CFG's Policy Manager, Richard Sagar, outlines what the government's Winter Economic Plan means for charities.

With news that the Autumn budget will not take place this year, the Chancellor’s short notice ‘Winter Economic Plan’ was greatly anticipated, for the twelve or so hours notice we had!

Of particular interest was what government would do to mitigate the furlough scheme coming to an end in October, to avoid a large rise in unemployment; especially with additional social distancing measures already announced, and with the likelihood of more on the way sooner rather than later.

Job Support Scheme

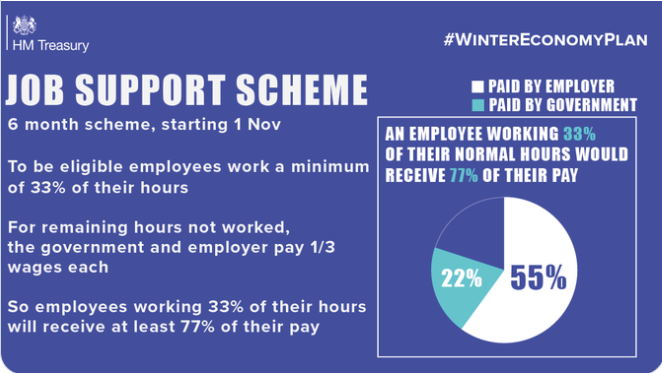

The centrepiece of the Chancellor’s approach was the ‘Job support scheme’ which will begin on 1 November, as the Job Retention Scheme comes to an end, and will last for six months. The scheme will provide a top-up on wages for employees working a minimum of 33% of their hours.

For the remaining hours not worked, the government and employer pay 1/3 of the wages each. Employees will receive at least 77% of their pay, with the employers reimbursed in arrears for the government contribution, with the government contribution capped at £697.92 per month. Importantly, the grant from government will not cover Class 1 employer NICs or pension contributions, although these contributions will remain payable by the employer.

There are additional requirements, with all SMEs eligible, but with large businesses required to demonstrate that their business has been adversely affected by Covid-19. With no further definition of SME or large business, it is unclear if larger charities will be eligible, and what exactly qualifies as ‘adversely affected’ is also unclear. We will be seeking further clarification on these matters.

In practice, this all means that for an employee working 33% of their usual hours, charities would need to pay 55% of their usual wages, which this infographic from HMT makes clear.

The government has also provided a helpful Job Support Scheme factsheet which includes a table outlining the various costs to employers or government depending on how many hours worked:

It is at best unclear if employers in the charity sector will choose to pursue this approach, as this is still quite a large cost for charities in very difficult financial circumstances and does not help to retain jobs in those areas severely affected by social distancing restrictions.

However, combined with Jobs Retention Bonus it may provide the additional incentive to retain staff on reduced hours until the end of January when they would become eligible for the bonus (bearing in mind that employees must work at least 14 hours a week on the NLW to be eligible for the Job Retention Bonus).

Importantly, as the CEO of the Resolution Foundation, Torsten Bell, has rightly pointed out this may mean that the end of January becomes the new October cliff-edge. One would think additional measures will be needed before too long to avoid a large number of job losses further down the line.

Under ordinary circumstances, announcements of this kind from a Conservative Chancellor would be seen as extraordinarily generous, but as we all know we do not live in ordinary times, and compared to the furlough scheme it does not seem quite so generous.

Unlike all other fiscal announcements of this kind, there were no accompanying costings for each scheme, so it is hard to know how much the government thinks these measures will cost, as compared to the furlough scheme, but it will almost certainly be less by orders of magnitude.

It is sad to say that even with the Job Support Scheme, there will be significant job losses in the sector in the coming months.

VAT New Payment Scheme

Alongside the big announcement of the ‘Job support scheme’ there were additional announcements that will be of interest to the sector. Perhaps the most useful scheme is the VAT deferral ‘New Payment Scheme’. This will allow charities who deferred VAT due in March to June 2020 to spread their payments over the financial year 2021-22 via 11 equal instalments. Any charity who deferred VAT is eligible, with an opt-in process starting in early 2021.

With cashflow such a challenge for the sector, we think this will be much appreciated by many charities.

Self Employed Income Support Scheme Grant extension

The Self-employed Income Support Scheme (SEISS grant) has been extended in line with Jobs Support scheme, so that it will last for six months from November 2020 to April 2021 and will apply only to those who are eligible for the SEISS grant. There are further details on the scheme found in section 2.5 of the full Winter Economic Plan, but as we think these grants will not be of too much relevance to the sector, will provide limited benefit to charities.

It is also worth noting comments from the Creative Industries Federation that “many of the sector’s two million self-employed workers-including limited company contractors, PAYE freelancers and the newly self-employed - will continue to fall through the gaps."

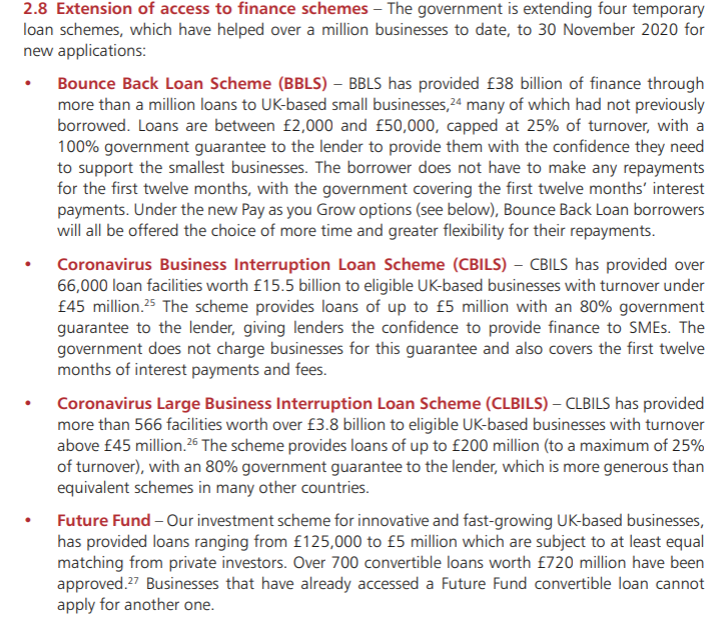

Extension of access to finance schemes

Many of the additional measures provided offer extensions to the application period for the four government-backed loans schemes and changes to the repayment for bounce-back loans (labelled as ‘Pay as you Grow’) meaning it can now be paid over 10 years, with the option to make interest only payments, or for those in real difficulty suspend payments. Lenders under CBILS can also extend the term of the loans for up to ten years. Further details on the extension of the four loans schemes can be found below:

These measures may prove useful for the private sector, but from conversations we have had with members, most will not be keen to take on more debt at a time of tremendous economic uncertainty.

Extension of temporary VAT reduced rate for hospitality and tourism

While not affecting most charities, there was also additional support for the hospitality and tourism sectors, with the planed VAT increase from 5% to 20% due in January now postponed until the end of March.

Overall, the measures announced provide some additional help to charities at a time when it is much needed. But they are no substitute for more bespoke interventions which we have proposed as part of the #Nevermoreneeded five point plan. An additional comment made by the Chancellor to introduce the speech that “the economy is more likely to undergo a more permanent adjustment” could be a portent for quite a profound shift in fiscal policy in the months and years to come.

With no budget scheduled for this year, we can hope that the upcoming Spending Review provides an opportunity for the government to listen to the sector and makes the changes needed, so that the sector can play it’s full, essential role in ‘building back better’ into 2021 and beyond.