What does the Chancellor's Autumn Statement mean for you and your organisation? Richard Sagar, Head of Policy, CFG, takes an in-depth look.

Overview

It was clear for some time that the OBR forecast would not be good news for the Chancellor and, as expected, it paints a bleak picture of the public finances for the next year.

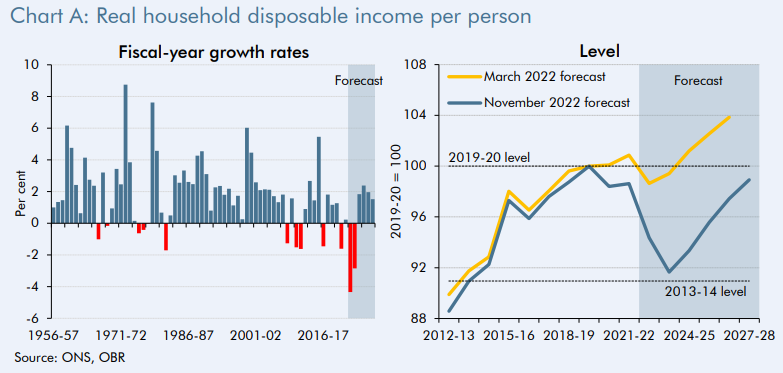

With a 7% fall in household disposable incomes over the next two years, the UK economy is in recession, with GDP falling by 1.4% in 2023 and a rise in unemployment from 3.6% to 4.9% in 2024.

The news on inflation is more positive with it set to peak this year.

The Chancellor has chosen a mix of tax increases and substantial cuts to public spending to create a “balanced path to stability” and “tackle the enemy of inflation”.

It is far too early to tell if the measures announced will achieve their intended aim of reducing inflation.

Many of the measures aim to raise revenue from those on higher incomes. The threshold at which individuals pay the highest rate of tax has been lowered from £150,000 to £125,400 (for which there are implications for Higher Rate Gift Aid spelt out below).

In addition, raising the living wage to £10.42 and continuing to cap energy bills to £3,000 for a typical household after April 2023 is better than entirely removing the cap. However, even with the additional payments to low income households, it will still mean may will see unaffordable increases in energy bills.

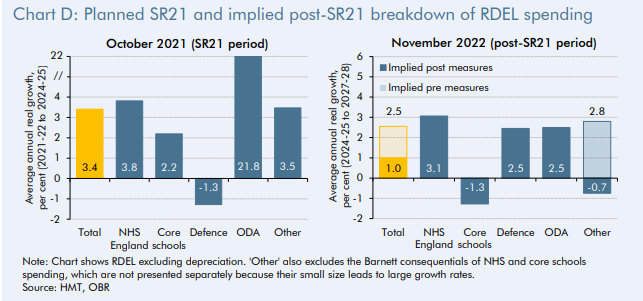

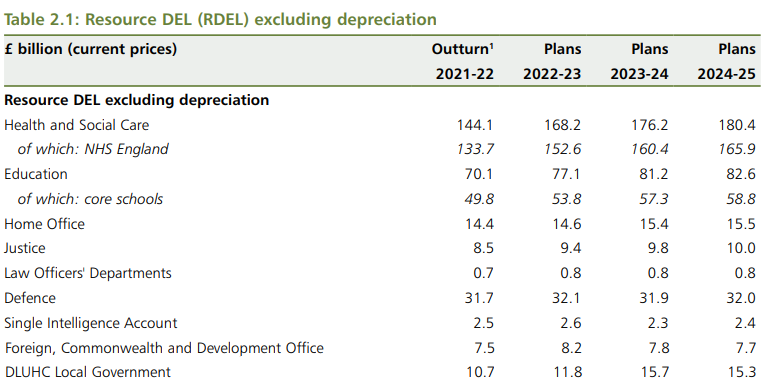

Some government departments are seeing notable budget increases, namely defence, schools, health and social care. But importantly, there will be significant cuts to other departments from 2024-25 onwards.

There will be an average cut of 0.7% for non-ringfenced departments, including the departments that charities and their beneficiaries rely on. Local government and Ministry of Justice have been struggling financially for some time and will continue to do so. And, although local authorities can increase council tax by 5% without referendum, the extra revenue will not offset cuts.

Departmental spending figures show public sector pay increases of only 2%. Will this be acceptable to public sector workers who will not see their pay increase inline with inflation? More strikes could be expected in the coming year.

Sector 'asks' ahead of the autumn statement

In October 2022, CFG and sector partners set out four key asks ahead of the autumn statement.

Uprating benefits in line with inflation

The Chancellor’s commitment to uprate benefits inline with inflation (10.1%) is undoubtedly a positive, and we should pay testament to the brilliant campaign by Joseph Rowntree Foundation (in which CFG played a small part).

Increasing the benefit cap by 10.1% from April 2023 is also very positive for those on the lowest incomes. However, the coming winter will be incredibly difficult for those people.

Thankfully, there were no further cuts to ODI spend, but the Chancellor stated that the principles set out in 2021 for a return to 0.7% GNI have not been met.

Read reaction comments from Caron Bradshaw OBE, CEO of CFG.

Inflation

The OBR has forecast that CPI inflation will be 9.1% for 2022 falling substantially to 7.4% in 2023 to 0.6% in 2024 and becoming negative in 2025 reaching -0.8%.

The forecasts show that inflation will fall under the Bank of England target 2% by 2024. If correct, this means that existing charity donations, grant income and reserves will not continue to fall in value as rapidly as they have done over the past year.

Energy Support

- Review of the Energy Price Guarantee (EPG)

From April 2023, the government will adjust the EPG, which places a limit on the price households pay per unit of gas and electricity. This means that a typical household in Great Britain will pay £3,000 per annum (up from the current £2,500 per annum) from April 2023 to April 2024.

It is positive that support for households will continue beyond April 2023, but this remains a sizeable increase in bills.

- Review of the Energy Bill Relief Scheme (EBRS)

A Treasury-led review of the EBRS will determine support for non-domestic energy consumers, excluding public sector organisations, beyond 31 March 2023. The government has shared the review’s terms of reference, and the findings will be published by 31 December 2022. While the government recognises that some businesses may continue to require support beyond March 2023, the overall scale of support the government is set to offer will be significantly lower, and targeted at those most affected to ensure fiscal sustainability and value for money for the taxpayer.

The new terms of reference for the review of non-domestic consumers is relevant to charities. Alongside sector partners, CFG is feeding into the evidence that is being collected by BEIS. More information on the review can be found here: Terms of Reference: Review of the Energy Bill Relief Scheme - GOV.UK (www.gov.uk)

- Energy Efficiency Taskforce (EETF)

The government is announcing a new long-term commitment to drive improvements in energy efficiency to bring down bills for households, businesses and the public sector with an ambition to reduce the UK’s final energy consumption from buildings and industry by 15% by 2030 against 2021 levels.

- New government funding worth £6 billion will be made available from 2025 to 2028, in addition to the £6.6 billion provided in this Parliament. To achieve this target, a new EETF will be charged with delivering energy efficiency across the economy.

The need to improve the energy efficiency of UK buildings is most welcome. We sincerely hope that the charity sector is included in any funding that is available to reduce energy use in charity properties. CFG will work to ensure BEIS makes this funding available for our sector.

- Alternative Fuels Payment (AFP) - The government will double to £200 the level of support for households that use alternative fuels, such as heating oil, liquefied petroleum gas (LPG), coal or biomass, to heat their homes. This support will be delivered as soon as possible this winter. The government will provide this payment to all Northern Ireland households in recognition of the prevalence of alternative fuel usage in Northern Ireland. The government will also provide a fixed payment of £150 to all UK non-domestic consumers who are off the gas grid and use alternative fuels, with additional ‘top-up’ payments for large users of heating oil based on actual usage.

Benefit Changes

- Uprating of benefits

The government is increasing benefits inline with inflation, measured by September CPI which is 10.1% this year. Around 19 million families will see their benefit payments increase from April 2023. This includes increasing the State Pension by inflation, in line with the commitment to the Triple Lock. The standard minimum income guarantee in Pension Credit will also increase in line with inflation from April 2023 (rather than in line with average earnings growth). This will ensure pensioners on the lowest incomes are protected from inflation and do not lose some of their State Pension increase in the Pension Credit means test. Some disability benefits are devolved in Scotland, so it is for the Scottish Government (SG) to decide uprating.

- Raising the benefit cap

The benefit cap will be raised by 10.1%, in line with September CPI, so that more households will see their payments increase as a result of uprating from April 2023. The cap will be raised from £20,000 to £22,020 for families nationally and from £23,000 to £25,323 in Greater London. While for single adults it will be raised from £13,400 to £14,753 nationally and from £15,410 to £16,967 in Greater London.

Both of these announcements are very good news for people on the lowest incomes. This announcement follows campaigning by the Joseph Roundtree Foundation and others (including CFG). It was also one of the central asks of the sector's letter to the Chancellor ahead of the budget.

Unfortunately, we have not seen an increase in Local Housing Allowance (LHA), so for many in the private rented sector the additional money that was meant to go on essentials will just go to fill the difference between rent and housing benefit.

- In-Work Conditionality for Universal Credit claimants

The government will bring forward the nationwide rollout of the In-Work Progression Offer, announced at Spending Review 2021, starting with a phased rollout from September 2023, to support individuals on Universal Credit (UC) and in-work to increase their earnings and move off benefits entirely. This will mean that over 600,000 claimants on UC whose household income is typically between the equivalent of 15 and 35 hours a week at the NLW will be required to meet with a dedicated work coach in a Jobcentre Plus to increase their hours or earnings.

- Household Support Fund

£1 billion (including Barnett impact) will be provided to enable the extension of the Household Support Fund in England over 2023-24. The Fund is administered by local authorities who will deliver support to households to help with the cost of essentials. It will be for the devolved administrations to decide how to allocate the additional funding.

- Employment and Support Allowance: delay managed move

The government is pushing back the managed migration of claimants on income-related Employment and Support Allowance (with the exception of those receiving Child Tax Credit) to UC to 2028. Employment and Support Allowance claimants are still able to make a claim for UC if they believe that they will be better off, and this will not affect the managed migration of other legacy benefits onto UC.

- Reforming Support for Mortgage Interest

To support mortgage borrowers with rising interest rates, the government will allow those on UC to apply for a loan to help with interest repayments after three months, instead of nine. The government will also abolish the zero earnings rule to allow claimants to continue receiving support while in work and on UC. This will come into effect in Spring 2023.

Departmental spending

- Official Development Assistance (ODA) Spending

The government remains committed to returning to spending 0.7% of Gross National Income (GNI) on ODA when on a sustainable basis the government is not borrowing for day-to-day spending and underlying debt is falling. In accordance with the International Development (Official Development Assistance Target) Act 2015, the government will continue to review and confirm each year whether a return to spending 0.7% of GNI on ODA is possible against the latest fiscal forecast. In the meantime, the government’s plans assume ODA spending will be around 0.5% of GNI.

Is it positive to see that government did not choose to make further cuts to development spending, but it is disappointing that it did not take the decision to restore UK aid to 0.7% which is a Conservative manifesto commitment.

- NHS funding - The government is providing additional funding of £3.3 billion in each of the next 2 years to support the NHS in England in response to the significant financial pressures it faces, and enabling rapid action to improve emergency, elective and primary care performance.

- Central government adult social care and discharge funding increase - The government is investing an additional £1 billion of central government funding in England in 2023-24, increasing to £1.7 billion in 2024-25 to get people out of hospital on time and into social care. £600 million in 2023-24 and £1 billion in 2024-25 will be allocated through the Better Care Fund. The remaining £400 million in 2023-24 and £680 million in 2024-25 will be allocated to local authorities through a ringfenced adult social care grant which will also help to support discharge.

- Adult social care charging reform in local authorities - The government is responding to the concerns of local government by taking the difficult decision to delay the national rollout of social care charging reforms from October 2023 to October 2025. Funding for implementation will be maintained within local government to enable local authorities to address current adult social care pressures. This will be allocated at the Local Government Finance Settlement through the Social Care Grant.

Local government

- Council Tax flexibility

The government is giving local authorities in England additional flexibility in setting council tax by increasing the referendum limit for increases in council tax to 3% per year from April 2023. In addition, local authorities with social care responsibilities will be able to increase the adult social care precept by up to 2% per year. This will give local authorities greater flexibility to set council tax levels based on the needs, resources and priorities of their area, including adult social care.

While the funding settlement for next year is better than many feared, it still doesn't offer the long-term funding commitment to put local authorities on a sustainable footing, particularly as budgets are set to be cut during 2024-25.

The greater flexibility to raise revenue will help mitigate some of these financial challenges, but as the LGA have pointed out “council tax has never been the solution to meeting the long-term pressures facing services”.

Government should seek to work with councils to develop a long-term funding strategy to deliver critical local services and growth more effectively. Charities can be important partners in the design and delivery of public services, but charity finances cannot replace government funding.

The current crisis is already pushing up demand for services, particularly among communities that receive the least financial investment. It is essential that sufficient funding is available to deliver services at the scale and quality required, so people can access the support they need.

Tax

- Government will decrease the additional rate threshold from £150,000 to £125,140 from 6 April 2023. The government is also fixing other personal tax thresholds within income tax, NICs and Inheritance Tax for an additional 2 years, until April 2028.

The reduction of the additional rate threshold will mean that more tax payers will be eligible for higher rate Gift Aid. This will mean the donor can claim back the 45% minus the basic rate of 20% on your overall donation. This is not too substantial a change for the sector but might incentivise more people on the higher rate to make donations.

- Income tax and National Insurance contributions thresholds - The income tax Personal Allowance (PA) and higher rate threshold (HRT), and the National Insurance contributions (NICs) Upper Earnings Limit (UEL) and Upper Profits Limit (UPL) are already fixed at their current levels until April 2026 and will now be maintained for an additional two years until April 2028. From July 2022 the NICs Primary Threshold (PT) and Lower Profits Limit (LPL) were increased to align with the PA and will be maintained at this level from April 2023 until April 2028. The Class 2 Lower Profits Threshold (LPT) will also be fixed from April 2023 until April 2028 to align with the LPL. The PA, PT, LPL and LPT will remain at £12,570 and the HRT, UEL and UPL will remain at £50,270. The PA and NICs thresholds apply across the UK. The HRT for non-savings and non-dividend income will apply to taxpayers in England, Wales, and Northern Ireland, and the HRT for savings and dividend income will apply UK-wide. The government will legislate for the income tax measures in Autumn Finance Bill 2022, and NICs changes in affirmative secondary legislation in early 2023.

- National Insurance contribution rates and thresholds for 2023-24 - The government will fix the Lower Earnings Limit (LEL) and the Small Profits Threshold (SPT) at 2022- 23 levels in 2023-24. The LEL will remain at £6,396 per annum (£123 per week) and the SPT will remain at £6,725 per annum. The Upper Secondary Threshold, Apprentices Upper Secondary Threshold, and Veteran Upper Secondary Threshold, will stay fixed at £50,270 per annum until April 2028, to remain aligned with the UEL and UPL. The Freeport Upper Secondary Threshold will also be fixed at £25,000 per annum. The government will use the September CPI figure of 10.1% to uprate the Class 2 and Class 3 NICs rates for 2023-24. The Class 2 rate will be £3.45 per week, and the Class 3 rate will be £17.45 per week. The government will legislate for these measures in affirmative secondary legislation in early 2023.

- National Insurance contributions Secondary Threshold - The government will fix the level at which employers start to pay Class 1 Secondary NICs for their employees (the Secondary Threshold) at £9,100 from April 2023 until April 2028. It is fair that businesses play their part in reducing the UK’s debt. The Employment Allowance means that 40% of businesses do not pay NICs and will be unaffected by this change, and the largest employers contribute the most. The government will legislate for this measure in affirmative secondary legislation in early 2023.

Freezing income tax and national insurance thresholds until 2028 means that many more people will see an increase in taxes. But additionally freezing the thresholds for the foreseeable future will also see the employment costs of charities go up.

- Maintaining the VAT registration and deregistration thresholds at the current levels for an additional 2 years - The VAT registration and deregistration thresholds will not change for a further period of 2 years from 1 April 2024. At £85,000, the UK’s VAT registration threshold is more than twice as high as the EU and OECD averages.

Freezing the VAT registration threshold will likely mean more charities will need to register for VAT in the near future. If you hit this threshold over the course of the next two years you will also need to be aware of the relevant guidance around Making Tax Digital for VAT too. If this applies to your organisation, please look out for CFG training on all things VAT in our events calendar.

- Company Car Tax (CCT) Rates - The government is setting rates for Company Car Tax until April 2028 to provide long term certainty for taxpayers and industry in Autumn Finance Bill 2022. Rates will continue to incentivise the take up of electric vehicles: • appropriate percentages for electric and ultra-low emission cars emitting less than 75g of CO2 per kilometre will increase by 1 percentage point in 2025-26; a further 1% in 2026-27 and a further 1% in 2027-28 up to a maximum appropriate percentage of 5% for electric cars and 21% for ultra-low emission cars • rates for all other vehicles bands will be increased by 1 percentage point for 2025-26 up to a maximum appropriate percentage of 37% and will then be fixed in 2026-27 and 2027-28

- Online Sales Tax (OST) - Following consultation, the government has decided not to introduce an OST, an idea put forward by certain stakeholders in the context of Business Rates reform. The government’s decision reflects concerns raised about an OST’s complexity and the risk of creating unintended distortion or unfair outcomes between different business models. A response to the OST consultation will be published shortly

- Solvency II Reform - The government has today published a consultation response setting out the final reforms of Solvency II. These reforms will unlock tens of billions of pounds for investment across a range of sectors.

The Solvency II reforms will have important implications for insurance industry. CFG will consult with corporate partners to determine how, if at all, this will impact the charity sector.

Business rates

While charities get 80% mandatory relief on business rates alongside a 20% discretionary relief depending on local authorities, the following changes to business rates may be of interest to affected charities:

- Business Rates – Overall Package

From 1 April 2023, business rate bills in England will be updated to reflect changes in property values since the last revaluation in 2017. A package of targeted support worth £13.6 billion over the next 5 years will support businesses as they transition to their new bills, protect businesses from the full impact of inflation, and support our high streets. English Local Authorities will be fully compensated for the loss of income as a result of these business rates measures and will receive new burdens funding for administrative and IT costs.

- Business Rates - Multiplier Freeze

The business rates multipliers will be frozen in 2023-24 at 49.9 pence and 51.2 pence, preventing them from increasing to 52.9 pence and 54.2 pence. This is a tax cut worth £9.3 billion over the next five years. This will support all ratepayers, large and small, and mean bills are 6% lower than without the freeze, before any reliefs are applied.

- Business Rates - Transitional Relief Scheme

Upwards Transitional Relief will support properties by capping bill increases caused by changes in rateable values at the 2023 revaluation. This £1.6 billion of support will be funded by the Exchequer rather than by limiting bill decreases, as at previous revaluations. The ‘upward caps’ will be 5%, 15% and 30%, respectively, for small, medium, and large properties in 2023-24, and will be applied before any other reliefs or supplements. This delivers significant reform to the business rates system and responds to a key stakeholder ask. The 300,000 properties with falls in rateable values will see the full benefit of that reduction in their new business rates bill from April 2023. Over the life of the 3-year list the scheme will support around 700,000 ratepayers.

- Business Rates - Retail, Hospitality and Leisure Relief

Support for eligible retail, hospitality, and leisure businesses is being extended and increased from 50% to 75% business rates relief up to £110,000 per business in 2023-24. Around 230,000 RHL properties will be eligible to receive this increased support worth £2.1 billion.

- Business Rates - Improvement Relief

At Autumn Budget 2021 the government announced a new improvement relief to ensure ratepayers do not see an increase in their rates for 12 months as a result of making qualifying improvements to a property they occupy. This will now be introduced from April 2024. This relief will be available until 2028, at which point the government will review the measure

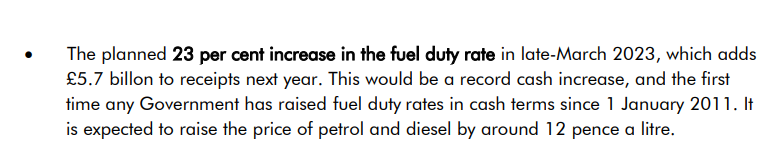

Although not mentioned in the Autumn budget, the OBR is presuming that fuel duty will increase by 23%. This would have a sizeable impact on household budgets, but also for charities and community groups whose services rely on transportation. Although I would strongly suspect that the Chancellor will not increase fuel duty by this much, ultimately due to public pressure. It is worth keeping an eye on if your charity will be impacted by increases in the cost of fuel.

National Minimum and National Living Wage

- National Living Wage (NLW) and National Minimum Wage (NMW) 2023 Uprating - Following the recommendations of the independent Low Pay Commission (LPC), the government will increase the NLW for individuals aged 23 and over by 9.7% to £10.42 an hour from 1 April 2023. This represents an increase of over £1,600 to the annual earnings of a full-time worker on the NLW and is expected to benefit over 2 million low paid workers.74 The government has also accepted the LPC’s recommendations for the other NMW rates to apply from April 2023, including: • Increasing the rate for 21-22 year olds by 10.9% to £10.18 an hour; • Increasing the rate for 18-20 year olds by 9.7% to £7.49 an hour; • Increasing the rate for 16-17 year olds by 9.7% to £5.28 an hour; • Increasing the apprentice rate by 9.7% to £5.28 an hour; and • Increasing the accommodation offset rate by 4.6% to £9.10 an hour.

The increase in the NMW/NLW means that the cost of operating for many charities will increase. And without additional income to pay for these higher rates, charities may have to make cuts elsewhere or use reserves to pay for these increases. It is important that employers take account of these changes and update their payroll software.

Levelling Up Fund

- The government remains committed to levelling up and spreading opportunity across all areas of the UK. To support this, the Autumn Statement confirms that the second round of the Levelling Up Fund will allocate at least £1.7 billion to priority local infrastructure projects. Successful bids will be announced before the end of the year.

Although it was announced by the Chancellor that the second tranche of Levelling Up Funding will be £1.7bn, the successful bids have not been announced. In addition, analysis by IPPR has shown that £560m of the Levelling Up and Shared Prosperity Fund will be lost to inflation: £560 million in levelling up funding lost to inflation | IPPR.

Insights and reactions from CFG's corporate partners

BHP

Rachelle Rowbottom, Tax Partner, said: "While it is good news that the government remains committed to tackling low pay, charities that pay the National Living Wage need to be aware of the increased costs that will arise from 1 April 2023 when the rate is increased by 9.7% to £10.42 an hour (for those aged 23 and over). An additional challenge at a time when funding sources are already squeezed."

Simon Buchan, Head of VAT, commented: "The current economic climate will almost certainly see more charities seek to be more sustainable by diversifying their activities. In today’s Autumn statement the Government announced a further freeze to the VAT registration threshold until April 2026 which will almost inevitably lead to more smaller charities being brought into the VAT net."

Hays Macintyre:

Jamie Whale, Senior Manager, said: "With many of the proposed changes to income and corporation tax already scrapped, much of the tax impact on the charitable sector was removed even before today’s announcement. Nevertheless there were several points for the sector to consider:

- Increases to minimum wage (£10.42 per hour from April 2023), in tandem with the 1.25% increase in employer’s NI already announced, and the long-term freezing of NI thresholds, will continue to increase employment costs for charities.

- An increase in the Corporation Tax rate to 25% (from 1 April 2023), although not impacting most charitable groups, emphasises the need to structure a charitable group correctly and avoid tax inefficiencies

- A series of changes will be made in connection with the first business rates revaluation in England since 2017. Promises to partly cushion small businesses from increases will be welcomed by charities operating charity shops, though the detail will need to be carefully reviewed in an invariably complex system.

The Chancellor appeared to rule out any plans to charge VAT on private school fees.

Buzzacott:

Luke Savvas, Charity Tax Partner, commented: "Not much in the Budget was announced to specifically help the charity sector, which is disappointing given the third sector is relied upon by many to support those below the poverty line. It will be interesting to see if the increased levies on electricity generators and windfall taxes on the oil and gas giants will be used to support low-income households facing increased spending on food and fuel. Extending the energy price cap for one year beyond April is welcomed but made less generous, with typical bills capped at £3,000 a year instead of the £2,500. I suspect the need for charities to plug the gap with support will not falter."

Read Buzzacott’s full thoughts on the statement.

Sayer Vincent:

Ross Palmer, Senior Tax Manager, said: "In the end, this statement perhaps contained very few surprises. There was some positive news for individuals with regards to benefits and pensions, and increased support around business rates which may help some organisations. While the announcements may at least provide a degree of certainty for the future to allow for planning, this feels like another missed opportunity to both recognise and help support the role played by charities and other social purpose organisations, who continue to see high demand while sources of income are diminishing."

Quantum Advisory:

Increase in the National Living Wage: In a further bid to help vulnerable individuals the Chancellor announced an increase in the National Living Wage of 9.7% from April 2023, which means that the National Living Wage will increase to £10.42 an hour for those aged 23 and over. This is the largest ever increase and is expected to benefit over two million low paid workers, increasing annual earnings of a full-time worker on the National Living Wage by over £1,600.

Sarah Garnish, a Consultant at Quantum Advisory, said: “With the National Living Wage rising, those employers with salary sacrifice arrangements will need to ensure that employees earning the National Living Wage where their salary - after salary sacrifice - goes below this new threshold are opted out of the salary sacrifice arrangement.”

Further freeze on Income Tax and National Insurance Thresholds: The picture doesn’t look quite so rosy for taxpayers however with the freeze on income tax and national insurance thresholds being further extended to April 2028. Thanks to the effects of ‘fiscal drag’, more taxpayers are already seen to be moving into higher rate tax brackets due to the rise in inflation and income growth. The freeze will see this continue over the coming years, meaning millions will be paying more tax on their incomes

CFG would like to thank our corporate partners for sharing their insights.

If you have any questions about the Autumn Statement, or would like to discuss any policy-related matters, please email the team.