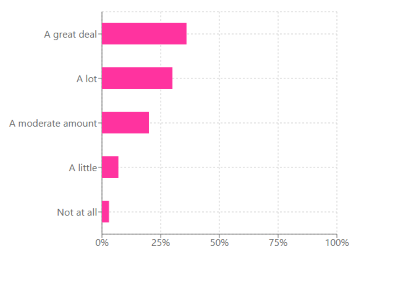

- 66% of respondents have either ‘a great deal’ or ‘a lot’ of concern about absorbing the increased costs under their current financial models.

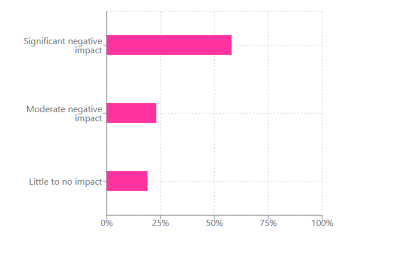

- 81% of respondents say that the rise will have a negative impact on their ability to offer competitive benefits to staff, with 58% saying this impact will be ‘significant’.

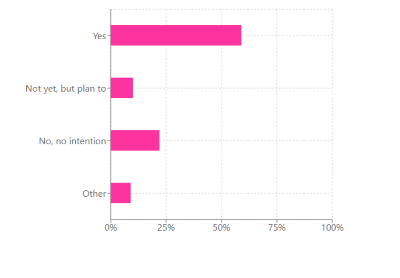

- 69% of respondents say their charity has already started to reduce headcount or will in the near term

- 41% of respondents have already cancelled plans to take on new staff or launch new services that would have otherwise gone ahead, with a further 23% saying they are likely to do so in the near future.

Charity leaders were also asked to share the impacts of the rise and how it’s impacting their financial planning, budgeting and fundraising efforts, as well as any steps they have taken to increase operational efficiency.

There has been very little change in the overall levels of concern amongst charities since we first surveyed them in November 2024.

As many respondents noted, there are few options left for charities to streamline their operations and increase efficiency, as many cuts have already been made due to a difficult operating environment .

As such, many charities have already begun to reduce staff headcount, and are cutting services, impacting on the ability of charities to support those who rely on the services they provide, as well as those working within the sector.

In addition, several charities raised the issue of increased competition for funding as a result of this rise, and noted the impact the rise in ERNICs has on suppliers and funders, which in turn increases the pressure on charities.

Results

Q1: What has the actual impact of the ERNICs rise been so far?

“We have set a deficit budget (for the first time ever) for 2025-26 and are taking steps to cut our service delivery to rebalance our financial footprint for future years.” (Major museum)

“As expected, was part of the financial pressures that led us to removing some new roles from our budget to limit the expected size of the deficit.” (Major healthcare charity)

“We are having to review our service provision as staffing makes up circa 82% of our turnover and is the one area we cannot reduce without compromising what we offer. The original budget for the next year was forecasting a deficit of close to £500k and a lot of hard work has been undertaken to review any savings we can make easily, as well as closing services which are no longer financially viable for us to maintain. This next year will be about the sustainability of our charity.” (Large social care charity)

“For the first time ever, we are struggling to create a balanced budget for 2025-26. We are trying to construct a new financial model to address this and other cost pressures.” (Major heritage charity)

“Budget plans for 2025 have been cut back to accommodate additional employer NI costs. Unlike private companies we are unable to pass on the additional cost. We are being notified by some suppliers that as their NI costs are increasing they are passing the cost on to their clients’ fees accordingly. One supplier is increasing prices by 12.5% in response!” (Large animal welfare charity)

“We are a 100 employee organisation with just over £5m of income per annum. With the various other squeezes on the charity sector at the moment, this £100k cost to the charity with no benefit to either activities or staff has made planning for the next year incredibly challenging.” (Large environmental charity)

Q2: How do you think the increase to Employer NICs will impact your charity's operations, particularly in terms of staffing costs and financial planning?

“There will probably be redundancies to be made. We will possibly have to revoke our commitment to paying our lowest paid staff at UK 'real' living wage.” (Major museum)

“£150k in a full year, which will likely have to be met by cutting delivery roles as fundraising is already at capacity and cannot pass on to public sector clients (NHS and education) as they are cash limited too.” (Large health care charity)

“Financially - £132k - effective loss of colleagues in the charity. Setting a budget with a deficit for part of the delivery as from April (just before for some redundancy) and reduction in hours of support for young people in other roles. Reduction in salary and terms and conditions for new roles recruited to.” (Large homelessness charity)

“We will have to cut an additional £125k from the budget. Currently proposed to come from staff benefits and staff headcount. We are continuing to delay investments in systems and resilience, making us more vulnerable.” (Large education charity)

“This charity provides adult social care services and the charges to users have increased by more than inflation. There is an expectation that this may reduce demand and therefore present a challenge to maintain a break-even position in the next financial year.” (Large social care charity)

“Operational delivery will reduce as we look to reduce staff numbers to offset this new and unanticipated cost pressure within the landscape of other increasing cost pressures that cannot be offset by grant funding, fundraising and commercial income generation.” (Major heritage charity)

“Funding won't stretch as far as it used to, so service delivery will be adversely impacted. Restricted fund projects that include a staffing element are now under-funded, and they will require a top-up from unrestricted reserves to deliver the funding objectives.” (Large Museum)

Q6: What steps have you now taken or do you have planned for the next financial year, to adjust your charity's budget to accommodate the potential increase in staffing costs?

“Hiring freeze, terminating the most costly contracts, leading to a reduction on delivery and therefore impact.” (Large health care charity)

“Unable to take on new staff or expand the team as hoped to meet the increased demand for services. Concerns that we may lose skilled staff because we cannot pay them more. Cuts in services.” (Medium-sized youth and children services charity)

“We have factored it in and looked at whether we can reduce costs even further in the year ahead. Our budget is largely fixed so the only way we can stay afloat is to cut expenses, including staff.” (Large domestic abuse charity)

“The increase in the National Living Wage impacts us significantly as we run a community nursery where we have increased staff costs but don't have an equivalent increase in funding to absorb this and cannot reduce staff. This means we will have to cut staff in our back office and also increase our nursery prices. It is a similar picture for the increase in NI which is felt across the organisation.” (Large community development charity)

“Team restructures are being planned to remove current vacancies and to redesign roles to enable overall cost reductions to be achieved.” (Major housing charity)

“There is no alternative other than to budget for the NI and Living Wage increases. The knock-on effect of several years of high Living Wage increases is that higher paid salaries are also forced upwards to maintain differentials and to avoid ‘leapfrogging’.” (Large museum)

Q7: Have you implemented (or do you plan to implement within the next six months) ways to improve your charity's operational efficiency to offset increased organisational costs?

“We have spent 10 years ‘streamlining' as our government support has failed to meet the costs of inflation. Streamlining now can only mean cutting services.” (Major museum)

“We have been doing this for years – there is no fat left to cut!!! We are already doing crazy amounts of work with tiny amounts of money! We have just been through 14 years of austerity, massive minimum wage rises which mean everyone has to have a wage rise, and a pandemic – there are massive increases in demand from our community who are in dire straits. We are not the public sector! We don't waste money and are already extremely cost effective and efficient!” (Medium-sized youth and children services charity)

“We did this throughout last year as we saw a decrease in grant funding so had to adapt to it. We feel we have pared everything back as far as we can.” (Large domestic abuse charity)

“We are always looking for efficiencies or ways to improve but most of our work is face to face delivery, so it is difficult to streamline.” (Large community development charity)

“We already all work remotely and overheads have already been stripped back as much as currently possible. Processes have been streamlined over the last few years, so we have little more we can do at the moment to reduce costs.” (Medium-sized heritage charity)

“We are struggling to identify what new investments we can make to deliver operational efficiencies.” (Major heritage charity)

Q8: How have the changes impacted your charity's fundraising efforts and ability to secure necessary funding?

“There is noticeably more competition for philanthropic contributions. Some donors don't appear to understand the extent to which the landscape is changing for charities.” (Large museum)

“Negatively - it is a perfect storm! Increasing overheads/salaries/costs. Massively increasing demand for services. Reduction in funding sources including available funding from local authorities. Business/individuals and large numbers of trusts closing. We are being asked to do more on less but are already cut to the bone.” (Medium-sized youth and children services charity)

“Funding is becoming increasingly difficult to secure. Staff feel anxious about their long-term prospects within our organisation.” (Large domestic abuse charity)

Data in full:

Q3: How concerned is your organisation about affording the rise in the rate of employer NICs?

Very concerned: 55%

Moderately concerned: 27%

Slightly concerned: 18%

Not at all concerned: 0%

Q4: How concerned are you about your organisation’s ability to absorb the changes under your current operating and financial models?

A great deal: 36%

A lot: 30%

A moderate amount: 20%

A little: 7%

Not at all: 3%

Q5: How has the imminent increase to the rate of Employer NICs affected your charity's ability to offer competitive employee benefits and perks?

It will have a significant negative impact: 58%

It will have a moderate negative impact: 23%

It will have little to no impact: 19%

Q9: Has your organisation started to implement reductions in staff?

Yes: 59%

Not yet, but we are going to have to reduce headcount: 10%

No, we do not intend to reduce headcount: 22%

Other: 9%

Q10: Has the change to Employer NICs resulted in your organisation cancelling expansion plans, plans for new staff or new services that would otherwise have been expected to go ahead?

Yes: 41%

Not yet, but it is likely we will do so: 23%

No: 25%

Not yet, and it is unlikely we will do so: 11%