The majority of charity employers are concerned about absorbing significant additional staffing costs following the government's decision to increase Employer National Insurance Contributions, according to CFG's latest survey.

Since Rachel Reeves, Chancellor of the Exchequer, delivered the government’s budget and spending review statements on 30 October, CFG’s member charities and others across the UK have shared their concerns about what it means for their organisation’s financial health and sustainability.

The day after the budget, CFG sprang into action, launching a UK-wide survey to collect more insights on the impact of what’s been dubbed by the sector as the triple whammy of the:

- 1.5% increase in Employer National Insurance Contributions (ERNICs)

- lowering of the pay threshold at which employers start to pay ERNICs for their members of staff

- 6.7% increase in the National Living Wage (21 and over)

You can learn more about our immediate response to the news here and read our budget briefing here.

About the survey respondents

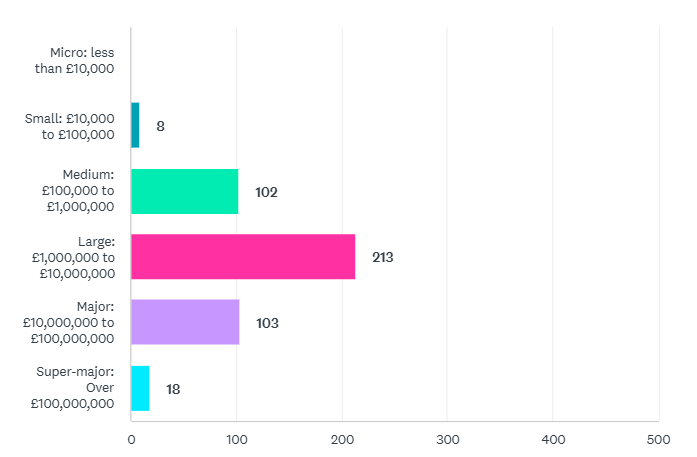

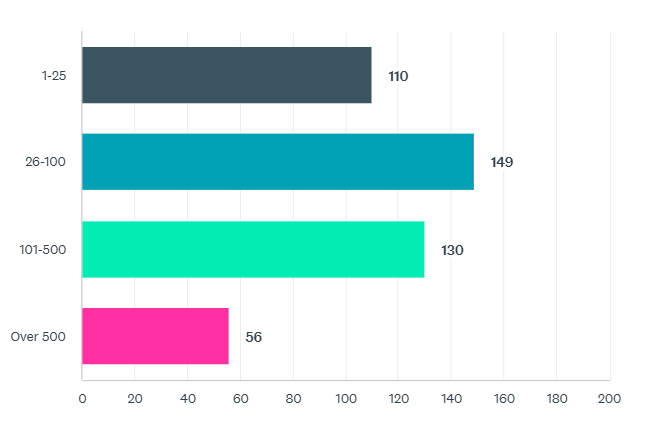

Our post-budget survey ran between 31 October to 15 November 2024. We gathered insights from 446 respondents, mainly comprising charity leaders (C-suite staff and trustees) and finance and operations professionals working with UK-based charitable organisations.

The majority were registered charities or social change organisations. They represented a diverse range of charities in terms of size and sector, from small charities to household names.

Organisational size by income:

Organisational size by headcount:

High levels of concern

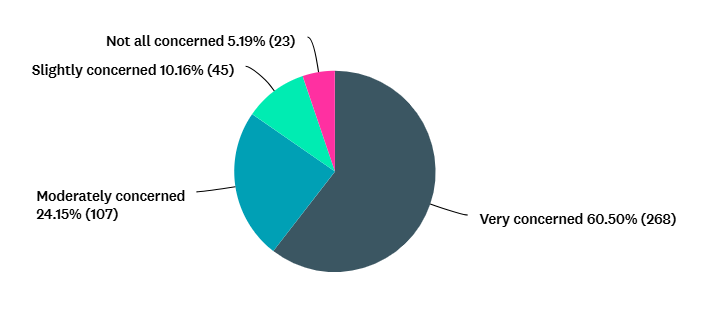

More than eight in ten charities (84%) are very or moderately concerned about affording the rise in ERNICs

A significant majority of respondents (84%) expressed serious concern about the affordability of increased ERNICs. This financial pressure is forcing charities to take difficult decisions about how they support their beneficiaries and continue to deliver their charitable objects for the public benefit. The survey results paint a stark picture of the challenges facing the charity sector, and the people, communities and local economies they serve.

How concerned is your organisation about affording the rise in the rate of ERNICs?

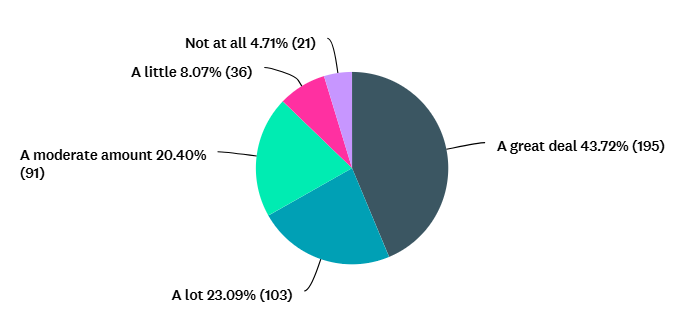

Overall, how concerned are you about your organisation's ability to absorb the changes under your current operating and financial models?

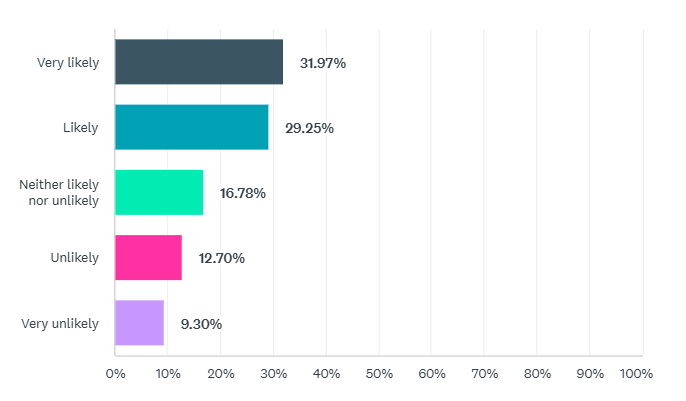

More than six in ten charities (61%) are likely or very likely to consider reductions in staff

To mitigate the impact of rising costs, many charities are considering reducing their workforce, either by not backfilling vacancies, not extending temporary contracts, reducing the use of fixed term contracts and contractors, or through redundancy.

One respondent told us:

“...we will work with employees to renegotiate their contracts to hopefully find a fit for more flexibility around their hours worked.”

Another said:

“The majority of our staff costs are the people who provide care, so we are unable to reduce hands on staffing. Our back office is already lean so it would be counterproductive to cut at Head Office too. However, if that is what we have to do to survive we will have no choice.”

One local community charity commented:

“Apart from the start of the lockdown during the pandemic, this is the first time that we are having to give serious consideration to making certain positions redundant.”

How likely is it that your organisation will need to look at reductions in staff such as redundancies or not extending fixed-term contracts as a result of the changes?

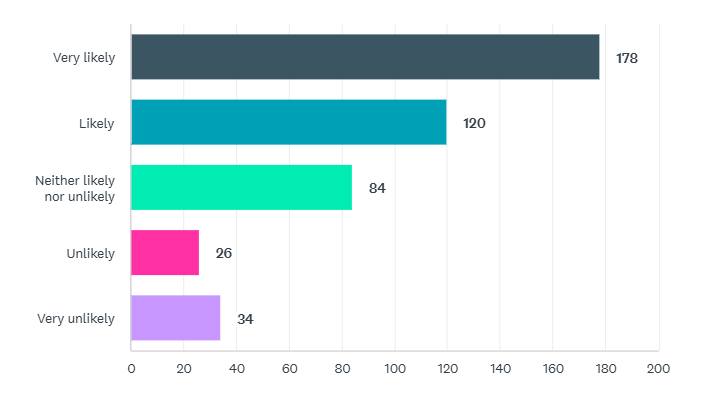

More than two-thirds (67%) of charities say they are likely or very likely (40%) to cancel expansion plans, new staff or new services

Two-thirds of charities are contemplating cancelling expansion plans, which includes hiring new staff and launching new services, with 40% saying they are very likely to cancel such plans. These measures, while necessary for sustainability, could have far-reaching consequences for the services that charities provide to communities across the UK, and beyond.

For others, the budget announcements will force them to press ahead with plans in order to increase their prospects of survival.

One respondent said:

“If anything, this drives the need to expand as we need to be sustainable, its more the impact on how we achieve the growth with reduced resources.”

Another commented:

“Expansion is the only way to drive more income and therefore we will still try to press ahead with our plans.”

Other respondents said they are looking to their funders for support and guidance, and others said they will have to draw on their reserves in order to secure plans that are already under way.

How likely is it that these changes to Employer NICs and National Living Wage will result in cancelling expansion plans, plans for new staff or new services that would otherwise have been expected to go ahead?

The final costs

We asked respondents to outline the expected annual costs of the increase in ERNICs, the lowering of the threshold, and the increase of the National Living Wage (which had already been budgeted for). Some respondents had yet to calculate the additional costs and others provided an initial rough calculation only. The estimated costs are outlined below by size of organisation by number of staff.

- For organisations employing between one and 25 people, the additional costs ranged between £8,000pa and £30,000pa.

- Charities employing between 26-100 staff noted that the additional costs ranged from £60,000pa at the lower end to £518,000pa. The average additional costs were £166,000pa for these charities.

- Charities with a staff team of 101-500, will see additional costs range between £100,000 and £1.2m per annum.

- The largest charities, employing more than 500 people, will inevitably see the largest increase in staffing costs. The figures quoted ranged from £1.5m to £6m per annum from April 2025.

Common themes from the survey

Cutting existing services

Charities expressed concern that they may have to consider cutting the vital services they currently provide, if no extra funding is provided to support the sector. Some respondents highlighted that reducing their services is essential to their survival.

A CEO of a youth homelessness charity said:

“We can survive but only by cutting essential services.”

One CEO of a charity that supports people with brain injuries and neurological conditions commented:

“Ultimately, if we do not receive sufficient funding to cover these increases, we will need to reduce the services we offer.”

Another charity leader from a local health and social support charity said:

“There is no choice but to use reserves and consider cuts to essential services/supports, when requests for help are increasing.”

Shock factor

Many charities, after surviving the Covid-19 pandemic and the cost-of-living crisis, had begun to look towards the future with cautious optimism.

Some respondents stated that they had made plans to expand their charitable services and had already taken into account the increase in the National Living Wage, which had been expected.

The increase to ERNICs and the lowering of the threshold came as a shock. With just five months in which to plan for the changes, many respondents noted that they will have to cancel their growth plans.

One director of finance and resources for a charity that supports people with complex disabilities put it simply:

“We are now in survival mode which we did not expect.”

Another charity leader stated:

“[There's] no more meat on the bones”.

Pivoting fast

Other respondents emphasised the importance of sustaining their existing services and highlighted the negative impact of uncertainty on their ability to plan for growth and social care intervention.

The director of a youth and young people's charity said:

“We will need to find a way to pay for what we already have or reduce this if we can’t before we can think about expansion.”

A charity leader of a disability charity commented:

“We try to plan two years ahead to ensure the services our beneficiaries rely on can be sustained. Sudden and significant changes by any government to our cost base are therefore unwelcome.”

The finance director of a charity that works with people recovering from drug and alcohol issues, explained why it's so difficult for charities to refocus:

“Due to the nature of our work, it is very difficult to remove posts without it adversely impacting our services.”

They added:

"These services play a vital role for people seeking to address their substance use as well as reducing the burden on the NHS. At a time where drug and alcohol related deaths are at their highest there is now a major risk to our ability to recover."

'No more meat on the bones'

A challenging operating environment for charities in recent years, exacerbated by the pandemic and cost of living crisis, has forced many to do more with less as demand for services has risen whilst funding has reduced.

As a result, many charities had already implemented all possible measures to increase efficiency and sustainability. Now there are very few options left to further reduce operating costs and increase funding.

The CEO of a local charity supporting more than 1000 older people in their region said:

“We are cut to the bone already.”

The CEO of a local hospice commented:

“We have already made cuts and remain facing a challenge, this challenge is now even harder to overcome.”

A respondent from a charity that supports new mothers and families stated:

“We cannot be any more streamlined than we already are.”

A leader of a charity providing services to autistic people and their families told us:

“The majority of our staff costs are the people who provide care, so we are unable to reduce hands-on staffing. Our back office is already lean so it would be counterproductive to cut at head office too. However, if that is what we have to do to survive we will have no choice.”

A local heritage charity leader concluded:

“We have been trying to be efficient for years, there is no more meat on the bones.”

Personal pressures

For many charities, one of the only options available to them when looking for ways to reduce costs will be by reducing headcount, and 61% of respondents stated that they were either likely or very likely to look at reductions in staff count.

This will be achieved either through redundancies or by not extending fixed-term contracts, or a combination of both. Recruitment freezes are also likely to be applied.

Many survey respondents noted that reducing staff numbers would have a negative impact on morale and that job losses will deal a significant blow to the charity’s beneficiaries and clients. Some respondents expressed their personal sadness about having to potentially let staff go.

The founder and CEO of a local youth and families charity stated:

“We are being hit on every side - it is incredibly depressing, staff constantly have the threat of possible redundancy over their heads.”

They added that the overall cost of the changes announced in the budget will be in the region of £30k per year, or the equivalent of a full-time post in an organisation of less than 20 people.

They continued:

"Negatively, more and more resources are needed to dedicate to fundraising because of rising costs and means that our community has less of our time not more."

The head of finance at a faith charity explained:

"[I'm] actually losing sleep - waking up trying to find solutions, wondering which staff to cut, how to reduce services etc."

Public service delivery contracts

Charities play a vital role in delivering and supplementing public services. These include services for mental health to primary and social care, youth and children’s services and housing.

Whilst more than 70% of the income that charities receive comes from non-governmental sources such as the public, the government spends in the region of £15bn on grants and contracts each year with the charity sector, with the spending divided equally between national and local government.

Many of the charities that responded to the survey deliver public services on behalf of local government, the NHS or government departments. An exemption has been put in place for public sector services, but it does not extend to those organisations that operate as a business or charity or those that are commissioned by government.

A number of respondents that deliver public service contracts stated that the value of the contracts will not cover operating costs. Without an increase in contract value, some say they may have no choice but to hand back contracts.

The CEO of a mental health charity stated:

“We may have to hand back contracts which will no longer be affordable.”

Another CEO of a community charity providing support services commented:

“Without [extra funding] we would need to consider our future viability...and potentially hand back contracts to local authorities.”

The CEO of another local social care provider said:

“Following the inflation crisis there is no wriggle room left within contracts and the unexpected increase to costs is therefore incredibly difficult to cater for.”

Impact on public services and Labour’s ‘missions’

Even for those charities that do not work directly with or for local authorities or government, the impact of increased costs and reduced services is likely to have a knock-on effect on public services. As one healthcare charity highlighted, the changes will result in crucial services and research having to be cancelled, leading to an increased burden on the NHS.

A director of a large national healthcare support and research charity said:

“This money will have to come out of our charitable work, which will ultimately add to the NHS bill instead.”

The government’s key mission areas which include health, housing, education and crime, could all be impacted should charitable organisations cut back services and staff expertise or, as seems likely for some, close their doors forever.

A reduction in local services will likely increase the pressure on public services and local government, leading to increased costs and/or critical services being lost.

Funding challenges

Across the board, charities will be looking to grantmakers and corporate partners for support. It is not lost on the survey’s respondents that significantly increasing income via funders and partners will be a tall order.

Several respondents noted the fierce competition within the sector for grant funding, and they acknowledged that this competition will only continue to increase.

This year, a number of funders have frozen grant giving and have reduced the number of opportunities to apply for funding to support core costs. Organisations across the board will be feeling the pinch.

Reducing charitable activities and project delivery to remain financially sustainable means that grantmakers and partners have fewer opportunities to engage with and support the organisation.

One respondent of a homeless charity pointed out:

“There could be a risk that funding from corporate partners is affected or decreases as the rise of NIC will impact them as well.”

The CEO of a domestic abuse charity commented:

“Our funding is dependent on our ability to support service users - with capacity reduced we will support fewer service users and therefore attract less funding.”

Threshold reduction

Some charities noted that the rise in ERNICs itself was not the main concern, but that the impact of the lowering of the threshold at which organisations start to pay ERNICs would be the primary cause of the financial pressure they would be facing.

Staff earning between £5,000 and £9,100 each year – part-time and temporary workers – will mean additional costs for their employers from April 2025. This will make part time roles less cost-effective for employers, potentially leading to job losses for people who depend on being able to work part-time, often to fit around caring responsibilities or education.

The CEO of an assisted living residence said:

“The impact of the reduced threshold will have the greatest impact by bringing our majority part-time staff into the costs.”

Another leader of a disability charity stated:

“This is catastrophic for us driven by the lowering of the threshold, it increases our NI bill by over 40% and disproportionately affects those who have high numbers of low paid workers. I don't know how we are going to survive.”

National Living Wage increases

In addition to the ERNICs changes, the Chancellor’s recent announcement also confirmed an expected rise to the National Living Wage (NLW) to £12.21 an hour.

Whilst many charities stated that they already paid employees above this rate, others shared concerns about affordability.

However, charities view the increase as largely positive, acknowledging that it is a welcome boost in pay for those staff members.

Looking to the future, one charity leader stated:

“Whilst employee morale will increase short term, as they have not had a pay rise for 18 months and will do now, longer term we will have to reduce our headcount to manage the overall staff budget.”

Several charities highlighted that the rise in NLW will impact the relativity of the pay scales which, if not addressed, may affect staff morale for higher paid staff. Some also highlighted the long-term effects this could have on their organisations.

A leader of a national charity that provides a range of services including wellbeing, health, housing and education to its community, commented:

“We are expecting our lowest paid colleagues to be pleased with the increase in NLW. Other colleagues might expect the same increase but this won't be possible so there will be positive and negative implications for staff morale.”

The CEO of a charity that provides care in their community stated:

“The gap between the lower paid staff and higher paid staff would be so little that it would demoralise those with additional responsibilities and discourage people to work their way up through the organisation. This would in future damage our succession planning and the organisation will end up with no leader(s).”

Some respondents noted that they will now find it difficult or impossible to increase pay rates for other staff because of the financial impact of NMW and NLW changes. While they welcome the uplift in NMW/NLW in principle, the knock-on effect will put charity finances under serious pressure.

Another CEO of a local charity working with children, young people and families said:

“[NLW increases will] push up lower salaries across the board, which are unaffordable. Ultimately it will put us at risk of closure.”

Summary

The combination of rising costs, reduced funding, and increased demand has pushed charities to their limits of ‘survivability’. The triple-whammy of the rise in National Living Wage and Employer National Insurance Contributions (ERNICs), whilst lowering the threshold for paying them, has exacerbated this situation.

Many charities were looking to the future with cautious optimism, having survived the pandemic and cost-of-living crisis. With just five months to prepare for the rise in ERNICs, many are now facing difficult decisions, including potential job losses, service cuts, and contract hand-backs. Some charities may have no option but to close which was unexpected pre-budget.

In all these scenarios, the impact will be felt by the people and communities those charities serve, as well as their employees and volunteers. Losses of services and expertise will potentially increase the burden on the public sector and hinder progress in key areas such as health and social care, housing, education and crime.

As charities struggle to survive, they will need increased support from funders and corporate partners. The increased competition for funding will increase pressure of all charity leaders, staff and volunteers.

Resources/links

Government resources

Policy paper: Changes to the Class 1 National Insurance Contributions Secondary Threshold, the Secondary Class 1 National Insurance contributions rate, and the Employment Allowance, all from 6 April 2025 (HMRC/gov.uk website)

In the news

Relate enters administration and makes 80 employees redundant, 3 December 2024 (Civil Society website)

Culture Secretary defends treatment of charities amid 'real danger' posed by NI hike, 28 November (Third Sector website)

CFG responds to Chancellor’s letter to sector, 26 November 2024 (CFG website)

How CFG is supporting members and the sector following the budget, 6 November 2024 (CFG website)

7,361 charities respond to joint sector letter to the Chancellor, 31 October 2024 (NCVO website)

References

Understanding the ecosystem: charities and public services (Pro Bono Economics website)

CFG would like to thank all those who responded to our survey and shared their stories.

If you would like any further information about the survey and its results, or this report, please don't hesitate to email the team.