What does the Chancellor's Autumn Statement mean for you and your organisation? Richard Sagar, Head of Policy, CFG, takes an in-depth look.

Overview

Prior to the Autumn Statement, the Chancellor of the Exchequer, Jeremy Hunt, promised 110 measures to help grow the British Economy. Most of the headline measures were trailed well before the announcement itself. Among the most notable of these was the cut to National Insurance (which was more than expected and ended up being the proverbial ‘rabbit out of the hat’).

But the news was far from all positive for individuals. According to analysis by the OBR, the Chancellor has failed to increase thresholds for income tax and national insurance contributions in line with inflation since 2021. HMT will net more than $44bn by 2028.

This ‘fiscal drag’, has meant, and will mean, that many people will be paying more tax on their incomes for years to come, with nearly four million more paying the 20% income tax rate.

The OBR commented: "the overall 3.5 per cent peak-to-trough drop in Real Household Disposable Income per person between 2019-20 to 2024-25 is still the largest reduction in real living standards since ONS records began in the 1950s."

The other significant measures unveiled in advance of the Chancellor's speech, was the increase to the National Living Wage, and an extension of ‘full expensing’* for business through to 2028-29. This measure was one among many aimed at ‘backing British business’ or ‘cutting taxes and rewarding work’.

Charities were not mentioned at all by the Chancellor during his speech, and there were very few charity-specific measures announced in the more detailed documents that accompanied the Autumn Statement.

The announcements on benefits were more positive than expected, with working age benefits increasing in line with inflation (6.7%), and Local Housing Allowance (LHA) rates being raised to the 30th percentile of local market rents.

More concerning were the additional sanctions introduced, especially those aimed at people with disabilities (see below).

Perhaps the most concerning thing not mentioned was public sector budgets, and more specifically those of departments not protected, including Local Government.

Prior to the Chancellor's statement, the Local Government Association (LGA) called for him 'to set out a package of financial measures that ensures the future financial sustainability of the sector, throwing a lifeline to the vital local services that people depend upon every day.'

Unfortunately, no such measures were announced, with the OBR stating:

'there is still a risk to our forecast from wider pressures on local authority finances. Since 2010-11, local authority spending has fallen from 7.4 to 5.0 per cent of GDP, and it falls further in our forecast to 4.6 per cent of GDP in 2028-29. Given local authorities’ statutory duty to provide a range of services where demand is likely to continue to grow, for example adult and child social care, pressure on local authority finances and services will continue.'

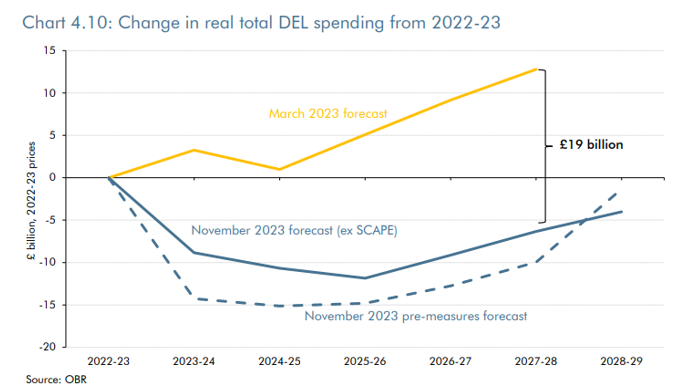

With inflation eroding the real value of government Departmental Expenditure Limits (DEL), it is forecast that they will see budgets decrease significantly until 2028-29.

For the charities, and more importantly, the beneficiaries that rely on the funding that these departments provide, this is not sustainable. Additional funding is urgently needed in order to put those services on a sustainable footing, prevent the closure of services and those who rely on services from falling through the cracks. It is just not sustainable for charities to continuously subsidies government funding shortfalls.

*This is a capital allowance tax scheme that allows companies to deduct 100% of the cost of qualifying plant and machinery from their taxable profits in the year of purchase, instead of spreading the cost across multiple tax years.

OBR economic forecast:

The sector's 'asks' ahead of the Autumn Statement

In October 2023, CFG and the other sector partners that form the Civil Society Group set out three key asks ahead of the autumn statement.

The first was to ‘Introduce an ‘Essentials Guarantee’ to embed in the social security system the widely supported principle that, at a minimum, Universal Credit should protect people from going without essentials. This was not introduced, although a raft of other announcements on welfare and work were (see below).

The second was for government to ensure public bodies have the resources they need to deliver public services by increasing funding to enable them to uplift grants and contracts to cover the costs of public service delivery.

No new spending plans for Local Government were announced, and due to higher inflation eating into the real-terms value of public service budgets, alongside protection for ringfenced departments, it will likely mean cuts in real terms to local government budgets.

This means that many charities will likely have to continue subsidising public sector grants and contracts with charitable funds. But, as NCVO and other organisations have pointed out, this is not sustainable in the long-term. Sooner or later, additional funding will need to be provided, or many charitable organisations will be at risk of closure.

The final ask concerned streamlining and reviewing the charity tax and compliance systems. There was no mention of irrecoverable VAT or ‘Extending charitable rate relief to wholly-owned charity trading subsidiaries’.

It is good news that HMT did listen to our ask to reintroduce VAT relief for the installation of energy saving measures in buildings intended for use solely for a relevant charitable purpose. Following a CFG consultation with charity members, we found that additional financial incentives could encourage charities to install ESMs that they otherwise wouldn’t.

As one charitable museum trust commented to us: “VAT relief would allow us to plan for these changes with a larger degree of optimism that we'll actually be in a position to attain them.”

In addition, ACRE provided very helpful briefings with further information on the potential benefit this change could make to village halls and rural buildings. Having submitted to a consultation on the topic in May, it is welcome that HMRC has listened to the sector and says it will be implementing reforms in February 2024. We look forward to more information on these changes in due course.

Inflation

The OBR is forecasting that inflation is expected to be more persistent than they previously thought, falling below 5% by the end of 2023 but not returning to its 2% target until the first half of 2025. In addition, markets now expect that interest rates will need to remain higher for longer to bring inflation under control.

The OBR states:

“More persistent, domestically driven inflation boosts nominal tax revenues compared to March. But it also raises the cost of welfare benefits, and higher interest rates raise the cost of servicing the Government’s debts. It is mainly due to the Chancellor’s decision to leave departmental spending broadly unchanged that higher inflation and other forecast changes reduce borrowing by £27 billion in 2027-28 compared to our March forecast.”

CPI inflation: Source ONS, OBR

Benefit/Unemployment support

- Raising Local Housing Allowance (LHA) rates – In April 2024, LHA rates in Great Britain will be raised to the 30th percentile of local market rents.

- Uprating of benefits – The government is increasing working age benefits in line with inflation, measured by September CPI which is 6.7% this year. The government is also maintaining the Triple Lock. The basic State Pension, new State Pension and Pension Credit standard minimum guarantee will be uprated in April 2024 in line with earnings growth. This is measured by the usual metric of annual earnings growth in May-July, which is 8.5% this year.

- Some disability benefits are devolved in Scotland, so it is for the Scottish Government (SG) to decide uprating. Department for Work and Pensions (DWP) benefits are fully devolved in Northern Ireland, so it is for the Northern Ireland Executive to decide uprating in Northern Ireland.

- DWP: new powers to tackle fraud and error – The government is legislating to give DWP further access to claimant data to better identify fraud and error in the welfare system in Great Britain.

- Tackling the Economic Impacts of Domestic Abuse (TEIDA) Fund – The government will make £10 million of additional funding available in 2024-25 for projects that aim to understand the impacts of domestic abuse on the labour market, support victims of domestic abuse in the workplace or prevent victims experiencing further abuse.

- Expanding the Flexible Fund for victims of domestic abuse – The government will provide £2m of additional funding to expand the Flexible Fund, which trials an innovative new approach to provide one off payments to victims of domestic abuse. This support will reduce the financial pressure on victims to return to the abuser and will enable victims to set themselves up sustainably, for example by securing long term accommodation.

- Universal Credit surplus earnings – The government will maintain the surplus earnings threshold for Universal Credit claimants in Great Britain at £2,500 for a further year until April 2025.

- Universal Credit: Severe Disability Premium Transitional Element rates – The government will increase the rates of the Severe Disability Premium Transitional Element to provide further support for legacy benefit claimants in Great Britain that naturally migrate to Universal Credit.

- Personal Independence Payment (PIP) easements – DWP is continuing operational measures to reduce the waiting time for new PIP claims in England & Wales. DWP’s ability to use these measures has been extended until November 2024, to ensure that new disability benefit claimants are not facing excessive wait times to have their benefits claims processed.

- Work Capability Assessment (WCA) gateway reform – The government is reforming the activities and descriptors in the Work Capability Assessment for new claimants in Great Britain, to support more people into employment, with implementation occurring from 2025.

- Additional Jobcentre Support – The government is expanding Additional Jobcentre Support currently live in 90 Jobcentres in England and Scotland to trial intensive support for people who have been receiving Universal Credit for 7 weeks, in addition to the support after 13 and 26 weeks announced at Spring Budget 2023.

- Restart scheme – The government is expanding its programme of employment support for the long-term unemployed for two years from 2024 across England and Wales. Those who have been on Intensive Work Search for 6 months will now be eligible, as opposed to the previous requirement of 9 months. In addition, work coaches will track the activity of participants to ensure they comply with requirements of the Restart programme.

- Post-Restart Claimant review point – From late 2024, Universal Credit claimants in England and Wales who have completed Restart and remain unemployed after 18 months will undergo a review conducted by a work coach. Claimants who do not agree to revised claimant commitments without a good reason, which could include attending a mandatory work placement or new intensive work search activities, will have their claim closed.

- Fit note reform – The government will explore end-to-end reforms of the fit note process to support more people to resume work after a period of illness. Trailblazer trials, in a small number of areas in England, will test changes to make referrals to health and employment services easier and improve digital access for patients. They will include trigger points for referrals for people who have received a fit note for a prolonged period of time and new designs of the fit note form. The government will launch a consultation in 2024 on wider reforms, to examine providing individuals whose health affects their ability to work, with easy and rapid access through the fit note process to specialised support for a return to work.reason, which could include attending a mandatory work placement or new intensive work search activities, will have their claim closed.

- Post-Restart employment schemes, including Mandatory Work Placements – From late 2024, the government will begin rolling out new schemes to support Universal Credit claimants in England and Wales, who have completed Restart and remain unemployed after 18 months. Following the post-Restart claimant review point, claimants will be mandated to attend a time-limited work placement or undertake other intensive work activity.

The most notable and positive change for those on low incomes is Local Housing Allowance rates being raised to the 30th percentile of local market rents. Which will be a lifeline to many, in addition government increasing working age benefits in line with inflation, measured by September CPI (6.7%), is a big sigh of relief as there were fears that it could be increased by April CPI which would have been lower.

A wide range of measures have been announced to ‘support the long-term unemployed into work’, and while a number of the measures are to be commended, including expanding programmes of employment support and additional Jobcentre support. It is deeply concerning that additional sanctions are being put in place, especially for those who are long-term sick and disabled. With Joseph Roundtree Foundation claiming that ‘changes to disability benefits raise destitution concerns’

Ultimately the measures announced fall far short of the ‘Essentials Guarantee’ being embedded in our society security system, which was called for by the Civil Society Group.

Tax

- Reforms to Energy-Saving Materials VAT Relief – Following a call for evidence, the government will expand the VAT relief available on the installation of energy-saving materials by extending the relief to additional technologies – such as water-source heat pumps – and bringing buildings used solely for a relevant charitable purpose within scope. Thanks to the Windsor Framework, these reforms will be implemented UK-wide in February 2024. Full details on these reforms will be published shortly.

- National Insurance contributions (NICs) rates – The government will cut the main rate of Class 1 employee NICs from 12% to 10%. This will take effect from 6 January 2024. The government will also cut the main rate of Class 4 self-employed NICs from 9% to 8%. This will take effect from 6 April 2024.

From 6 April 2024 the government will also ensure that no one will be required to pay Class 2 self-employed NICs. Details of this change are:

From 6 April 2024, self-employed people with profits above £12,570 will no longer be required to pay Class 2 NICs, but will continue to receive access to contributory benefits including the State Pension.

- Those with profits between £6,725 and £12,570 will continue to get access to contributory benefits including the State Pension through a National Insurance credit without paying NICs as they do currently.

- Those with profits under £6,725 and others who pay Class 2 NICs voluntarily to get access to contributory benefits including the State Pension, will continue to be able to do so.

The government will set out next steps on Class 2 reform next year. As part of this reform the government will protect the interests of lower paid self-employed people who currently pay Class 2 NICs voluntarily to build entitlement to certain contributory benefits including the State Pension.

- Uprating Blind Person’s Allowance and Married Couple’s Allowance for 2024-25 – The government will uprate the Blind Person’s Allowance (BPA) and the Married Couple’s Allowance (MCA) by the September CPI figure of 6.7% in 2024-25. The BPA will be valued at £3,070 and the MCA will be valued at between £4,280 and £11,080. This decision represents no policy change, as it confirms the default position for these allowances to be uprated by CPI, as set out in the Income Tax Act 2007.

• Off-Payroll Working (IR35) – calculation of PAYE liability in cases of non compliance – The government will legislate in the Autumn Finance Bill 2023 to allow HMRC to reduce the PAYE liability of a deemed employer to account for taxes paid by a worker and their intermediary on payments received where an error has been made in applying the off-payroll working rules.

• National Insurance contributions rates and thresholds – The government will freeze the Lower Earnings Limit (LEL) and the Small Profits Threshold (SPT) at 2023-24 levels in 2024-25. For those paying voluntarily, the government will also freeze Class 2 and Class 3 National Insurance contribution (NIC) rates at their 2023-24 levels in 2024-25. The LEL will remain at £6,396 per annum (£123 per week) and the SPT will remain at £6,725 per annum. The main Class 2 rate will remain at £3.45 per week, and the Class 3 rate will remain at £17.45 per week. This will not affect existing arrangements for payments of voluntary Class 2 or Class 3 NICs connected with previous tax years.

• Extending the Employer NICs relief for employment of veterans – The government is extending the NICs relief for employers of eligible veterans for one year. The relief means businesses pay no employer NICs on annual earnings up to £50,270 for the first year of a qualifying veteran’s employment in a civilian role.

• Improving the data HMRC collects from its customers – The government is legislating in the Autumn Finance Bill 2023 to require employers, company directors, and the self-employed to provide new or improved data to HMRC to enable better outcomes for citizens and businesses. These changes will take effect from the tax year 2025-26.

• Business rates: retail, hospitality, and leisure relief – The current 75% relief for eligible Retail, Hospitality and Leisure (RHL) properties is being extended for 2024-25, a tax cut worth £2.4 billion. Around 230,000 RHL properties in England will be eligible to receive support up to a cash cap of £110,000 per business.

• Merger of R&D tax reliefs – The existing Research and Development Expenditure (RDEC) and SME schemes will be merged, with expenditure incurred in accounting periods beginning on or after 1 April 2024 to be claimed in the merged scheme. Merging schemes is a significant tax simplification, including an aligned set of qualifying rules and a more visible above the line credit. The notional tax rate applied to loss-makers in the merged scheme will be lowered from 25% as per the current RDEC scheme, to 19%. A note setting out the key changes to the policy following the technical consultation is published alongside the Autumn Statement, ahead of it being legislated for in the Autumn Finance Bill 2023.

• R&D tax reliefs: additional tax-relief for R&D intensive loss-making SMEs – The intensity threshold in the additional support for R&D intensive loss-making SMEs will be reduced from 40% to 30%, bringing approximately 5,000 more R&D intensive SMEs into scope of the relief. The government will also introduce a one-year grace period, so that companies that dip under the 30% qualifying R&D expenditure threshold will continue to receive relief for one year. Businesses will be able to claim for expenditure incurred from 1 April 2023 once the Autumn Finance Bill 2023 has received Royal Assent, with the reduction in intensity threshold and grace period coming into effect for accounting periods beginning on or after 1 April 2024.

• R&D tax reliefs: removing nominations and voiding assignments – From 1 April 2024, R&D claimants will no longer be able to nominate a third-party payee for R&D tax credit payments, subject to limited exceptions. In addition, no new assignments of R&D tax credits will be possible from 22 November 2023. This means that in most circumstances payments of R&D tax reliefs will be paid directly to the company that claims for the R&D, ensuring they have full oversight of the claim, and receive payment more quickly. This will be legislated in the Autumn Finance Bill 2023.

• Closing the R&D review – At Spring Budget 2021, the government launched a review of R&D tax reliefs to ensure the UK remains a competitive location for cutting edge research, the reliefs continue to be fit for purpose and taxpayer money is effectively targeted. The government is now concluding that review with the announcement of the merged scheme. Further action may needed to reduce the unacceptably high levels of non-compliance in the R&D reliefs, and HMRC will be publishing a compliance action plan in due course. The government will also continue working with industry to develop the enhanced support for R&D intensive SMEs, and consider further simplifications.

• Women’s Sanitary Products – The government will extend the scope of the current VAT zero rate relief on women’s sanitary products to include reusable period underwear from 1 January 2024.

Government funding and Levelling Up

- DEL Spending Assumption from 2025-26 to 2028-29 – Planned departmental resource spending for the years beyond the current Spending Review period (2025-26 to 2028-29) will continue to grow at 1% a year on average in real terms, excluding the funding provided to local authorities in 2024-25 as part of the one-year Retail, Hospitality, and Leisure relief scheme. Departmental capital spending will follow the cash profile agreed at Spring Budget 2023, with new commitments funded in addition to this, including further support for levelling up programmes and business access to finance.

- Support for affected communities within the UK following the conflict in Israel and Gaza – The £3 million of additional funding that the government has already provided to the Community Security Trust will be maintained in 2024-25. In addition, the government is also providing up to £7 million over three years for organisations like the Holocaust Educational Trust to help tackle antisemitism in schools and universities.

- Official Development Assistance (ODA) Spending – The government has committed to return to spending 0.7% of Gross National Income (GNI) on ODA when it is not borrowing for day-to-day spending and underlying debt is falling, as reviewed each year against the latest fiscal forecast for the following year. Autumn Statement 2023 confirms that these conditions have not been met for 2024-25.

- New devolution deals – The government has finalised four new devolution deals across England. This includes two Level 3 mayoral deals with Greater Lincolnshire, and Hull and East Yorkshire and two Level 2 non-mayoral deals with Lancashire and Cornwall. The government is also in advanced discussions to agree a Level 2 non-mayoral deal with Devon and Torbay.

- Extension of Level 2 devolution deals – The Department for Levelling Up, Housing and Communities intends to offer Level 2 devolution powers to councils that cover a functional economic or whole county area, and meet relevant criteria as set out in the Levelling Up White Paper, where there is local consent to such arrangements.

- Single Settlements Memorandum of Understanding – At Spring Budget 2023 the government announced two new trailblazer deals with West Midlands Combined Authority (WMCA) and Greater Manchester Combined Authority (GMCA). This included a commitment to provide flexible, single funding settlements for these MCAs at the next Spending Review. The government has published a Memorandum of Understanding (MoU) for these single settlements. The MoU sets out how the government will operationalise these single funding settlements for the GMCA and WMCA.

- Business rates retention – the government has agreed the detailed terms of the long-term business rates retention arrangements for the Greater Manchester and West Midlands Combined Authorities, delivering on the commitment in the trailblazer deals announced at Spring Budget 2023. These arrangements will commence from April 2024.

- Level 4 framework – The government has published a new framework for extending deeper devolution to existing Level 3 Mayoral Combined Authorities (MCAs). The Level 4 framework provides new powers for MCAs to draw down on, based on the trailblazer deals negotiated with the Greater Manchester and West Midlands Combined Authorities, including powers over adult skills, local transport and housing.

- Levelling Up Partnerships (LUPs) extension to Scotland – The government, in collaboration with the Scottish Government, is announcing over £80 million of investment for the expansion of the Levelling Up Partnerships programme to Scotland, for Na h-Eileanan an lar, Argyll and Bute, Dundee, and the Scottish Borders. The government will consider, as the programme develops, how to extend it further.

- Additional regeneration projects – In addition to the recently announced Levelling Up Fund Round Three projects, the government is announcing £37.5 million to support regeneration in places across the UK. These are: the Isles of Scilly, Warrington, Monmouthshire, North Norfolk and Eden. All funding is subject to final checks, including subsidy control. Bolsover will also receive £15 million, ensuring that all Priority Places, as determined using the Levelling Up Need metrics set out in the Levelling Up White Paper, have benefited from levelling up funding. The government will also support the Hay Festival in Wales, and the reallocation of £20 million from within the Inverness & Highland City Region Deal to fund essential landside infrastructure improvements for the Corran Ferry, subject to agreement through the appropriate Deal governance structures. This will ensure the long-term sustainability of the lifeline service.

- Local Finance Working Group – The Department for Levelling Up, Housing and Communities will work with the UK Infrastructure Bank, the British Business Bank, Homes England and other departments to consider – with local and private sector partners – how to support levelling up through improving access to finance. The group will report to Ministers by the spring.

- Investment Zones Programme Extension – The Investment Zones programme in England will be extended from five to ten years. Investment Zones will be provided with a £160 million envelope from 2024-25 to 2033-34 which can be used flexibly between spending and tax incentives, subject to ongoing co-design of proposals and agreement of delivery plans. The UK government will work in partnership with the Scottish and Welsh governments with the intention of delivering an extension to the Investment Zones programme in Scotland and Wales and continue to work with stakeholders on how best to deliver the benefits of the Investment Zones programme in Northern Ireland.

- Announcing Investment Zones – Greater Manchester’s Investment Zone will focus on advanced manufacturing and materials across Manchester, Salford, Rochdale, Bury, Oldham and the wider city region, with anchor investment from First Graphene, Kadant, Werit and Hydrograph worth over £10 million. West Midlands’ Investment Zone will focus on advanced manufacturing across Birmingham, Wolverhampton and Coventry, with benefits felt across the wider region, with anchor investment from Bruntwood SciTech and Woodbourne Group worth £70 million in total and backed by over £5 million of investment into enabling digital platforms to support advanced manufacturing growth. East Midlands’ Investment Zone will focus on advanced manufacturing and green industries across Nottinghamshire, Derby and Derbyshire with benefits felt across the wider region, with anchor investment from Rolls Royce and Laing O’Rourke worth £9.3 million. In addition to this, the government can confirm there will be two Investment Zones in Wales; one located across Cardiff and Newport, delivered by the South East Wales Corporate Joint Committee and another focusing on Wrexham and Flintshire delivered by the North Wales Corporate Joint Committee. The government will be working closely with the Welsh Government on the delivery of these Investment Zones.

- Investment Opportunity Fund – The government is creating a £150 million fund to support Investment Zones and Freeports across the UK to secure business investment opportunities. The fund will be available over five years.

- Homes for Ukraine and homelessness prevention – The government will extend ‘thank you’ payments into a third year for Homes for Ukraine sponsors across the UK. They will remain at £500 per month and reflect the ongoing generosity of hosts in supporting those who have fled the war. The government is also providing £120 million funding for the devolved administrations and local authorities in England to invest in homelessness prevention, including to support Ukrainian households who can no longer remain in sponsorship.

National Minimum and National Living Wage

- National Minimum & Living Wage Uprating – From 1 April 2024, the National Living Wage (NLW) will increase by 9.8% to £11.44 an hour for eligible workers across the UK aged 21 and over. Young people and apprentices on the National Minimum Wage (NMW) will also see a boost to their wages.

The increase to the national living wage is to be welcomed and will benefit may on lower incomes, but it does mean that the operating cost for many charities will increase, and without an additional uplift to grant income to pay for these higher rates, charities will have use reserves, or cut back elsewhere to pay for these increases.

Funding for the sector

Support for affected communities within the UK following the conflict in Israel and Gaza – The £3 million of additional funding that the government has already provided to the Community Security Trust will be maintained in 2024-25.

In addition, the government is also providing up to £7 million over three years for organisations like the Holocaust Educational Trust to help tackle antisemitism in schools and universities.

Pensions

- Call for Evidence on Lifetime Provider Model and small pots consultation response – The government is launching a call for evidence on a lifetime provider model to simplify the pensions market by allowing individuals to move towards having one pension pot for life, and on a potential expanded role for collective defined contribution (CDC) schemes in future. The government will also introduce the multiple default consolidator model to enable a small number of authorised schemes to act as a consolidator for eligible pension pots under £1,000.

- Public consolidator for DB pension schemes – DWP will launch a consultation this winter on options for DB schemes, currently unserved by the market, to consolidate into a new statutory vehicle run by the Pension Protection Fund.

- Pension investment expertise and skills – The government supports the Pensions Regulator’s plans to implement a register of trustees to aid engagement with trustees and to update the trustee toolkit to include further information on productive finance.

- Local Government Pension Scheme: Investment reform consultation response – Following consultation, the government confirms that Local Government Pension Scheme (LGPS) guidance will be revised to implement a 10% allocation ambition for investments in private equity, which is estimated to unlock £25bn, as well as a March 2025 deadline for the accelerated consolidation of LGPS assets into pools, and setting a direction towards fewer pools exceeding £50bn of assets under management.

Insights and reactions from CFG's corporate partners

~ David Davison, Spence & Partners

On pensions:

The big pension announcement in the Autumn Statement concerned proposals to consider the implementation of a ‘pot for life’ which would allow individuals to select a pension plan and then have the right to force their employer to contribute to it. Whilst I totally understand the inefficiency of the existing model where individuals have multiple pension pots built up with numerous employers over many years this move, as is acknowledged by Government, faces huge practical and regulatory challenges. It also places the selection onus totally with the individual who may be ill-equipped to make an informed decision on which pension to select. It also potentially adds considerable complexity for employers in administering multiple schemes for their employees. Thankfully, it is only a call for evidence at this stage and I therefore think that implementation is a very long way off.

~ Simon Hubbard, Senior Consultant, Quantum Advisory

On National Insurance contributions:

“Reductions in National Insurance contribution rates will be welcomed by many, especially lower earners who face pressures from recent high inflation. The change indirectly makes saving into a pension less attractive for employees because these contributions are paid before the deduction of tax and National Insurance through an arrangement known as salary sacrifice. This change reduces the National Insurance that employees save by using such a salary sacrifice approach but it is still the most efficient way for employees to pay their pension contributions and there is no impact on the National Insurance saving made by the employer.”

Increase in the National Living Wage:

“With the National Living Wage rising, those employers with salary sacrifice arrangements will need to ensure that employees earning the National Living Wage where their salary after salary sacrifice goes below this new threshold are opted out of the salary sacrifice arrangement.”

Pensions triple lock retained:

“The 8.5% increase in the State pension in April 2024 will come as welcome news to the millions of pensioners in the UK for whom the State pension makes up the majority of their income. There had been speculation that the Government might not apply the triple lock in full because public sector cash bonuses could affect the calculation, but the Government has now decided that is can afford to award the full increase.”

~ Simon Buchan, Head of VAT at BHP

“In a statement which largely ignored the charity sector, the Chancellor threw some scraps from his table. The announcement to extend the relief from VAT on energy saving materials to buildings used solely for a relevant charitable purpose is a welcome if small crumb of comfort, whilst the continued business rate support to small businesses may help charity shops. Proposed technical clarifications for claiming 'cultural tax' reliefs look as though they will restrict the value of the reliefs to the sector.”

If you have any questions about the Autumn Statement or this briefing, don't hesitate to contact the Policy Team.

Something not right? Please let us know! Email the editor.