As income declines, the demands, costs and stress levels keep rising. CFG’s survey of its small and micro charity members paints a picture of the financial pressures they face.

As part of Small Charity Week (Monday 23 June – Friday 28 June), CFG surveyed 50 of our small charity members to find out more about their day-to-day operational challenges. The insights they shared show that most small charities are feeling increased financial and operational strain in 2025.

One respondent told us that their main funding came to an end in March 2025 and they are “now in a financially vulnerable position”. This was echoed by another charity leader who said that “increased costs and reduced support from other organisations have put us in a perilous financial position”.

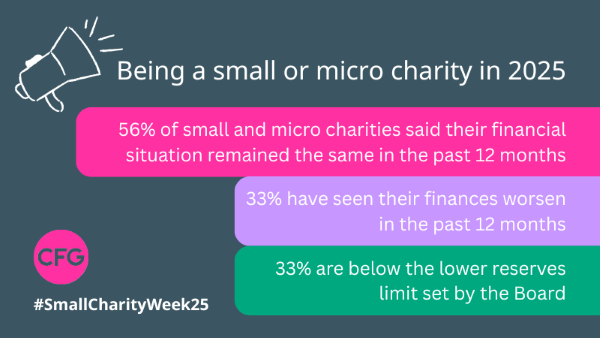

One third of survey respondents (33%) have seen their charity’s financial situation deteriorate in the past 12 months. Just over half reported (56%) that their financial situation had ‘remained the same’. Only 11% said that their financial situation had somewhat improved.

Another charity leader stated that “the funding environment is undoubtedly the hardest it's been for many years, with a number of major funders either pausing their funding or withdrawing altogether.”

These financial difficulties are further evidenced by the fact that one-third (33%) of respondents told us that their reserves are below the range set by their board. One charity said that a reduction in income and increase in maintenance costs for their building had meant that “reserves are required to generate income to bridge the gap”.

"We’ve had to cut back”

In terms of the main challenges facing small charities, reduced income and increased costs were cited as the biggest issues, followed by an increase in demand.

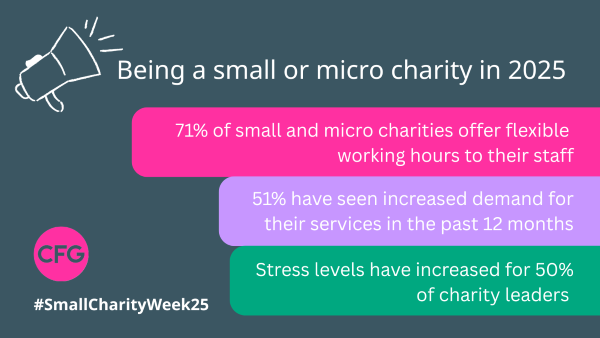

Just over half (51%) told us that they had experienced an increase in demand in the past year, with nearly one in 10 saying that this increase has been ‘significant’.

The combination of the reduction in income, with an increase in both costs and demand, has been particularly challenging.

“Costs have gone up significantly while the community expects us to deliver more”, explained one respondent. Another small charity leader said they’ve “had to cut back on some direct community activities” as a result of these financial pressures.

"Causing sleepless nights”

The impact of these pressures are felt, with 40% of respondents saying that their stress levels have ‘somewhat increased’ this year, and a further 10% stating that their stress has ‘significantly increased’.

Respondents cited workload/capacity issues and funding uncertainty as the main reasons for this stress.

“The increasing complexity of financial management and reporting” was a big source of stress for one CEO, who added: “We don’t have the funding to pay for people with the right skills to do it. It’s all on the CEO.”

Another small charity leader said: “I've never been someone who particularly experienced serious stress during a working lifetime of 40-plus years, but I do find our charity's financial position causing me occasional sleepless nights these days!”

Recruitment and retention

Our small charity members were also asked about operational issues. Succession planning was by far the most commonly cited area that charities needed support with, followed by digital transformation and change management.

One-third (33%) of respondents said recruitment had been ‘quite’ (21%) or ‘very’ (12%) challenging in the past year, though 32% said it was ‘not challenging at all’.

Concerns for charities around recruitment involved a limited salary budget, limited capacity to conduct recruitment, and a lack of qualified candidates.

Staff retention was viewed as far less challenging however, with more than six out of 10 charities (63%) describing this as ‘not challenging at all'.

Flexible working arrangements were considered helpful to staff retention, whilst others cited their ‘strong organisational culture’ and their ‘mission-driven work’, as key factors.

And in terms of wellbeing support, 71% of respondents said they offer flexible working hours to staff, with 58% providing remote work options.

Nearly one-fifth (23%) provide mental health support, 10% offer training on stress management, and 6% provide staff with an employee assistance programme. Ten per cent of respondents said they do not have any wellbeing benefits/policies for their staff.

Digital and AI

On the topic of digital investment, it was promising to see that nearly six in 10 charities had invested in new tools or infrastructure in the past 12 months, with a further 21% saying they planned to in the coming year. However, only 12% of charities described their investment as ‘significant’.

For those that had not invested, a lack of time for implementation (37%) was cited as the most common reason, followed by a lack of digital expertise and having limited funds to invest.

Our small charity members were also asked about their use of artificial intelligence (AI), with 35% saying their organisation is currently using AI, with a further 12% saying they are ‘interested’ in the technology.

Only 6% of respondents said they had an AI policy in place, though a quarter of charity leaders said they are planning to develop one.

Meanwhile, 26% of charities say they are not planning to use AI altogether, and 21% answered that they are not sure what AI could offer them.

About the survey

Whilst the most common definition of ‘small charities’ is those with under £1m in annual income, this accounts for roughly 97% of UK charities, and over 73% of UK charities are defined as ‘micro’ (having an annual income of less than £100,000).

Most of our survey respondents (54%) were from organisations with under £100,000 in annual income. Half of the respondents said they employ 1-10 staff and a further 35% told us they do not employ any staff. These organisations rely heavily on volunteers, with 65% telling us they have more than 10 volunteers.

These small and micro charities are the backbone of the charity sector, and provide vital services across the country. From foodbanks to hospices, community libraries to animal rescue centres, millions of lives are supported by the work of these organisations.

CFG is committed to supporting all charities, regardless of size, to deliver the maximum positive impact to their cause. This survey has shone a light on the range of challenges that many small charities are juggling.

During Small Charity Week, CFG will be sharing our updated Small Charity Guides. These bite-size, jargon-free guides are freely available to anyone and cover a wide range of topics related to charity finance and leadership, including reserves, Gift Aid, risk management and more.

We'd like to thank those micro and small charity leaders who provided these insights via our recent survey.

CFG resources

CFG’s, free to member, expert helplines provide confidential advice on accounting, tax, managing financial difficulties, recruitment and more

Check out the CFG podcast which brings together charity finance professionals, leaders and experts to discuss issues such as pensions, reserves and AI

CFG's turnaround group for charity finance leaders

Knowledge Hub articles

UHY’s Subarna Banerjee on ‘practical steps to help your charity prepare for budgetary constraints’

Barclays’ Roland Pearce on ‘building financial resilience’

UHY’s Allan Hickie on ‘income diversification’

CFG Knowledge Hub article from Bellevue Partners’ Robin Aitken on ‘resilience of charity income’

Bates Wells’ Eleanor Duhs on ‘data protection considerations for charities deploying AI’

Other resources

Zoe Amar: Helping small charities and communities grow their AI skills

Smartdesc: Charity Technology Leaders Report 2024

Directory of Social Change article on managing stress as a charity leader

NCVO guide on supporting the mental health and wellbeing of your team

NCVO’s small charity week website which provide guides and tools to support your organisation

If you are a CFG member or corporate partner and would like to share or signpost resources for our smaller charities, please email the team.