As small charities face rising pressure, is regulatory reform a lifeline, or a risk to trust and accountability?

Small charities—those with annual incomes under £1 million—form the backbone of community support across the UK. Yet, over the past decade, these organisations have come under mounting strain: public funding has declined, demand for services has grown, and support for financial management has steadily eroded.

The closure of the Small Charities Coalition in 2022 and recent regulatory inquiries—such as those into the Captain Tom Foundation and Community Accountancy Self Help (CASH)—have highlighted vulnerabilities in financial oversight, particularly as more small charities report financial difficulties and struggle to recruit trustees with the necessary skills.

The number of smaller charities on the register has contracted, reflecting operational and financial pressures that threaten the sector’s resilience. These challenges are especially acute for small charities working internationally, where governance risks and regulatory complexity amplify exposure to financial mismanagement.

The 2026 SORP Consultation: A critical opportunity

Amid these pressures, the 2026 Charity SORP consultation presents a pivotal moment for reform. The proposed “Think Small First” approach aims to make financial reporting more proportionate for small charities. However, a key question remains:

Can we make reporting more proportionate without sacrificing transparency or trust?

A key limitation of the draft proposals is that they rely solely on income to determine tiering. This approach—while administratively simple—fails to capture operational complexity, regulatory risk, or governance structures. A volunteer-led charity with £27k income faces vastly different challenges than one approaching £500k, yet both fall under Tier 1. Such blunt categorisation risks overburdening smaller charities, many of whom lack paid staff and administrative capacity.

Rethinking tiering: income vs risk

A central issue in the consultation is the structure of the reporting tiers. There are two major proposals the sector should consider:

Adjusting tier 2 thresholds

Lowering the current threshold from £500,000 to £250,000 would:

- Reflect the point at which financial complexity increases

- Align better with where professional oversight (e.g. independent examination by qualified accountants) is typically expected

- Encourage earlier adoption of robust systems

Tiering based on operational scope

An alternative approach would differentiate based on where a charity operates:

- International charities—due to cross-border financial, legal, and governance risks—would warrant enhanced reporting

- Domestic-only charities could benefit from more streamlined requirements

More holistically, the SORP could adopt a multi-dimensional framework—similar to models used by ICNPO or IFR4NPO—factoring in public accountability, cross-border activities, or complexity of funding. Income alone is insufficient as a proxy for reporting burden.

Either approach would allow for more targeted exemptions—like using FRS 102 Section 1A for genuinely low-risk, low-capacity organisations—while still promoting transparency where it matters most.

Why this reform matters to small charities

Key recent developments underscore the urgency of reform:

- Diminishing infrastructure support and an overall reduction in available services have left many small charities navigating financial management with limited guidance.

- Recent Charity Commission inquiries show that financial issues are a significant factor in triggering statutory investigations.

- Rising costs and falling donations continue to force small charities to scale back services or close altogether.

- Post-COVID hybrid working practices have introduced new challenges in financial oversight, trustee engagement, and internal controls—making clear, practical reporting guidance even more essential.

- Despite 53% of charities reporting income below £50k, these micro-charities face new narrative burdens under Tier 1—including impact reporting, volunteer disclosures, and encouraged sustainability commentary—while other FRS 102-reporting entities of similar size face no comparable narrative requirements.

Clear, fair, and proportionate reporting is vital to sustaining trust in the charity sector—and supporting its long-term resilience.

A call for a micro-entity tier

To better reflect the realities of small charity operations, the SORP Committee should consider introducing a fourth 'micro-entity' tier for charities under £50,000 in income. This would allow the smallest organisations—often fully volunteer-run—to remain compliant without disproportionately high narrative expectations. Alternatively, a more flexible, risk-based model could better reflect both complexity and public accountability.

Have your say

As we approach Small Charity Week in June, small organisations have a unique opportunity to help shape a regulatory framework that works for them.

Now is the time for small charities to make their voices heard and ensure the next SORP truly supports a resilient, transparent, and trusted sector.

Please focus your feedback on:

- Section 1 – Tiering (Questions 1–5)

- Section 9 – Smaller charities (Questions 40–41)

- Section 5 – Lease accounting (Questions 25–29) if your charity has or plans to have leases

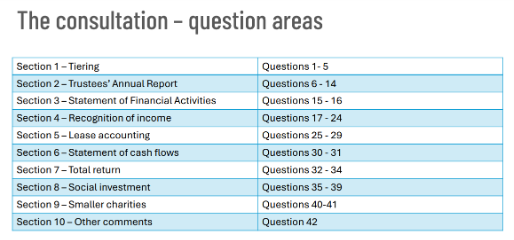

Summary of consultation areas

To help you navigate the consultation, here is a breakdown of the question areas included:

Deadline for completion of this Invitation to Comment: Midday, Friday 20th June 2025

Have your say by commenting on the consultation

The views expressed in this article are solely those of the author, and do not necessarily reflect the views of CFG