CFG's corporate partners and Richard Sagar, Head of Policy, take a closer look at the Chancellor's Spring Statement, considering what it means for charities and those they serve.

To say that the background to this year’s Spring Statement is difficult is something of an understatement.

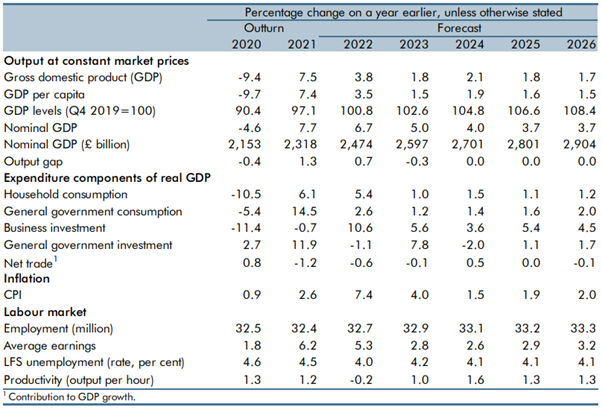

Inflation hit 6.2% in February (and this doesn’t take into account the Russian invasion of Ukraine and the increase to the energy price cap in April) and the Office for Budget Responsibility (OBR) is expecting it to increase further to 7.4% for the year.

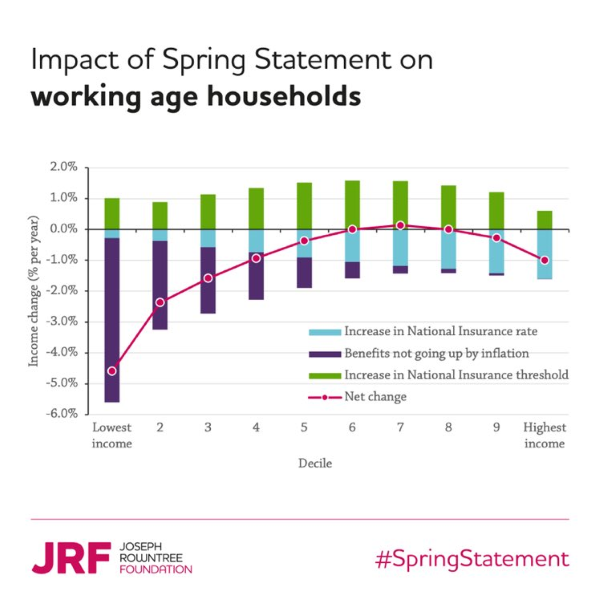

Combined with an impending 1.25 percentage point increase to NICs from April, and a real-terms cut to benefits (increasing by only 3.1%, which is well below inflation) charities and the beneficiaries they serve face a cost of living crisis not seen for many years.

The OBR stated in its forecast ‘the rise in inflation to a 40-year high this year is expected to reduce real household disposable incomes (RHDI) on a per-person basis by 2.2 per cent in 2022-23 the biggest fall in living standards in any single financial year since ONS records began in 1956-57.’

This could be devastating to those on the very lowest incomes in our society, and correspondingly the charities and social organisations that support them.

With this in mind, we expected the Chancellor to unveil a set of measures which matched the challenge faced by those who need support the most. Suffice to say he did not.

Policy announcements

Several policy announcements were made which attempted to alleviate cost of living pressures. Those of particular relevance to our sector included:

NICs Threshold

National Insurance thresholds will increase from £9,880 to £12,570 from July 2022. Around 70% of NICs payers will pay less, which will offset and soften the blow of the introduction of the Health and Social Care levy. While of some benefit to those on low incomes, it will primarily benefit middle and higher earners with roughly two-thirds of the benefits going to the richest 50%.

There are additional changes to class 2 NICs payments for low earners so that from April, self-employed individuals with profits between the Small Profits Threshold and Lower Profits Limit will not pay class 2 NICs.

Income Tax

The Basic Rate of income tax will be reduced to 19% from April 2024. There were concerns about how this might affect Gift Aid, but there was a helpful addition to the budget documents which stated that a three-year transition period for Gift Aid relief will apply, to maintain the income tax basic rate relief at 20% until April 2027.

Employment allowance Increase

From April 2022 the employment allowance will increase from £4000 to £5000 per year. This modest increase will save eligible charities at most £1,000 and is welcome, but for the vast majority with even a modest wage bill this won’t offset the increase in NICs payments for employers with the upcoming 1.25% increase. Those charities affected may need to change relevant software to take account of this change.

As Paul Johnson, Director of the IFS has pointed out, it is slightly bizarre for the government to commit to cutting income tax by 1% while at the same time increase NICs by 1.25%, as this will exacerbate the difference between those with unearned income and those with earned income.

Household Support Fund

The Household Support Fund is to receive an additional £500m. Delivered by Local Authorities it will go towards providing some additional support to vulnerable households. However, as with many measures announced, it will provide minor relief.

Levelling Up Fund second round

The government is launching the second round of the Levelling Up Fund and publishes a refreshed prospectus, inviting bids to come forward from all eligible organisations across the UK.

There is very little by way of detail, including nothing further on what will be in the prospectus and on funding. The sooner that this information is published the better.

Tax Plan

Alongside the policy measures already outlined, the Chancellor put forward further measures in his new Tax Plan. While there was very little of direct interest to charities, there was a focus on:

- Reforming business tax reliefs allowing them to claim relief on certain R&D expenditure

- Creating incentives to business to invest in productivity-enhancing assets, and

- A promise to revisit the operation of the Apprenticeship Levy to determine if it could further increase expenditure on the right kind of employee training.

The final bullet will be of interest to many in the sector who have not been able to utilise the Apprenticeship Levy for their charity. We will look forward to further details on this in due course.

What was missing

The biggest single omission from the Spring Statement was any additional support for those in receipt of benefits. Benefits will only increase by 3.1% in the coming financial year and the OBR has forecast it reaching 8.7% in Q4 2022.

People on the very lowest incomes will see a real-terms cut to their incomes at a time where they can ill afford it. This will be devastating to many and will undoubtedly lead to a significant increase to demand for many charitable services, placing additional strain on charity finances.

The Joseph Roundtree Foundation pointed out that by failing to increase benefits, the Chancellor ‘has abandoned many to the threat of destitution.’ JRF's chart above shows how.

Overview of OBR economic forecast

Perhaps the most notable row in this table is CPI inflation which is forecast to be 7.4% this year, falling to 4% in 2023 and 1.5% in 2024.

The labour market is performing relatively well with no fall in employment forecast, but with earnings forecast to increase by less than inflation, this will mean many will be worse off for the next several years.

Comments from CFG partners

Faith Kitchen, customer segment director at Ecclesiastical Insurance

The government has again refused to make charities exempt from paying Insurance Premium Tax (IPT), putting additional financial pressure on them which many can ill afford.

Against the backdrop of the pandemic, a thirty-year high in inflation and a cost-of-living crisis with rising fuel, energy and food costs, charities have constantly stepped up to support those most in need. That demand is likely to continue, particularly for charities working with people in poverty, and budgets are being stretched to breaking point.

If the government made charities exempt from IPT then they could free up funds to help them continue with their vital work, to meet increasing operational costs and to plan for the future.

Rachelle Rowbottom, Tax Partner at BHP

The announcement regarding the reduction in the rate of income tax from 20% to 19% in April 2024 will have a detrimental impact on Gift Aid claimable by charities. However, it is pleasing to see that in line with previous policy, the Government has acknowledged this, and the Spring Statement has confirmed that a three-year transitional period will apply until April 2027. This will mean that Gift Aid will continue to be available at a level equal to the income tax basic rate of 20% for this three-year period.

It is said that this will support almost 70,000 charities and is worth over £300m. Going forwards, charities will need to consider the impact of this on their income streams and make plans to make up the shortfall.

Simon Buchan, Head of VAT, BHP

The introduction of the zero rate on the installation of energy saving materials following Brexit shows what is possible for the right cause. Is this the time to test the Government’s support for the sector and push for a special VAT rate for purchases by charities or a S33 type refund scheme?

Simon Hubbard, senior consultant and actuary, Quantum Advisory

The Government will increase the amount someone can earn before they start paying National Insurance contributions from £9,880 to £12,570 from July 2022. The change will save a typical worker £330 and more than offset the impact of the new 1.25% health and social care levy for many workers that comes into force from April.

“There has been some concern about the new health and social care levy at a time when prices are rising and family budgets are being squeezed. Reduced National Insurance bills will bring some welcome relief and leaves lower earners paying no Income Tax or National Insurance.

“However, this does have a knock-on effect and will mean that salary sacrifice arrangements for pension contributions for those employees who currently earn between £9,880 and around £12,570 will no longer be beneficial to them. Employers who offer these types of arrangements – including charities – should review these arrangements to ensure that employees within these thresholds are not impacted.

David Davidson, Director, Spence and Partners

Given the background environment I’m sure there will be a collective welcome for the Chancellor’s decision to bring the lower NI threshold in line with the lower tax threshold taking a large number of individuals out of NI completely and simplifying the whole tax system in the process.

There are, however, impacts for workers earning less than £12,570 pa, such as part-time workers, many who work for charities.

To qualify for a full state pension one or more of the following needs to apply for at least 30 years:

- you were working and paying National Insurance

- you were getting National Insurance Credits, for example you were unemployed, sick, or a parent or carer

- you were paying voluntary National Insurance contributions

The state pension is a valuable benefit at £137.60 per week and if possible individuals will want to maintain their entitlement.

Some state benefits such as child benefit, universal credit and job seekers allowance automatically provide an NI credit. However, other benefits such as statutory sick pay need to be applied for, so make sure you check this.

You might be able to top up your state pension by paying voluntary National Insurance contributions. Each missing year costs about £800 and is often a good way of boosting retirement income.

Individuals just need to be aware of the negative impact and take suitable action.

Ross Palmer, Senior Tax Manager, Sayer Vincent

National Insurance

The National Insurance Primary Threshold and Lower Profits Limit will increase to £12,570 from July 2022, in order to give sufficient time for payroll software to be updated. However there is no matching increase to the Secondary threshold which relates to employers contributions and therefore many charities will still face the additional cost of the 1.25% National Insurance/Health and Social Care Levy increase from April 2022.

While aligning the income tax and National Insurance thresholds will go some way to helping individuals, there is no corresponding increase to the thresholds for employers. This will leave many charities still impacted by the additional costs of the health and social care levy amid increasing prices and demand for services. – Ross Palmer, Sayer Vincent

Income Tax and Gift Aid

The Government has announced that it will reduce the basic rate of income tax to 19% from April 2024. As Gift Aid is a refund of the basic rate of income tax, this will result in a reduction in the amount of Gift Aid paid from 25p per pound to approximately 23.5p. The Government has included provisions for a three year transitional period which will maintain the current rate of Gift Aid relief until April 2027 which will give charities some more time to plan for the reduction in funding.

While the fall in income tax will reduce the level of Gift Aid that can be claimed, it is good news that the Government has considered the impact on Gift Aid and has implemented a transition period in order to lessen this on charities. The long term impact of this reduction highlights the importance of projects such as ‘The Future of Gift Aid’ led by the Charity Tax Group which aims to unlock much of the Gift Aid that goes unclaimed and would help raise additional funds to offset the reduction caused.

Final words

Summing up, Caron Bradshaw OBE, CEO of CFG, states:

The country faces a catastrophic socioeconomic situation. The triple whammy of a cost-of-living crisis, rising inflation and a drop in real income will be devastating. Sadly, the Chancellor’s Spring Statement has failed to alleviate the very real concerns we all have, as organisations working for the benefit of others and as individuals.

The Chancellor’s policies for tackling the crisis are welcome in as far as they go but he failed to seize the opportunity to go further and avoid deepening inequality. Positive steps include an extra £500m to local authorities through the Household Support Fund and an increase to the National Insurance threshold to £12,570.

But at the very time the Government is rightly working to level up, those on the lowest incomes face a significant cut to their living standards and the rise in inflation is set to outstrip increases in universal credit which was not raised. Many are likely be plunged into poverty in 2022.

As ever, charities and social change organisations will support their communities, but they too face the daunting prospect of another 12 months of juggling increasing demands on services with an increase in operating costs.

If the Chancellor is serious about "capital, people and ideas" then it’s time for a rethink. All sectors must genuinely be included in discussions so that real, long-lasting solutions can be found.