CFG's policy experts, Richard Sagar and Isaac Bristol, pore over all the relevant announcements and changes so you don't have to.

If you ever needed confirmation that we live in the most bizarre timeline possible, then everyone knowing all the key announcements from the budget before the Chancellor speaks (courtesy of an OBR Economic and fiscal outlook being published by mistake) is confirmation of that. These are very strange circumstances indeed.

In one of the most trailed budgets of all time, Rachel Reeves has ‘rolled the pitch’ with warnings of many potential tax increases, and even an increase in income tax, although it was deemed breaking a manifesto commitment was not a political risk worth taking.

In a real sense, income tax will be increasing as the Chancellor will continue the recent tradition of extending the income tax and NI threshold freeze until 2030, dragging more people into higher bands via fiscal drag. Although it does raise a large amount of revenue (C.£8.6bn) it is a much less progressive way of increasing income tax than just adding a penny or so to the base rate.

Alongside this, we saw a flurry of tax increases on everything from a new mileage-based charge on electric cars, increases to income tax rates on property, savings, dividends, changes to gambling duties, a high value council tax surcharge, and everything in-between. In total this budget raises an additional c.£26bn.

For a full list of the relevant tax changes that impact charities, see the briefing below.

Charity specific announcements

The most significant measures announced directly to our sector were the introduction of a new VAT relief from 1 April 2026 for business donations of goods to charity for distribution to those in need or use in the delivery of their charitable services, which we have long called for (further details on the policy detail in the briefing below) and making salary sacrifice pension schemes less generous, capping the amount that is exempt from Employer and Employee NICs at £2k annually from April 2029.

CFG surveyed our members in the run-up to the budget on this issue to understand the possible impact and found that the majority of those surveyed offer a salary sacrifice scheme for pensions, and that the prospective changes will add additional costs to charities across income brackets.

A number of charity members are also questioning whether they will continue to offer salary sacrifice with one mid-sized charity telling us: “We might withdraw salary sacrifice arrangements if reduced tax advantages meant the administrative burden outweighed the appeal to employees.”

The survey is still open and we encourage charities that could be impacted by this change to complete it. Please find more on this issue in the briefing below.

A higher-than-expected increase to the National Living Wage and Minimum Wage was also announced a day prior to the budget, with workers over 21 seeing a rise of 4.1% to £12.77 per hour while workers between 18-20 will get an 8.5% rise to £10.85 per hour from April next year.

While we support the need for a high paying economy, without a corresponding increase in grants and contracts, many charities will struggle to meet these increased costs. The Resolution Foundation have also pointed out that the sizeable increase for younger workers is "unnecessarily big" and could make it harder for people in that age group to find a job.” Based on previous surveys of charity members, particularly those in social care, this will be another cost increase at a time they can ill afford it.

Perhaps the best news for charity demand, particularly those who work with children, was the scrapping of the two-child benefit cap, which is likely to have a big impact on child poverty and do something to alleviate the demand that many children’s charities are facing.

The OBR has largely revised its forecasts from March for the worse, though the higher-than-expected GDP growth this year is something the Chancellor will hope to repeat. Further details on the Office for Budget Responsibility Economic and Fiscal outlook, and all relevant measures from the Budget are below:

OBR forecast and economic data

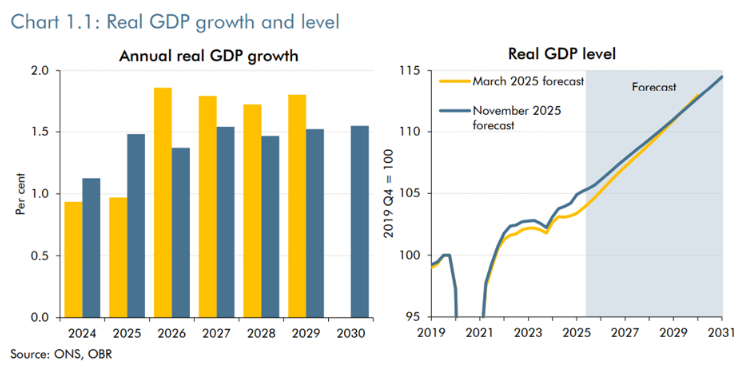

Real GDP growth and level

A point the Chancellor raised at the dispatch box was that the OBR now forecasts real GDP growth to be 0.5% higher than in its March predictions, bringing it to 1.5%. However, longer-term growth has been revised, with the current 1.5% expected to remain steady over the forecast period.

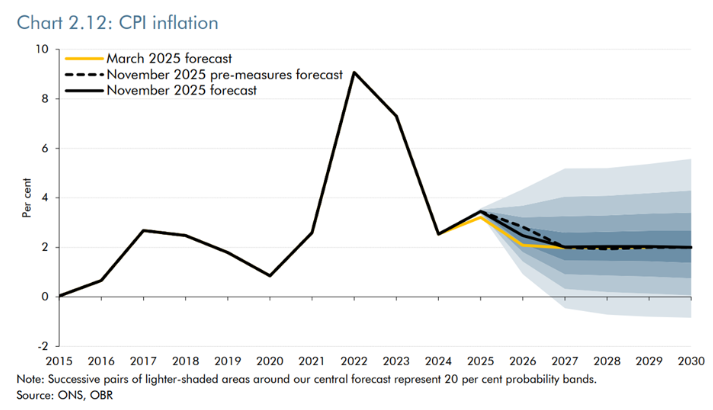

CPI Inflation

Inflation is forecasted to remain at around 3.5% for Q4 2025, before falling to 2.5% in 2026. This is 0.4% higher than the OBR’s estimates in March. This discrepancy has been attributed to higher services and food prices. There remain concerns moving forward around the unpredictability of inflation due to rising wage growth, and “ongoing geopolitical developments” that could lead to volatility in energy markets and international trade.

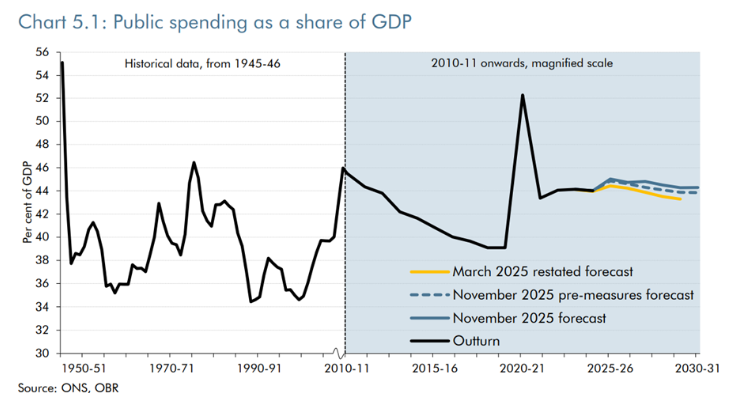

Public spending as a share of GDP

Public spending is forecast to rise to 45% of GDP over the next quarter before gradually declining to 44.3% by 2030–31.

Departmental expenditure limits are expected to rise as a share of GDP from 20.5% of GDP in 2024-25 to 21.2% of GDP in 2027-28 and then fall to 20.6% of GDP in 2030-31.

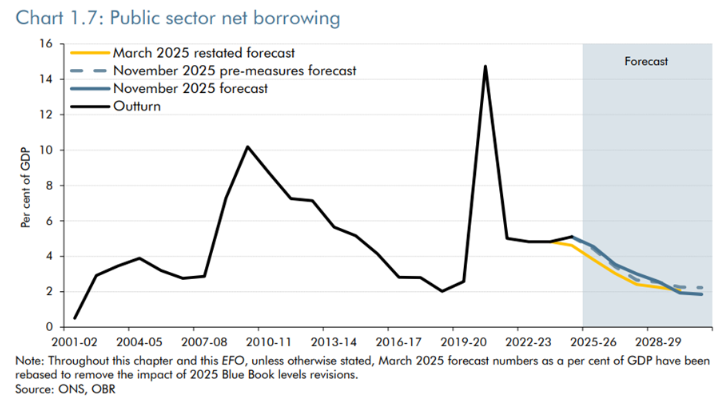

Public sector net borrowing

Borrowing as a share of GDP is projected to fall from 5.1% last year, to 4.5% this year, and then decline to 1.9% of GDP in 2030-31.

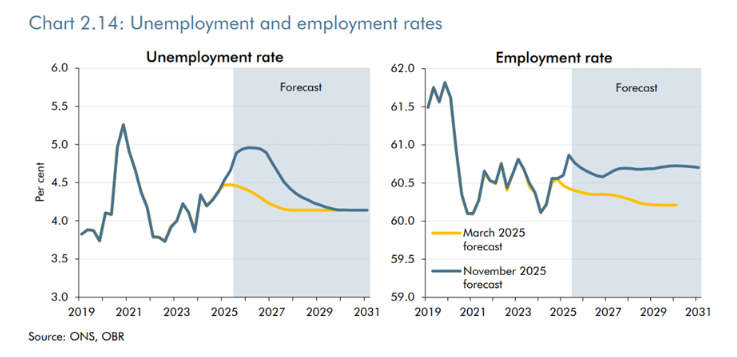

Unemployment and employment rate

Again, the unemployment rate sits significantly above previous March 2025 predictions: explained by the struggle for new entrants into the labour market to find work. The current rate, of near 5%, is expected to be the peak, with a gradual fall to the “equilibrium rate of 4.1%” from 2027. The rate of job losses has only picked up modestly, consistent with the claimant count and redundancies.

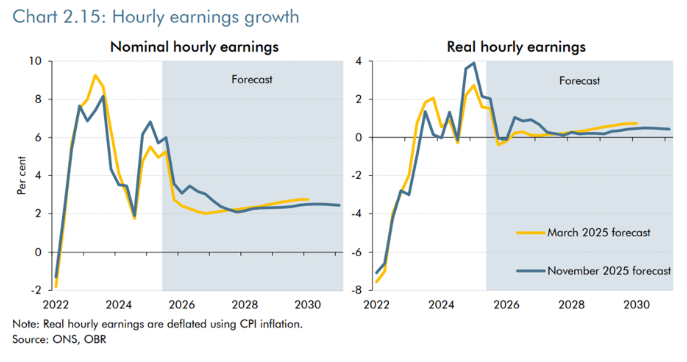

Nominal and real earnings growth

The OBR estimates nominal weekly earnings growth will hold at around 5% in 2025, before falling to 3.3% in 2026. These figures are both around 1% higher than expected in March. The 2025 change reflects upward revisions to earnings growth at the end of 2024 and slightly stronger-than-expected growth at the start of 2025

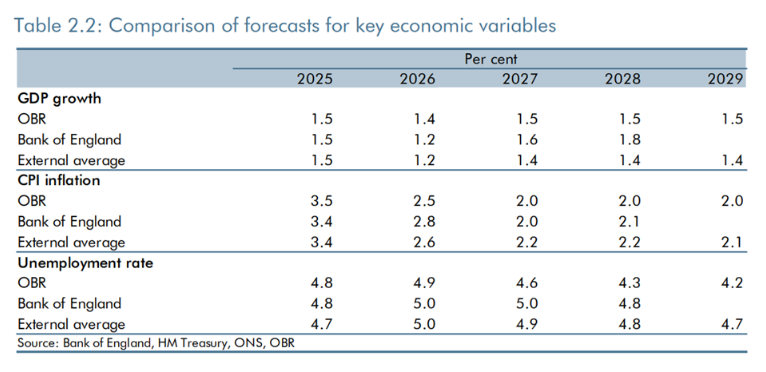

Comparison of forecasts for key economic variables

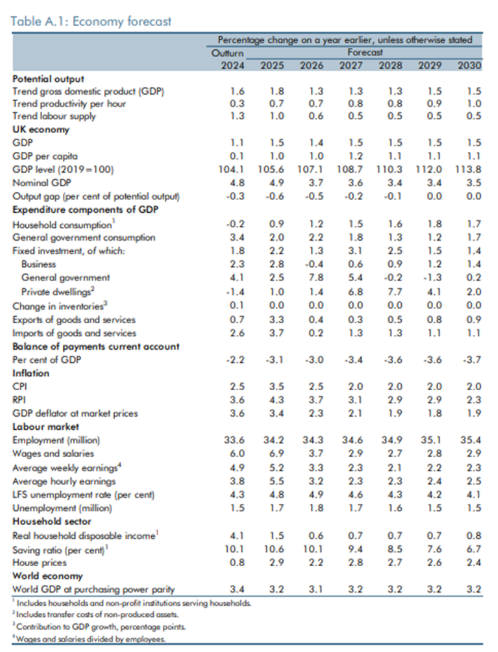

Economy forecast

Sector 'asks' ahead of the Budget

Ahead of the budget, the Civil Society Group wrote to the Chancellor to consider a number of measures that could be implemented to help support the charity sector. These included:

- Improving collaboration and funding for local government: The VCSE sector delivers more than £14 billion worth of public services and faces growing pressure to do more with fewer resources. To address this, civil society must be recognised and valued as an equal, strategic partner.

- Introducing measures to encourage philanthropy: The UK’s philanthropic potential remains largely untapped and could be unlocked through stronger leadership.

- Modernising tax and fiscal incentives to promote giving and donations: Many charity tax and relief thresholds have remained unchanged for years, losing value due to inflation and creating unnecessary barriers to giving. Updating these limits and introducing appropriate reliefs would strengthen charities’ ability to raise funds.

- Reducing the digital divide between VCSE and other sectors: Smaller charities are at risk of being left behind digitally due to a lack of funding and skills. Introducing a new fund to address the digital deficit would result in a more efficient and resilient civil society.

- Enabling Safe, Proportionate AI Adoption in UK Charities: AI has the potential to transform service delivery across both the charity sector and the wider economy. To ensure its benefits reach as many people as possible, charities need targeted support to adopt AI safely, proportionately, and at pace.

Several of the proposals CFG put forward were included in the Budget, including the removal of VAT on donated goods and charity services which CFG and others in the business community have lobbied on for some time.

However, many were not. We will continue to work with the government to push for those changes that will improve the financial position of the charity sector outside of the budgetary process.

Budget

National Wage and National Minimum Wage

From 1 April 2026, the National Living Wage will increase by 4.1% to £12.71 per hour.

The National Minimum Wage for 18-20 year olds will also increase by 8.5% to £10.85 per hour for 16-17 year olds and apprentices by 6.0% to £8.00 per hour.

The accommodation offset will increase by 4.1% to £11.10 per day.

Labour markets

Youth Guarantee and Growth and Skills Levy – The government is making available more than £1.5 billion for additional employment and skills support, and the Growth and Skills Levy, over the spending review period. This will ensure young people have access to high-quality training opportunities and the support they need to earn or learn, alongside measures to simplify the apprenticeship system and make it more efficient. Further details will be announced shortly.

Youth Guarantee: Jobs Guarantee scheme – The government will guarantee a six-month paid work placement for every eligible 18-21 year old who has been on Universal Credit and looking for work for 18 months. This will cover 100% of employment costs for 25 hours a week at the relevant minimum wage, and additional wraparound support.

Welfare

Universal Credit: Removing the two-child limit – The two-child limit in the Universal Credit Child Element will be removed from April 2026.

The red book makes the further point that this will lift 450,000 children out of poverty and goes on to say that “Lifting the two-child limit is the quickest and most cost-effective way to reduce child poverty over this Parliament.” This is perhaps the single biggest measure announced in the budget to reduce charity demand, and many charities that tackle child poverty have welcomed this announcement.

Housing Benefit: Reducing the financial cliff edge for claimants in supported housing and temporary accommodation from Autumn 2026 – To improve work incentives, the government is adjusting how earnings are treated for Housing Benefit and Universal Credit claimants in supported housing and temporary accommodation, so that most claimants will not be subject to reductions in income for working more hours.

Universal Credit: Extend the £2,500 surplus earnings threshold for one year from April 2026 – The government will maintain the surplus earnings threshold at £2,500 for Universal Credit claimants for a further year until April 2027.

Operational improvements to health and disability assessments – The government is increasing Work Capability Assessment (WCA) reassessment capacity, extending Personal Independence Payment award reviews periods and increasing face-to-face health assessments.

Pathways to Work employment support – Under the Pathways to Work Guarantee, anyone claiming out-of-work benefits who is disabled or has a health condition will have access to 1,000 specialist advisers and tailored support, including an expanded Connect to Work programme in England and Wales.

Motability Scheme: Reforming tax reliefs – From July 2026, vehicles leased through the Motability Scheme, or through any equivalent qualifying schemes, will be subject to 20% VAT on top-up payments which are made in addition to the transfer of eligible welfare payments for more expensive vehicles on the scheme. Insurance Premium Tax will also be applied at the standard rate of 12% for insurance related to vehicles leased through the scheme. Tax changes will not apply to vehicles designed for, or substantially and permanently adapted for, wheelchair or stretcher users.

Universal Credit: Increasing the maximum amount for childcare costs – The maximum amount that can be reimbursed for childcare costs for eligible Universal Credit claimants will increase by £736.06 for each additional child above the current maximum cap for two children.

Winter Fuel Payments – The £35,000 threshold will be maintained for this Parliament.

Pensions

Salary sacrifice for pension contributions – The government will charge employer and employee NICs on pension contributions above £2,000 per annum made via salary sacrifice. These changes will be legislated for through primary and secondary legislation which will be introduced in due course. This will take effect from 6 April 2029.

As was widely trailed, the government has decided that salary-sacrificed pension contributions above £2,000 per employee per year lose their NICs exemption. However, it was not known when this would take hold. With the announcement that it will take effect from April 2029 onwards, there is plenty of time for charity employers to make adjustments due to this change.

The OBR estimates that this will raise £4.7bn by 2029-30, assuming that employers pass around 76% of the extra costs to employees, half via lower employer pension contributions and half via lower salaries/bonuses – and notes that more aggressive wage-cutting behaviour is constrained by OpRA rules and employment law.

Nonetheless, based on a snapshot survey of CFG members conducted in November 2025, CFG concludes these changes could affect a significant number of charities, with preliminary results pointing to many mid to large sized charities offering salary sacrifice on pensions for employees, and there being noticeable additional costs for many due to these changes.

A single large charity surveyed (270 employees) could see an additional NIC cost of £65,000 per year. Another mid-sized charity commented: "We might withdraw salary sacrifice arrangements if reduced tax advantages meant the administrative burden outweighed the appeal to employees".

We will look to gather further evidence from charities on how this change might affect them.

Official Development Assistance (ODA)

Official Development Assistance (ODA) update – The government remains committed to restoring ODA spending to 0.7% of Gross National Income (GNI) as soon as the fiscal circumstances allow. The OBR’s latest forecast shows that the ODA fiscal tests are not due to be met within the Parliament. The government will continue to monitor future forecasts closely and, each year, will review and confirm, in accordance with the International Development (Official Development Assistance Target) Act 2015, whether a return to spending 0.7% of GNI on ODA is possible against the latest fiscal forecast.

It is disappointing to see that the government remains committed to cutting ODA to 0.3% of GNI which will have a deleterious impact on the ability of aid organisations to tackle humanitarian crises. We hope that government restores the aid budget back to 0.7% of GNI to tackle global poverty and crises at source and rebuilding the UK’s credibility as a reliable development partner.

Tax thresholds

Income tax Personal Allowance and higher rate thresholds – The government is maintaining the income tax Personal Allowance at £12,570 and higher rate threshold at £50,270 from April 2028 to April 2031. The additional rate threshold remains at £125,140 from April 2028 to April 2031. The Personal Allowance threshold applies UK-wide. The higher rate threshold for non-savings, dividend and property income and for property income will apply to taxpayers in England, Wales and Northern Ireland, and for savings and dividend income it will apply UK-wide. This will be legislated for in Finance Bill 2025-26.

Inheritance tax thresholds – The inheritance tax nil-rate bands are already set at current levels until April 2030 and will stay fixed at these levels for a further year until April 2031. The forthcoming combined allowance for the 100% rate of agricultural property relief and business property relief will also be fixed at £1 million for a further year until 5 April 2031. This will be legislated for in Finance Bill 2025-26 and take effect from 6 April 2030.

National Insurance contributions thresholds for employees and the self-employed – The government is maintaining the NICs Primary Threshold (PT) and Lower Profits Limit (LPL) at £12,570 from April 2028 until April 2031. The NICs Upper Earnings Limit (UEL) and Upper Profits Limit (UPL) will be maintained at £50,270 from April 2028 to April 2031, as well as other employer NICs relief thresholds aligned with the UEL. The government will legislate for this measure in affirmative secondary legislation in early 2028.

Employer National Insurance contributions – secondary threshold – The government is maintaining the per-employee threshold at which employers become liable to pay National Insurance (the Secondary Threshold) at £5,000 from April 2028 until April 2031. The government will legislate for this measure in affirmative secondary legislation in early 2028.

As mentioned in our introduction, the main income and National Insurance Tax thresholds will be frozen until 2030. Leading to more people and employers being captured by these tax rates

Tax

Charity Tax Relief – A new VAT relief will be introduced from 1 April 2026 for business donations of goods to charity for distribution to those in need or use in the delivery of their charitable services.

The relief will apply to goods donated to charities registered with HMRC for tax purposes and, where required, with the appropriate charity regulator. This approach has been adopted to maintain consistency with existing charity tax rules and reserve these benefits for organisations with wholly charitable aims and structures. Charitable incorporated organisations will be in scope of the relief on the same basis.

The relief will operate with per-item value limits. There will be a £100 per-item value limit, with a higher £200 limit for a set list of essential goods usually valued over the £100 limit, including white goods, furniture, carpets, computers, phones and tablets, which play an important role in tackling hardship and digital poverty. Based on stakeholder responses to our consultation, we’re confident this will capture the vast majority of donations. Excise goods such as alcohol and tobacco will not be eligible for the relief. For valuation, businesses will be able to use either the original cost price or the item’s value at the point of donation, with appropriate adjustments for age or condition. This provides a clear, workable approach that accommodates different stock types and operating models.

The relief will be legislated for in the Finance Bill 2025 and will take effect from 1 April 2026. HMRC will publish detailed guidance ahead of implementation to support businesses and charities in preparing for and making full use of the new measure.

The biggest positive announcement that directly affects charities is the introduction of this VAT relief. CFG has long campaigned on this issue alongside Business lobby group and other charity infrastructure bodies.

Charity compliance – The government will introduce legislation to strengthen the charity tax rules on tainted donations, approved investments and non-charitable expenditure. These changes will be legislated for in Finance Bill 2025-26 and will take effect from 6 April 2026.

HMRC first consulted on these proposed changes over 2 years ago and since then we have worked with HMRC officials to try to avoid any unintended consequences of these changes. We will continue to work with officials on the accompanying guidance so that it does not accidently create disincentives for charitable giving. Further infomation from HMRC on these changes can be found here- Legislation to introduce changes to charity tax rules - GOV.UK

Tax Update event – The government will announce further changes to simplify and improve tax and customs administration at a Tax Update in early 2026.

Making Tax Digital (MTD) administrative changes – The government will introduce new powers from 1 April 2026 to ensure MTD and the new penalty reform legislation works as intended. This will be legislated for in Finance Bill 2025-26.

Business rates

Business rates – From 1 April 2026, business rates bills in England will be updated to reflect changes in property values since the last revaluation in 2023. As a result of the revaluation, the small business multiplier will decrease from 49.9p in 2025-26 to 43.2p in 2026-27, and the standard multiplier will decrease from 55.5p to 48p.

A package worth £4.3 billion over the next three years will support businesses as they transition to their new bills. The government will also introduce new permanently lower retail, hospitality and leisure multipliers, to deliver the manifesto commitment to rebalance the business rates system and support the high street. English local authorities will be fully compensated for the loss of income as a result of these business rates measures and will receive new burdens funding for administrative and IT costs.

Business rates Transitional Relief – To support ratepayers facing large bill increases at the revaluation the government is introducing a redesigned Transitional Relief scheme worth £3.2 billion over the next three years, providing more generous support for those paying higher tax rates. The Transitional Relief caps will be as follows for properties with a rateable value of:

Up to £20,000 (£28,000 in London): in 2026-27 – 5%, in 2027-28 – 10% (plus inflation), in 2028-29 – 25% (plus inflation).

£20,001 (£28,001 in London) to £100,000: in 2026-27 – 15%, in 2027-28 – 25% (plus inflation), in 2028-29 – 40% (plus inflation).

Over £100,000: in 2026-27 – 30%, in 2027-28 – 25% (plus inflation), in 2028-29 – 25% (plus inflation).

Note: These caps are applied before changes in other reliefs and local supplements.

Business rates Transitional Relief Supplement – The government is introducing a 1p supplement to the relevant tax rate for ratepayers who do not receive Transitional Relief or the Supporting Small Business scheme to partially fund Transitional Relief. This will apply for one year from 1 April 2026.

Business rates 2026 Supporting Small Business scheme – Bill increases for the smallest businesses losing some or all of their small business rates relief or rural rate relief will be capped at the higher of £800 or the relevant transitional relief caps from 1 April 2026. Note, support is applied before changes in other reliefs and local supplements.

Business rates 2026 Supporting Small Business scheme – The government has expanded the 2026 Supporting Small Business scheme to ratepayers losing their retail, hospitality and leisure (RHL) relief. This will apply for three years from 1 April 2026, giving additional support worth £1.3 billion to those losing RHL relief. Note, support is applied before changes in other reliefs and local supplements.

** Business rates 2023 Supporting Small Business Scheme** – The government is introducing a one-year extension of the 2023 Supporting Small Business scheme in 2026-27. This support will protect the smallest businesses from overnight bill increases. Note, support is applied before changes in other reliefs and local supplements.

Call for Evidence: Business rates and investment – The government is publishing a Call for Evidence at Budget on the role business rates play in investment. It also seeks feedback on the impact of the Receipts and Expenditure valuation method on investment.

Business rates retail, hospitality and leisure multipliers – From 1 April 2026, the government is introducing two permanently lower business rates multipliers for eligible RHL properties with rateable values below £500,000. These rates will be 5p lower than the national multipliers , making the small business RHL multiplier 38.2p in 2026-27 and the standard RHL multiplier 43p in 2026-27.

While charities get mandatory rate relief of 80% and 20 discretionary relief, rateable values can still feed into bills for organisations that use Retail, Hospitality and Leisure relief and shops and cafes run by charity trading subsidiaries.

CFG’s view

"Today's budget announcement from Chancellor Rachel Reeves was a real mixed bag," commented Sarah Lomax, Co-CEO, CFG. "We are thankful that, unlike last year's budget, no major burdens were placed on charities. However, there was little to ease the concerns around the financial sustainability of the sector..."

Read the full news story

“The Chancellor's increase in the National Living Wage and National Minimum Wage will be welcomed by many workers, and we recognise the government's commitment to making work pay," comments Richard Sagar, Head of Policy. "This represents genuinely positive news for millions of people across the country.

“However, for many charitable organisations, this increase – which significantly exceeds current inflation rates and average earnings – comes at a particularly challenging time..."

Read the full news story

Reactions from CFG's corporate partners

Comment from LCP:

It’s a big Budget for pensions – the key points from a pensions perspective are:

- Potential easement on paying surplus to members

- Changes to proposed inheritance tax regime could delay payments to beneficiaries (and a scheme’s wind-up after April 2027) by 15 months.

- Salary sacrifice NI benefit capped on first £2,000 of pension contributions from 2029

Paying surplus to members

Pension schemes in surplus will be able to pay surplus direct to members who are over normal minimum pension age (currently normally 55) from April 2027 where scheme rules and trustees permit it.

Inheritance tax

What the OBR did not cover, but is buried in the Budget documents, are changes to the proposed application of inheritance tax to unused pensions from April 2027. These are likely to be welcomed by those administering an estate where IHT is due, but could add 15 months to the time it takes to settle death benefits from a pension scheme. If no workaround is introduced, it could also block the wind-up of a pension scheme for 15 months if a member dies just before a scheme moves from buy-in to buy-out.

Salary sacrifice

As widely expected, the revenue raising measures included a cap on the National Insurance (NI) exemption for pensions salary sacrifice arrangements equivalent to £2,000 of contributions per year. The key bit of good news is that the introduction has been postponed to April 2029, giving a lot more time to prepare and three years before costs increase.

When the £2,000 cap comes in it will be a significant change, which will increase NI costs for both employers and employees. There were also some other pensions measures mentioned:

- Indexation of PPF compensation in respect of pre-1997 benefits of CPI (max 2.5%) where the original scheme provided indexation on such benefits.

- Registration process for collective money purchase schemes with unconnected employers

- No longer possible to make voluntary NI contributions to benefit from a higher State pension for time spent abroad

Sarah Osato, Investment Manager, Quilter Cheviot, says:

The latest budget has ushered in a 4.1% hike to the national living wage, well above the current and forecasted inflation rate, whilst Chancellor Rachel Reeves has pushed through a striking 8.5% boost for workers aged 18 to 20. For many charities already operating on a shoestring, this means potentially hundreds of extra pounds per employee.

The knock-on effect is huge, where some charities may be forced to tighten their belts even further, considering redundancies, pausing recruitment, or cutting staff hours. With resources stretched thin, organisations could be compelled to pare back services, shelve vital projects, or even sell off endowments to keep the lights on. These are moves that threaten both todays and tomorrow’s beneficiaries.

Meanwhile, Employer National Insurance Contributions (NICs) are frozen at £5,000 until April 2031, offering no respite to the sector in spite of persistent lobbying.

The government’s decision to extend the freeze on income tax thresholds for another three years also means a stealthy tax hike for all. Take-home pay is set to shrink, and with less money in their pockets, many donors, especially those in the squeezed middle, may think twice before giving. While Gift Aid claims could inch up, any gains are likely to be wiped out by reduced disposable income. We anticipate that this will have additional effects on the cost of living and increase the nation's reliance on the charitable and voluntary sectors.

There’s a silver lining: from 1 April 2026, a new VAT relief will kick in for businesses donating goods to charity, either for redistribution to those in need or to support charitable work. This move could spark a welcome surge in in-kind corporate giving.

But the budget contained no direct funding boost for the voluntary sector. Some local government funding may trickle down to charities with council contracts, but overall, the sector remains under the cosh.

With demand for the voluntary sectors services still soaring, fuelled by previous funding cuts that have plunged more people into poverty, charities are unfortunately still facing the perfect storm: rising costs, greater demand, and not enough support to close the gap.

Ross Palmer, Tax Director, Sayer Vincent, comments:

Putting aside the premature leaking of many of the budget measures, this was a budget without too many surprises. Many charities will be wary of the increase to the National Living Wage from April 2026 which could result in a further cost pressure on already stretched budgets. The changes to National Insurance for salary sacrifice arrangements will result in some cost increases, although this change only applies from 2029, giving more time for organisations to plan for this.

Specifically for charities, the government have confirmed their intention to extend the zero-rate relief on goods donated by companies to those used by charities in their activities or distributed to beneficiaries. Hopefully, this will encourage more organisations to donate excess goods to charities where they can be put to charitable use, with the suggested compliance measures appearing relatively proportional and in line with sector recommendations. Organisations with premises may also benefit from some of the proposed changes to business rates - particularly retail, hospitality and leisure with lower multipliers expected to reduce bills.

Otherwise the budget represents another missed opportunity for the Government to simplify many of the tax rules and requirements that charities face, such as Gift Aid and charity VAT reliefs. For now we will have to hope that the promised ‘Tax Update Event’ in early 2026 may provide some further clarity.

Michael Samuel-Bryan, VAT Assistant Manager, MHA, comments:

Direct tax

There were minimal direct tax announcements directly affecting charities, however the government are introducing legislation to strengthen tax rules on tainted donations, approved investments and non-charitable expenditure. This is not new however, merely confirming announcements already made following an earlier consultation.

It was announced that the penalties for late filing of corporation tax returns is doubling from April 2026. Previously this was £100 for returns filed up to three month's late and £200 if the return is filed three to six months late. Because many charities aren’t required to submit a corporation tax return each year, some miss the HMRC notice requiring a return for particular years, only noticing when the return is already late. This measure will increase the cost of this for affected charities.

Prior to the budget it was announced that the minimum wage is increasing from April 2026. With the increases for different age brackets all significantly above inflation, this will be welcome news for employees, but for charities employing significant amounts of people this will increase their salary costs, on top of significant increases already in the last 12 months due to changes to National Insurance and the minimum wage increase in April 2025.

Also announced in the budget were changes to limit the national insurance savings where employee’s salary sacrifice their pension contributions to the first £2,000 salary sacrificed. These are only due to come in from 2029 onwards, and the exact effect will be dependent on how employers administer the salary sacrifice arrangements, but it will likely involve a combination of increased cost to employers, reduced take-home pay for employees and possibly reduced contributions into employees pension schemes if employers previously contributed some of their own employers NIC savings to their employee’s pensions

Indirect tax

(Donated goods to charities VAT relief)

This is a welcome policy change which has been called for by many businesses and charities for some time, encouraging surplus items to be put to good use by charities rather than going to waste. This provides both administrative relief to businesses who no longer are required to account for VAT on the donation of eligible goods, and a boost to charities who are expected to benefit from an increase in donations.

With effect from 1 April 2026 legislation will introduce an exception to the deemed supply rules for business goods donated free of charge to charities. Historically, VAT would have been due on the donation of goods free or charge, however this policy will introduce zero rating for eligible goods donation for onward distribution to people in need, or for use in the charity’s services.

This both removes the output VAT burden for the business and protects the input VAT recovered when the business originally purchased the goods.

Key points:

- Relief will apply to goods within a defined per-item value limit (to be set in legislation).

- There will be higher threshold for specified goods such as technology and household appliances.

- Eligible donations must be made to registered charities.

- Certain goods subject to excise duty will be excluded from the relief.

- Legislation will include futureproofing powers to uplift the value limits and amend the list of goods eligible for the higher threshold.

- They expect the relief to save approximately £10m of VAT annually for businesses.

- There are currently no plans to monitor or evaluate compliance with the policy however this may be considered once data has been analysed and collected.

Sarah Garnish, Consultant, Quantum Advisory, comments:

Following much speculation ahead of the Autumn Budget, the Chancellor has confirmed National Insurance will be charged on salary sacrifice pension contributions above £2,000 to both employees and their employer from April 2029. The government expects this change to raise £4bn - £5bn.

The exact impact will vary depending on how employers respond to the change. Implementation is expected to result in higher payroll costs for employers, lower take-home pay for employees and depending on how the salary sacrifice scheme is set up, less pension contributions being paid into employees’ pension schemes.

For example, an employee earning £40k per annum contributing 10% may see their take home pay fall by £160 per annum due to paying more in National Insurance. Similarly, the employer would need to pay £300 more in National Insurance for this one employee.

The introduction of the new limit accompanied by the news of the minimum wage increase will add additional pressure to employers, especially following the rise in employer national insurance / decrease in the national insurance threshold earlier this year. Employers are likely to look at ways of recuperating these extra costs, which could result in a reduction in employer pension contributions, less spend on non-pension employee benefits and lower future salary growth for employees.

Over the past couple of years, we have seen the Government make a conscious effort to improve the UK’s pension system. The Pensions Bill will introduce a new framework to improve pension scheme value and outcomes for members, while the Pensions Commission has been reformed, to address the ever-increasing concerns that future retirees are on track to have lower retirement incomes.

The limit on salary sacrifice contributions, in isolation, will for many employees make it less likely for them to contribute more to their pension and could potentially lead them to reduce what they contribute. All of this is very counterproductive to the aims of the government where they are looking to improve retirement outcomes for individuals.

I would encourage employers to consider the impact of the change on their pension scheme and ensure that the impact on their employees is carefully communicated. The current structure of each employer’s pension scheme should be reviewed and I’d recommend alternative options which may help reduce the impact on employers and employees alike are explored. For example, it might be possible to restructure the pension scheme to make it non-contributory for employees – albeit the complications of this would need to be fully investigated.

The only silver lining is that these changes won’t come into effect until April 2029. This gives us time to explore creative solutions and possibly work towards having the proposed change stopped.

Katherine Robinson, Senior Tax Manager, BHP, comments:

Despite the leaking of the OBR report prior to the budget speech, there was little within the actual speech to alleviate the perfect storm that charities are currently facing – increased demand for services, less funding and increase in costs.

In particular the 4.1% increase in National Living Wage to £12.71 and an 8.5% increase in National Minimum Wage to £10.85, both of which will come in April 2026 puts real pressure on charities to deliver and meet its objectives and may force them to cut staffing levels and rely on volunteer support.

Alongside this, the Chancellor has announced VAT relief on goods donated to charities from businesses. This in theory will support charitable giving and support the good work charities do, but the conditions and administration surrounding this relief may actually discourage giving.

More longer term, from 1 April 2029, there’ll be a £2,000 NIC fee cap on contributions to pension salary sacrifice schemes before employer and employee NICs need to be applied. This will need factoring into charity's cashflow forecasts.